views

Understanding Capital Gains

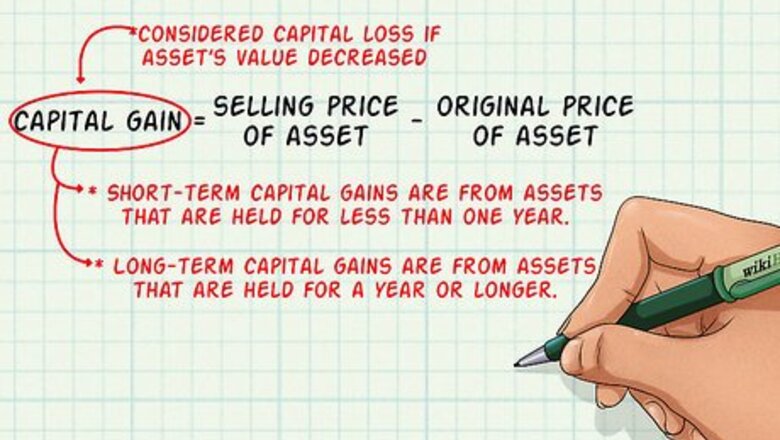

Define capital gains. Capital gains refer to the increased value of an asset over time. When the asset is sold, you compare the selling price with the original purchase price. The difference is your capital gain. If the asset decreases in value, it is considered a capital loss. Short-term capital gains are from assets that are held for less than one year. Long-term capital gains are from assets that are held for a year or longer.

Recognize what counts as a capital asset. Many things that you might not think of qualify as capital assets. The IRS defines capital assets as everything you own and use for personal use, pleasure and investment. You must calculate capital gains whenever you sell one of these capital assets. Examples of capital assets include investments such as stocks and bonds, your personal home or investment properties, household furnishings and your car. Other capital assets include timber grown on your property, coin or stamp collections, jewelry and precious metals. Your personal home may be exempt from taxes on capital gains if you owned it and used it as your primary residence for at least two years in the five years before you sold it and you haven’t excluded the gain on the sale of another property in the two-year period before the sale.

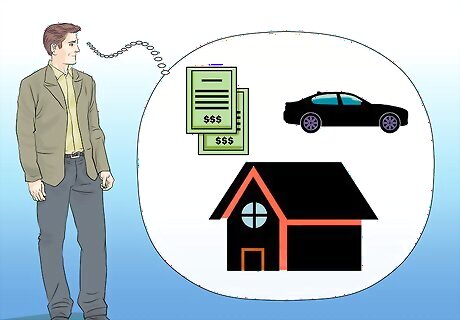

Understand why you need to calculate capital gains. The IRS requires you to calculate capital gains because you must pay income tax on them. All capital gains must be reported. The tax rate on capital gains is less than the tax rate on wages per bracket. The amount of tax you pay on capital gains depends on your tax bracket in 2015 (this rate will change as tax bracket rates change). Those in the 10 to 15 percent tax bracket pay 0 percent on capital gains. Those in the 25 percent, 28 percent, 33 percent, or 35 percent tax brackets pay 15 percent on capital gains. Those in the 39.6 percent tax bracket pay 20 percent on capital gains.

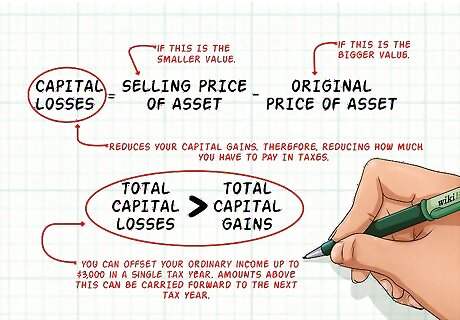

Learn how capital losses offset capital gains. If you sell something for less than what you paid for it, this is a capital loss. You can use your capital losses from investments to reduce your capital gains. This reduces how much you have to pay in taxes. Also, if your total capital losses exceed your total capital gains, you can offset your ordinary income up to $3,000 in a single tax year. Amounts above this can be carried forward into the next tax year. You cannot use capital losses from the sale of personal property to offset capital gains.

Calculating Capital Gains

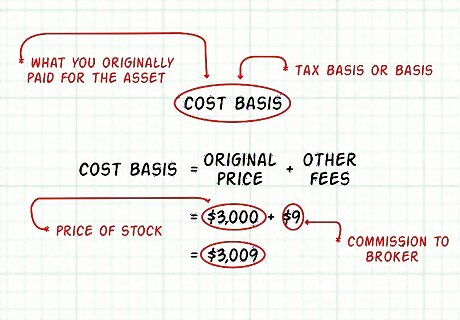

Verify the cost basis of your asset. The cost basis is essentially what you originally paid for the asset. For stocks and bonds, the purchase price can be adjusted up or down for stock splits, dividends, return of capital distributions and brokerage fees. For example, if you purchased stock for $3,000 and you paid a $9 commission to a broker, your cost basis is $3,009. The cost basis is also referred to as “tax basis” or simply “basis.”

Ascertain the selling price. For stocks that you sold, you can find the selling price on the order of execution confirmation or your brokerage account statement. For other assets you sell, keep records of the selling price. Make a copy of any receipts for sale of furniture, jewelry, coins or precious metals. If you sold property, keep a copy of the closing statement from the settlement.

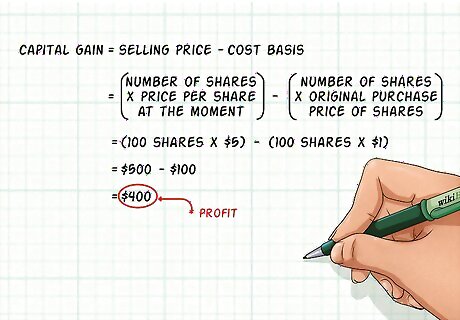

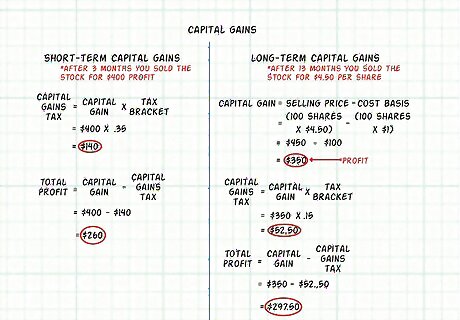

Calculate the difference. The difference between the buying price and the selling price is your capital gain or loss. The formula is Sale Price - Cost Basis = Capital Gain. For example, suppose you purchased 100 shares of stock for $1 each for a total value of $100. After three months, the stock price rises to $5 per share, making your investment worth $500. If you sell the stock at this point, you will have made a profit of $400. You would pay capital gains tax on the $400 profit. Since you held the stock for a period of less than a year, it would be considered short-term capital gains and be taxed at your regular income tax rate.

Managing the Tax Impact

Understand how taxes on capital gains affect investment results. Income taxes reduce the overall profit you earn on the sale of your assets. You can use different tactics to manage the tax impact on your capital gains. You can strategically plan the timing of the sale of your assets. Also, you can use your capital losses to offset you capital gains.

Divide capital gains on equities into short-term and long-term. Short-term capital gains are taxed at your regular tax income rate, and long-term capital gains are taxed at a lower rate. Therefore, sometimes it makes sense to hold off on selling equities in the short-term, even if the price spikes. The difference between your income tax rate and the reduced long-term capital gains tax rate can be significant. For example, in the scenario described above, you might be thrilled that you made $400 on the sale of that stock after only three months. However, if you are in the 35 percent tax bracket, then you would need to pay $140 in capital gains tax ( $ 400 ∗ .35 = $ 140 {\displaystyle \$400*.35=\$140} \$400*.35=\$140). Your total profit would then only be $260 ( $ 400 − $ 140 = $ 260 {\displaystyle \$400-\$140=\$260} \$400-\$140=\$260). Suppose in the same example, after 13 months, each share of stock was worth $4.50. Your total investment would be worth $450. If you sell, you would earn a $350 profit. However, since you’ve held the stock for longer than a year, that profit is a long-term capital gain and is only taxed at a 15 percent tax rate. Your capital gains tax would be $52.50 ( $ 350 ∗ .15 = $ 52.50 {\displaystyle \$350*.15=\$52.50} \$350*.15=\$52.50). This means your total profit after taxes would be $297.50 ( $ 350 − $ 52.50 = $ 297.50 {\displaystyle \$350-\$52.50=\$297.50} \$350-\$52.50=\$297.50). Even though you sold the stock for a lower price, timing the sell of your stock allowed you to minimize the tax impact and make a bigger profit.

Offset capital gains with capital losses. Some investors purposely sell investments at a loss in order to reduce their taxable capital gains. These tax-loss strategies may save investors enough in taxes to improve the overall performance of their portfolios. However, this approach can be perilous. If not executed correctly, you could end up losing more in capital losses than you save in taxes. Analyze the market carefully to select the right shares to sell at a loss. Don’t give up shares in a healthy company just because prices may have dipped temporarily. You could be missing an opportunity for large profits by not holding that investment for the long-term.

Comments

0 comment