views

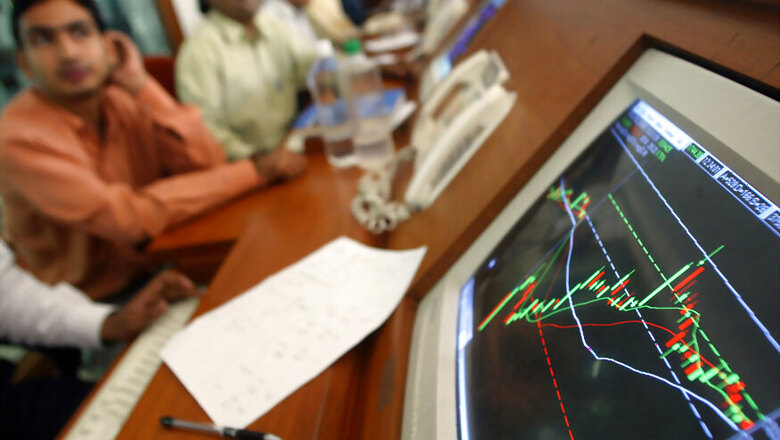

Mumbai: After four weeks of losses, domestic equities staged a mild recovery from six-moth lows, with both key market indices Sensex and Nifty reclaiming the psychological 26,000 and 8,000 levels, respectively.

Foreign investors constant offloading Indian stocks over potential US rate hike next month and cash-crunch shock in most of the sectors due to government's demonetization drive played the part in market momentum with key index tumbling to six-month low of 25,717.93.

While, market witnessed short-covering ahead of November derivative expiry amid higher global cues acting bulwark against the persistent losses enduring the inherent domestic market strength during the week.

Stocks once again lost viability on rupee volatility as it plunged to a fresh life-time record low of 68.86 against dollar during November expiry day -- pulling the market once again to end below the key 26,000-level.

However, the weekend saw the the first day of December series starting on a positive note with recovering rupee after RBI intervened heavily to arrest the currency's fall, while the US Thanksgiving holiday break stopped the dollar relentless surge as well as helped to pause sucking of FII capital from emerging markets.

Domestic traders lapped up beaten-down but fundamentally strong stocks amid firm global cues supported by positive Fitch Ratings on India's GDP growth.

Market sentiment revived to some extent after the rating agency forecast India's economic growth to accelerate next fiscal on the back of reforms and monetary policy easing.

Besides, the fall in rupee value also lifted the IT and pharma stocks.

During the week, the Sensex gained 166.10 points, or 0.64 per cent, to settle at 26,316.34. It hovered in the range of 26,343.95 and 25,717.93 during the week.

The Sensex has lost 1,926.94 points, or 6.86 per cent, in last four weeks.

The Nifty 50 index during the week rose 40.20 points, or 0.50 per cent, to end at 8,114.30 after shuttling between 8,122.25 and 7,916.40.

The broader market index fell by 618.95 points, or 7.12 per cent, in last four weeks.

The buying was led by IT, teck, metal, consumer durable, healthcare, FMCG, realty sectors, followed by shares of smallcap and midcap companies shares.

While selling was witnessed in bankex, auto, PSUs, power, capital goods and oil&gas counters.

Meanwhile, foreign portfolio investors (FPIs) and foreign institutional investors (FIIs) sold shares worth Rs 5,421.89 crore during the week, as per Sebi's record including the provisional figure of November 25.

In the broader market, The BSE Mid-Cap index rose 110.59 points, or 0.92 per cent, to settle at 12,183.02. The BSE Small-Cap index rose 158.76 points or 1.34 per cent to settle at 12,027.70. Both these indices outperformed the Sensex.

Among sectoral and industry indices, IT rose 6.61 per cent, followed by technology (5.16 per cent), metal (4.37 per cent), consumer durables (2.91 per cent), healthcare (2.76 per cent), FMCG (1.17 per cent) and realty (1.11 per cent).

However, bankex fell by 2.50 per cent, auto 2.19 per cent, power 0.81 per cent, capital goods 0.54 per cent and oil and gas 0.02 per cent.

Among the 30-share Sensex, 18 rose, 12 shares fell during the week.

TCS surged 8.37 per cent. The company said it will implement a unified global process blueprint for ASML, aiming to simplify business processes, improve operational efficiency and elevate stakeholder experience. ASML is one of the world's leading manufacturers of chip-making equipment.

Wipro jumped 6.36 per cent. The company announced that it completed the acquisition of Appirio on November 23, 2016. As mentioned in the media presentation submitted as part of results for Q2 September 2016, impact of the Appirio acquisition is expected to reflect in the financials of Wipro for Q3 December 2016, the company said.

It was followed by Lupin 6.29 per cent, Infosys 6.25 per cent, Tata Steel 5.87 per cent, Asian Paints 4.18 per cent, Hero Motoco 3.77 per cent, HUL 3.63 per cent, Sun Pharma 3.47 per cent and Cipla 2.47 per cent.

Bank stocks declined with the S&P BSE Bankex index sliding 2.50 per cent. State Bank of India was down 5.35 per cent.

Mahindra & Mahindra (M&M) was down by 4.73 per cent. The company announced that it inaugurated a spare parts warehouse in Mahindra World City (MWC), Jaipur. The warehouse will cater the requirement of customers in north and north-western region of the country for both automotive and tractor spare parts.

It was followed by Tata Motors 3.77 per cent, Gail 2.34 per cent, Power Grid 2.27 per cent, HDFC Bank 1.85 per cent, ICICI Bank 1.78 per cent and Maruti 1.75 per cent.

The total turnover during the week on BSE fell to Rs 12,443.90 crore from last weekend's level of Rs 15,905.20 crore while NSE rose to Rs 99,009.43 crore from Rs 94,503.03 crore.

Comments

0 comment