views

Getting Your Financials in Order

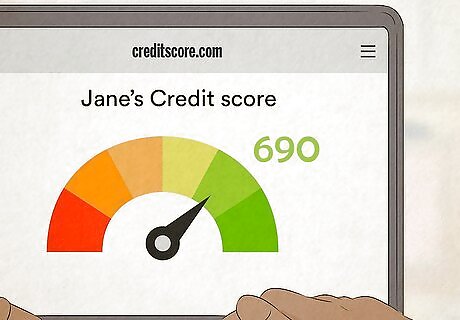

Strengthen your credit. The higher your FICO score, which ranges from 300 to 850, the better interest rate you'll qualify for. The difference between a 4.5% interest mortgage and a 5% interest mortgage can mean tens of thousands of dollars over the life of the loan. Get a free copy of your credit report so you can see what the lenders see on your credit history. Pay off credit cards and resolve any credit disputes or delinquencies. In general, scores between 650-700 will get the average rate. A higher score will generally qualify for at least a ¼% reduction in interest rate, but a score below 650 will usually cause an increase in your interest rates which sometimes can be significant.

Get pre-approved to determine the actual amount you can pay without getting into trouble financially. Apply to several lenders within a two-week period so that the inquiries do not adversely impact your credit report. Do this before contacting a real estate agent so you have a good idea of what you can afford, and you don't accidentally fall in love with a [house] that you cannot afford. Sellers love buyers who get pre-approved. Pre-approved buyers are almost always given the green light by lenders, meaning there's less risk for the deal to get scuttled before a successful closing. Don't accidentally get pre-qualified instead of pre-approved. There's a difference. Pre-approval means that the lender is usually prepared to give you a loan after seeing your financial vitals. Pre-qualified only means that the lender is estimating what you could borrow. It doesn't mean you'll get a loan.

Shop for your mortgage. Wait — why would I shop for a mortgage before deciding on a house? Isn't that totally backward? Not necessarily. Shopping for a mortgage before you decide on a house can be beneficial for one overriding reason: You'll know exactly how much you can borrow before you buy your home. Too many people fall in love with a home that they — well — can't afford. They struggle finding a mortgage that covers the cost of the home. Finding a mortgage first and a home second may seem less appealing, but it's smarter. You'll immediately be able to tell whether a home is in your price range or out of it. Think about the sort of down-payment you'll be able to afford. This should be part of your mortgage calculations, although you don't need to know for sure when shopping for a mortgage. Have a general idea in mind. More on this later in the article. Find out what ratios lenders are using to determine if you qualify for a loan. "28 and 36" is a commonly used ratio. It means that 28% of your gross income (before you pay taxes) must cover your intended housing expenses (including principal and interest on the mortgage, as well as real estate taxes and insurance). Monthly payments on your outstanding debts, when combined with your housing expenses, must not exceed 36% of your gross income. Find each percentage for your monthly gross income (28% and 36% of $3750 = $1050 and $1350, respectively). Your monthly payments on outstanding debts cannot exceed the difference between the ($300) or else you will not be approved.

Check out first-time buyers' programs. If you qualify for a first time home buyer program, these often have much lower down payment requirements. These are offered by various states and local governments. You may also be able to access up to $10,000 from your 401(k) or Roth IRA without penalty. Ask your broker or employer's human resources department for specifics regarding borrowing against those assets.

Talk to and retain a lawyer (optional). If you expect the buying of the house to be a simple, straightforward affair, then you'll probably only need a Realtor, the escrow company, and perhaps a mortgage broker. But then again, when do things ever go as expected? Hire an honest, reputable, (relatively) cheap lawyer if: The cost of the lawyer is a drop in the bucket compared to the total you are likely to spend for the home. The home you are buying is either in foreclosure or in probate, which means that the home is being distributed as part of a deceased person's estate. You suspect the seller might try to quickly back out of the deal or you don't trust them. Your state requires a lawyer at closing. Six states currently require a lawyer present. Talk to your state commission of real estate to find out if it's common practice in your state. It is also a good idea to check with an attorney before entering into a contract.

Shopping for a Home

Find a good real estate agent to represent you in the search and negotiation process. The real estate agent should be: amiable, open, interested, relaxed, confident, and qualified. Learn the agent's rates, methods, experience, and training. In the United States, sellers pay the Realtor commission while buyers may pay a fee for having the Realtor represent them. Look for a Realtor who lives local, works full-time, closes several properties per year, and has a reputation for being busy. Read more in How to Select a Realtor. A Realtor's job is to connect people who want to buy and sell a particular home. For this reason, a Realtor has an interest in selling homes. A very good Realtor will use their experience to sell the right home to the right buyer — you. A Realtor can tell you about the schools, nearby shopping, zoning of the property, construction nearby, ages and values of nearby properties, growth rate, and any other statistics on the area you may be interested in.

Sign up for an MLS alert service to search on properties in your area. A Multiple Listing Service will give you a feeling for what is on the market in your price range. Your agent can do this for you. If you sign up through a real estate agent, it is poor form to call the listing agent directly to see a house. Don't ask an agent to do things for you unless you're planning to have them represent you — they don't get paid until a client buys a house and it's not fair to ask them to work for free, knowing that you're not going to use them to buy your home!

Start looking for houses within your range. Most lenders suggest that you pay no more than 38% of your monthly income towards your mortgage and debts combined. This means, on any given month, no more than 38% of your paycheck goes to paying back loans. You should use an online Home Affordability Calculator to find your own sweet spot. However, for a good idea of the house you can afford, tally up your current monthly bills, including credit cards, student loans, etc., and compare them against your income in the following sheet:

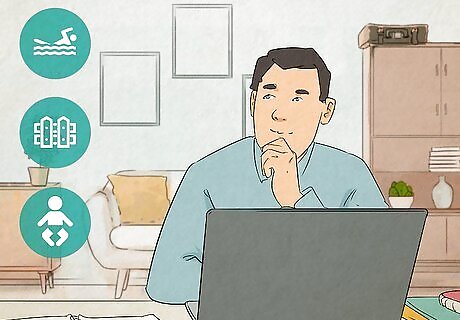

Start to think about what you're really looking for in a home. You probably already have a vague idea, but the angel's in the details. There are a couple things in particular that you and your family should give good thought to: What will you and your family need in several years? Maybe you're just a couple right now, but are there plans for kids in the future? A home that snugly fit two people could be torturous for three or four. What tradeoffs are you willing to make? In other words, what are your priorities? Although we like to believe that buying a house can be straightforward, it's often a complex ordeal in which we're forced to compromise. Do you care more about a safe neighborhood and good schools over a big backyard? Do you need a big, workable kitchen more than a big luxurious bedroom? What are you willing to sacrifice when it's crunch time? Do you expect your income to increase over the next couple years? If your income has increased by 3% for several years in a row and you hold a secure job in a safe industry, you can probably rest assured that buying an expensive but still reasonable mortgage is possible. Many homebuyers buy relatively expensive and then grow into their mortgage after a year or two.

Define the area you'd like to live in. Scout out what's available in the vicinity. Look at prices, home design, proximity to shopping, schools and other amenities. Read the town paper, if there is one, and chat with the locals. Look beyond the home to the neighborhood and the condition of nearby homes to make sure you aren't buying the only gem in sight. The area in which your home is located is sometimes a bigger consideration than the home itself, since it has a major impact on your home's resale value. Buying a fixer-upper in the right neighborhood can be a great investment, and being able to identify up-and-coming communities — where more people want to live — can lead you to a bargain property that will only appreciate in value.

Visit a few open houses to gauge what's on the market and see firsthand what you want. Pay attention to overall layout, number of bedrooms and bathrooms, kitchen amenities, and storage. Visit properties you're seriously interested in at various times of the day to check traffic and congestion, available parking, noise levels and general activities. What may seem like a peaceful neighborhood at lunch can become a loud shortcut during rush hour, and you'd never know it if you drove by only once.

Look at comparable houses in the neighborhood. If you are unsure about the price, have the home appraised by a local appraiser, who also looks at comparables. When appraising a home, appraisers will look for comparable homes or “comps” in the area that have similar features, size, etc. If your home is more expensive than the comps, or the appraiser has to find comps in a different subdivision or more than ⁄2 mile (0.8 km) away, beware! Never buy the most expensive house in the neighborhood. Your bank may balk at financing the home, and you probably won't see your home appreciate in value very much. If you can, buy the least expensive home in a neighborhood — as homes around you sell for more money than you paid, your home's value increases.

Making an Offer

Tailor your bid to the seller's circumstances. This is not easy, and often impossible, but it doesn't hurt to try when making one of the biggest purchases in your life. Here are some things to keep in mind as you think about your offer: What are the seller's financial prospects? Are they in desperate need of money or are they sitting on a pile of cash? Cash-strapped sellers will be more likely to take an offer that undercuts their asking price. If the house is a flip, the seller is often less emotionally invested and wants to sell quickly. Have your agent call the seller's agent and find out what they want for the property. People flipping houses usually already have a number in mind. You can find out if a house is a flip by looking at sale records, if it sold recently (around a year ago) and for much less than it's listed for now, and looks upgraded, it's probably a flip. You can also look it up on Google Maps street view to get some insight as to what it looked like before. If it looked run down with boarded up windows, and now it's looking pretty nice, it's probably a flip. It can also help to reassure the seller that you can close quickly (if you really can!). How long has the home been on the market? Homes that have been on the market for longer periods of time can usually be bid down. Have they already bought another house? If the sellers aren't currently living in the house they're trying to sell, it may be easier to bid less than you otherwise might.

Calculate your expected housing expenses. Estimate the annual real estate taxes and insurance costs in your area and add that to the average price of the home you're trying to buy. Also, add how much you can expect to pay in closing costs. (These take in various charges that generally run between 3 and 6 percent of the money you're borrowing. Credit unions often offer lower closing costs to their members.) Put the total into a mortgage calculator (you can find them online or make your own in a spreadsheet. If the figure is above 28% of your gross income (or whatever the lower percentage used by lenders in your situation) then you will have a hard time getting a mortgage. Determine whether you need to sell your current home in order to afford a new one. If so, any offer to buy that you make will be contingent on that sale. Contingent offers are more risky and less desirable for the seller, since the sale can't be completed until the buyer's house is sold. You may want to put your current house on the market first.

Be prepared to make an offer that's above the asking price. Economics of supply and demand will sometimes force your hand. If many people are competing for few homes, be prepared to lead with your highest possible offer. Some homebuyers don't believe that you should lead with your highest offer, but you could easily find yourself being outbid and never get the chance to bid on your house. If you want to give yourself the best shot on a home that you really, really like, lead with a high bid.

Talk to your Realtor when you're ready to formally present your offer. Although the guidelines for submitting offers may differ from state to state, this is usually how it goes: You submit your offer to your Realtor, who then forwards it to the seller's representative. The seller then decides to accept, reject, or make a counteroffer. Include earnest money with your offer. This is typically 1-5% of the offer. Once you sign an offer, you are officially in escrow, unless you cancel using an accepted contingency to the contract during the contingency period. During escrow (typically 30 to 90 days), your lender arranges for purchase financing and finalizes your mortgage. Consider putting an expiration time on your offer if you or your agent think it makes sense for that situation. For example, if you put a 24-hour expiration, you're only bound to that offer for 24 hours. This can put a little pressure on the seller to act quickly.

Finalizing the Deal

Determine how much of a down payment you'll need to offer up front. A down payment establishes equity, or ownership, in a home. That's also money that you don't have to pay interest on. The more of a down payment you're able to make on your home, the less money you'll ultimately pay on your home. You may be expected to put down 10-20% of the appraised value of a home depending on your loan package. However, there are loan packages that allow you to put down much less. Note that the appraised value may be higher or lower than the selling price of the house. If you have $30,000 saved for a down payment, for example, you can use it as a down payment for a home between $300k (10% down payment) or $150k (20% down payment). Putting less down often, but not always, requires you to pay private mortgage insurance (PMI), which increases your monthly housing cost but is tax deductible. However, 20% is the typical amount for not needing to pay PMI. If you can't afford a 10%-20% down payment on your home, but have good credit and steady income, a mortgage broker may assist you with a conventional or FHA mortgage. FHA mortgages only require a 3.5% down payment and there are other loan packages that require as little as 3% down. There are also USDA and VA loans that require no money down. Talk to your mortgage broker to find your best option.

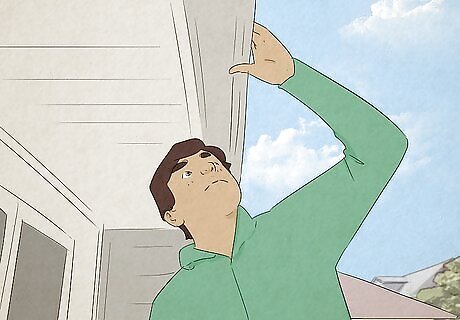

Make sure final acceptance is predicated on a suitable home inspection. Request the following surveys and reports: inspection, pests, dry rot, radon, hazardous materials, landslides, flood plains, earthquake faults, sewer scope and crime statistics. (You will generally have 7–10 days to complete inspections — be sure that your agent explains this fully to you when signing the purchase and sales contract.) A home inspection costs between $150 and $500, depending on the area and the size of the home, but it can prevent a $100,000 mistake. This is especially true with older homes, as you want to avoid financial landmines such as lead-paint, asbestos insulation and mold. If you use the inspection results to negotiate down the price of your purchase, then include the portion of the inspection report that notes the deficiency to prove that it exists.

Have a home energy audit completed on the house and ensure that the contract is contingent on the outcome. Getting a home energy audit is an essential part of the home buying experience. Not knowing what it really costs to heat and cool a home is a potential financial disaster waiting to happen. Home buyers make "guesstimates" when figuring out a new home budget. These estimates can be significantly incorrect and place families into dire financial circumstances.

Close escrow. This is usually conducted in an escrow office and involves signing documents related to the property and your mortgage arrangements. The packet of papers includes the deed, proving you now own the house, and the title, which shows that no one else has any claim to it or lien against it. If any issues remain, money may be set aside in escrow until they are resolved, which acts as an incentive for the seller to quickly remedy any problem areas in order to receive all that is owed. Consider using your real-estate lawyer to review closing documents and represent you at closing. Again, Realtors are unable to give you legal advice. Lawyers may charge $200-$400 for the few minutes they're actually there, but they're paid to look out for you.

Comments

0 comment