views

Does Venmo charge a fee?

Yes—but only for specific types of transactions. Venmo is a digital payment app that allows you to send and receive money to friends, family, and businesses for free. The platform is free to sign up and requires no monthly or annual fees when you use it. Users can send, receive, and transfer money (with a short waiting period) to their bank accounts at no cost. Venmo resembles other apps like Zelle, Cash App, and PayPal. However, the only difference is there's a social aspect to it, too. You can view, like, and comment on public transactions from your friends or contact list. PayPal acquired Venmo in 2013.

Types of Venmo Fees

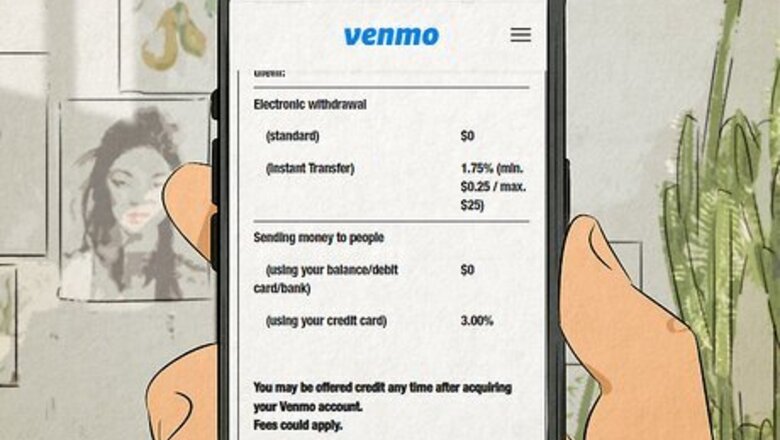

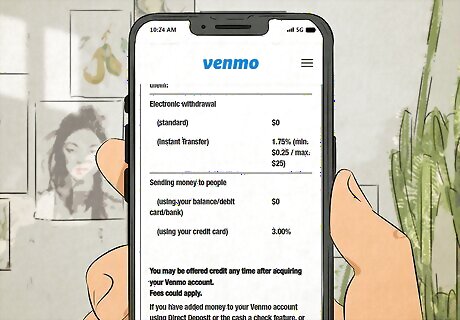

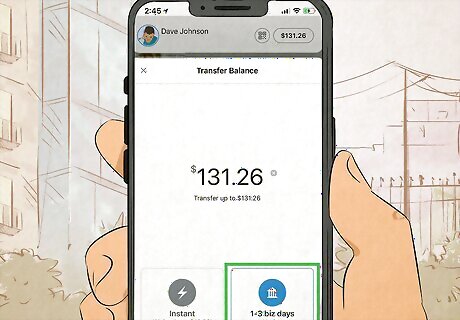

Instant Transfers If you need your money in a pinch, transfer your Venmo Balance to any eligible United States bank or Visa/Mastercard debit card within 30 minutes. Small 1.75% fees are deducted from the transfer amount, with a minimum fee of $0.25 and a maximum of $25.00. This fee is taken out for each transfer you make. For example, if you're transferring $100 instantly, the fee is $1.75. You'll receive $98.25 in your bank account.

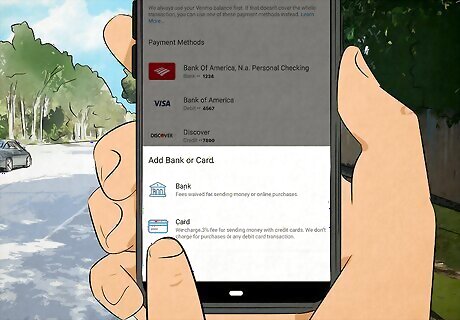

Credit Cards Link eligible credit cards to make payments if you're low on cash. However, it's important to note that these funds have a 3% fee of the amount sent. So, if you're sending someone $100, you'll pay a $3 fee. Your bank may charge an additional fee on top of Venmo's. You cannot transfer funds to a credit card. To determine if your credit card is eligible, link your credit card to your account on the mobile app or online at https://venmo.com/.

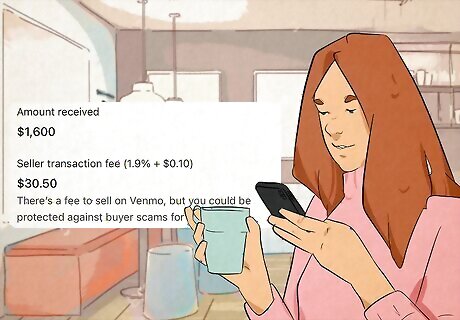

Merchant Fees Want to use Venmo to run your business or side gig? You can with a business profile! For every payment you make of $1 or more, Venmo will automatically deduct it from the total payment sent. The buyer, on the other hand, does not pay a fee. Fees vary depending on the payment method. For instance, fees for direct payments from Venmo are 1.9% + $0.10 of the payment total. Meanwhile, contactless payments (Tap to Pay) are 2.29% + $0.10 of the total payment. If there's a promo, the seller pays a fee of 1.9% + $0.10 + the promo redemption fee of 2.9%. So, that's a total of 4.8% + $0.10. For a $100 transaction, that's a $4.90 fee.

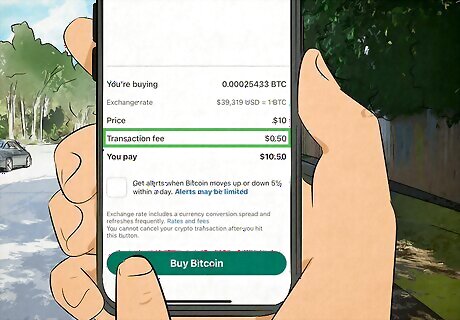

Cryptocurrency Fees If you want to buy, sell, or invest in cryptocurrencies, you can do that on Venmo. Fees vary based on the purchase or sale amount. They range between $0.49 to $2.49 for purchases under $200, 1.80% for purchases under $1,000, and 1.50% for more than $1,000. Fees don't apply to the selling or buying of PYUSD—PayPal's version of crypto or when you receive a cryptocurrency transfer or transfer to another Venmo or PayPal account. Venmo supports Bitcoin, Ethereum, Litecoin, Bitcoin Cash, and PayPal USD (PYUSD) in the United States (except for Hawaii).

Venmo Mastercard Fees Through Venmo, you can sign up for a debit or credit card. There are no fees when used at eligible ATMs within the MoneyPass network. However, out-of-network ATMs charge a $2.50 fee and a $3.00 fee for over-the-counter cash withdrawals. So, if you go to a bank teller to withdraw cash, you'll be charged if a signature is required. To find out if there's a no-fee ATM near you, visit www.moneypass.com.

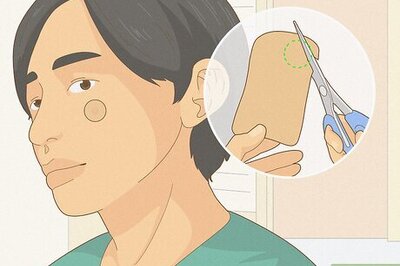

Check Cashing Fees Venmo charges a 1% fee for payroll and government checks and 5% for all other accepted checks, with a minimum of $5 per check. These checks can arrive within 10 to 15 minutes into your bank account or up to 1.5 hours if there's an issue. However, there is no fee if you choose the "Get Money in 10 Days" option. This option is only available for users in New York State.

How do you avoid Venmo fees?

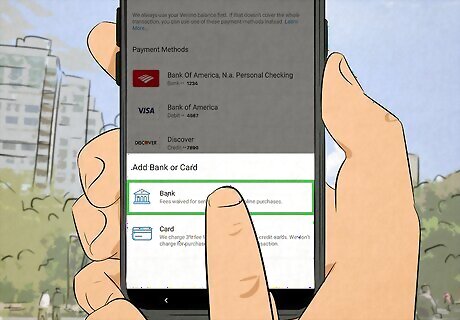

Use your Venmo balance, bank account, or debit card instead. A simple way to avoid the 3% credit card fee is to opt for your existing Venmo balance or connected bank or debit card instead. To use Venmo, tap your picture or initials on the "Me" tab to add a card to your Venmo account. Then, go to the wallet section and tap "Add bank or card," select whichever option suits you and add your card manually or scan it with your phone camera.

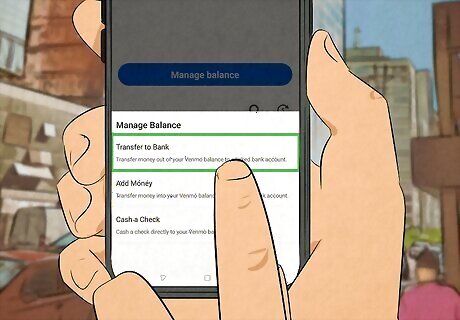

Choose standard electronic withdrawals to avoid instant transfer fees. If you can wait for your Venmo balance to transfer to your bank account or debit card, it can save you up to $25! To withdraw money go to the "Me" tab, then tap "Add or Transfer" under Wallet or Manage. Choose the standard transfer, which takes 1 to 3 business days with no fee. Similarly, New York State users can choose the 10-day option to cash a check to avoid fees.

How much can I send on Venmo?

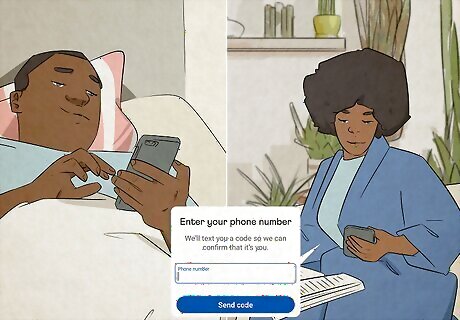

Verified users can transfer $5,000 per transfer. Venmo's weekly rolling limit for bank transfers is $19,999, with a maximum of $5,000 per transfer. However, if you still need to verify your identity, your weekly limit is $999.99. To verify your account, visit the "Me" tab, go to "Settings" and tap "Identity Verification." You'll need your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). Verification only works on the Venmo mobile app.

How do I send and receive money on Venmo?

Send payments by clicking the "Pay" button. Are you going for a night out but forgot your card? Pay a friend back with a click of a button. Open the Venmo app and tap "Pay/Request" at the bottom of the screen. Then, search for the person you want to pay—if you aren't friends already, add them! Enter the total amount and a note. Choose your payment method and click "Pay." To share your Venmo link use your QR code or profile link. If you're paying more than one person at a time, click the "+" icon next to the first recipient's name. Click "Next" and enter the amount you'd like to send each person and a note.

Request payments by clicking the "Request" button. Does a roommate have to send you their half of the rent? No problem. Tap the "Pay/Request" button, search the user's name, enter the amount and a note, and tap "Request."

Safety Tips

Use Venmo with trusted individuals. Scammers are out there, so avoid sending money to people you don't know. Venmo offers basic encryption to protect your account. However, you can add extra security by adding a PIN code. If you've lost your phone, sign into your account on https://venmo.com/ and select "Settings." go to "Security" and remove the session associated with your phone to log out remotely.

Transfer your Venmo funds immediately to protect them. Unfortunately, Venmo isn’t as secure as keeping funds in your standard bank account. Besides hackers, Venmo balances aren’t insured by the Federal Deposit Insurance Corporation (FDIC), so if Venmo as a company goes down or loses your money, you won't be automatically reimbursed. Keep as little Venmo “bucks” or funds in your account as possible.

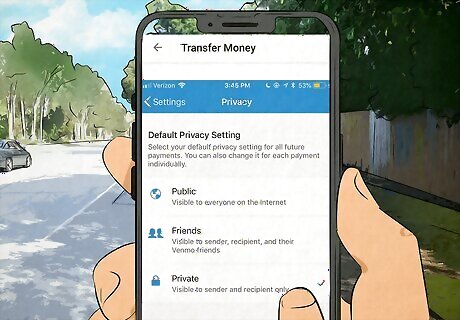

Change your Venmo account settings to private. What makes Venmo unique compared to other payment platforms is the ability to share who you’re sending money to and what for. While fun emojis may not paint the whole picture, others will be able to see who you’re giving money to—and when. Set your Venmo account to private by visiting “Settings” and disable sharing “transactions involving you” so the world doesn’t have to know when someone else sends you money.

Do I have to pay taxes on Venmo transactions?

Yes—but only for Merchant accounts. Suppose you're receiving payments for the sale of goods or services. In that case, you only have to pay taxes for items or services exceeding $20,000 or 200 transactions. However, it may differ from state to state. PayPal and Venmo merchants should file a Form 1099-K. In Maryland, Massachusetts, Vermont, and Virginia, merchant accounts that made less than $600 in sales do not need to report their earnings from Venmo. Merchants in Illinois do not have to report their earnings if they earned less than $1,000 and 4+ separate transactions. You do not need to pay taxes on transactions with friends or family.

Comments

0 comment