views

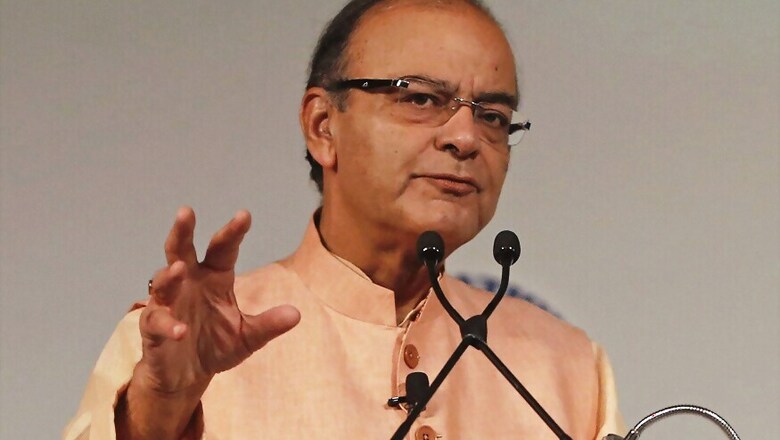

New Delhi: Finance Minister Arun Jaitley on Thursday clarified that depositors of small amounts of cash – housewives, workers, artisans – will not be harassed by income tax officials.

“There is an Indian tradition to keep cash at home for contingencies and small deposits under the tax exempt limit can be made in banks,” Jaitley said in a press conference. “Large depositors will have to face accountability under existing tax laws,” he added.

The Finance Minister said that no new laws for penalising large depositors are being contemplated.

Finance Ministry officials including the Revenue Secretary Hasmukh Adhia, Economic Affairs Secretary Shaktikanta Das and the Chief Economic Adviser Arvind Subramanian held a press conference in New Delhi to field questions about the demonetization, in which the government withdrew legal tender status to bank notes of denomination 500 and 1,000 rupees. They are being replaced with new bank notes of 500 and 2,000 rupee value. The step is to smoke out black money and counterfeit currency, Prime Minister Narendra Modi said on November 8.

Finance Minister Jaitley said that the Reserve Bank of India has taken steps to ensure that banks are able to deal with the rush of people depositing the worthless currency notes, including branches staying open on weekends. He added that the bank network in the country is adequate to handle the demonetization aftermath and if need be additional measures may be considered for rural areas, where the density of bank branches is low.

Jaitley also said that there would be some impact on consumption in the short run, but the move would be positive for the Indian economy in the medium to long term and consumption will be back to normal levels.

On a question on gold purchases, the FM said that people trying to get rid of black money by purchasing the yellow metal will face scrutiny because they will have to provide their PAN number. Even jewellery sellers will have to provide an account of such transactions.

Comments

0 comment