views

New Delhi: Anil Ambani is legally entitled to be reinstated vice chairman of Reliance Industries Ltd (RIL) if its de-merger on the basis of the family pact fails, counsel for Reliance Natural Resources Ltd (RNRL) told the Supreme Court on Wednesday.

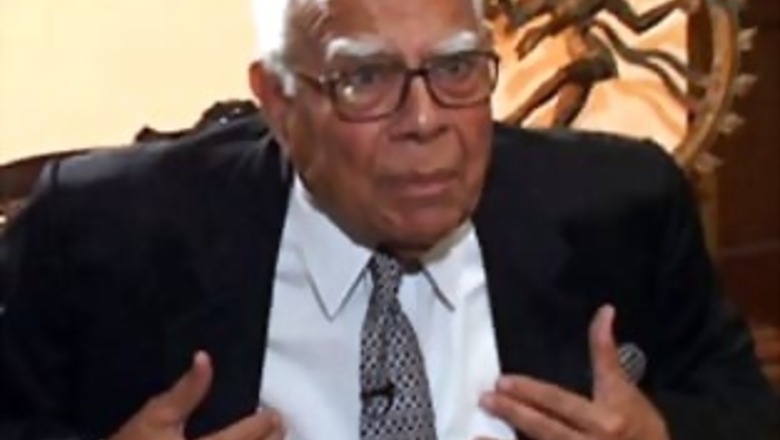

The failure of the de-merger scheme also exposes RIL to the prospect of being wound up, said counsel for RNRL Ram Jethmalani, while arguing before the three-member bench that is hearing the high-profile Krishna-Godavari gas dispute case.

"This will not be in the interests of millions of RIL shareholders," the counsel told the bench of Chief Justice KG Balakrishnan, Justice B Sudershan Reddy and Justice P Sathasivam.

"Under Section 392 of the Companies Act, if the scheme is not implemented, as envisaged, Anil Ambani is entitled to be reinstated in RIL board with full powers as existed before the July 27, 2004 board resolution."

Prior to that, Anil Ambani was vice chairman, managing director and on the board of RIL.

The senior counsel said since Anil's elder brother Mukesh is chairman of the company and its "alter ego" now, neither he nor the company were entitled to take the position that the family reorganisation pact was not known and take exemption from its liabilities.

He said the RIL board resolution of July 27, 2004, virtually stripped Anil Ambani of all powers, status, honour and dignity while giving complete control to Mukesh Ambani.

"This was the source of both anger and humiliation for Anil Ambani," he said.

"As promoter-director -- lifetime director, Mukesh Ambani is not liable to retirement and does not require the resolution of shareholders," said Jethmalani.

Accordingly, RIL cannot claim that the family business reorganisation pact brokered by Kokilaben, the widow of the empire's founder Dhirubhai Ambani, between her two feuding sons, is not binding on the company.

"The court has the power to supervise the scheme (of de-merger) which definitely ensures all hurdles are removed in the proper implementation of the scheme, particular those arising from dishonest conduct."

The three-member bench has been hearing the dispute over the supply of 28 million units of gas for 17 years at $2.34 per unit to Anil Ambani-led RNRL from the gas fields off the Andhra Pradesh coast, awarded to Mukesh Ambani's RIL.

The price, tenure and quantity were based on the 2005 family pact, but RIL subsequently said it could only sell the gas for $4.20 per unit, as this was the price, the company claimed, fixed by the Government.

The Bombay High Court had earlier ruled in RNRL's favour.

In his post-lunch arguments, Jethmalani told the bench that after the de-merger scheme secured legal sanction, the group led by Mukesh Ambani developed second thoughts on supply of gas.

"The Mukesh Ambani group entered into an agreement on the issue of gas supplies, sitting on both sides of the table, for and on behalf of RNRL and themselves," said Jethmalani.

He was alluding to the fact that the gas supply master agreement was signed before the younger sibling secured full control over what is now called the Reliance Anil Dhirubhai Group, adding it was not only imposed but also commercially unviable.

"The obnoxious gas supply master agreement signed on January 12, 2006, is the greatest circumstantial evidence that the family memorandum of understanding (MOU) was known and is binding on RIL," he said.

It was this pact, he added, that mentions 28 million units of gas per day at $2.34 per unit for 17 years to be supplied to his client.

"RIL earlier maintained it had no knowledge of the terms of the MOU, but later argued that the gas supply master agreement was fully compliant with the MOU," Jethmalani said.

"How the gas supply master agreement can be compliant with an MOU, whose terms were unknown to the author of the gas supply master agreement, is something difficult to fathom."

Even RIL counsel Harish Salve, who had earlier described the MOU as "a worthless scrap of paper", had to concede later that it was, indeed, a "valuable guidance tool" to arrive at a suitable gas supply agreement, Jethmalani added.

Comments

0 comment