views

Opening an Account When You are Moving to Australia

Ensure you are arriving in Australia in the next 12 months. Before pursuing an Australian bank account, ensure that your arrival will occur in 12 months or less. You will need to confirm your identity in person, in Australia, within 12 months of starting your account. If you are not able to accomplish this, the account you have started will become void, and your money will be returned.

Choose an Australian bank. There are four major banks in Australia: Westpac, Commonwealth Bank, NAB, and ANZ. Each of them offers similar account types with a low or zero monthly service fee, as long as you deposit a minimum amount. Conduct some research on each bank, perhaps even giving each bank a call, and then select the bank that best suits your needs.

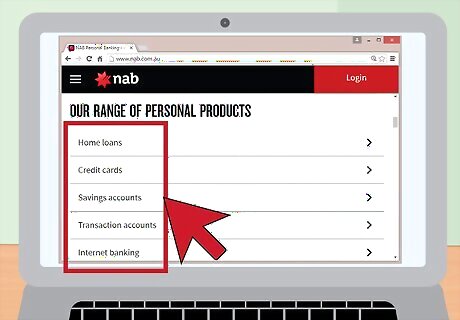

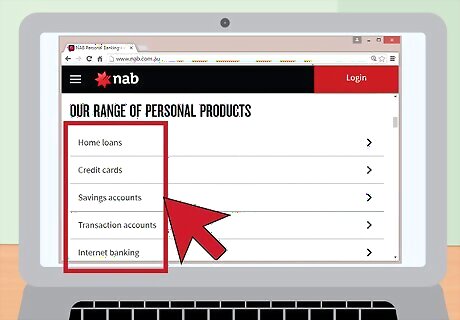

Select the type of account you will need. In general, there are two types of basic accounts that you can open: an everyday transaction account (similar to a checking account) or a savings account. Will you be using this account to conduct your daily business, or merely as a place to hold your money? Select the type of account you need.

Gather your personal information. In order to begin the process of opening an Australian bank account, you will need to have some personal information ready. You will need your social security number, driver’s license or I.D. number, your birth date, and residential address. You will also need to have a few important documents that verify your identity, such as a passport and marriage license.

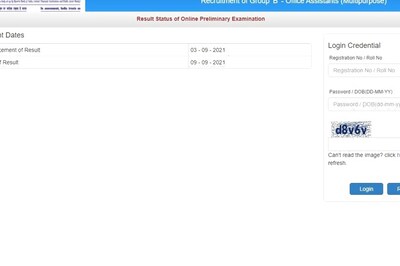

Apply online. Once you have selected your bank and gathered your personal information, visit the website of your bank and move through the application process. In most cases, you will need to scan or fax copies of some of your documents. If you prefer, you may also be able to apply by phone. You will still need to scan or fax some identifying documents.

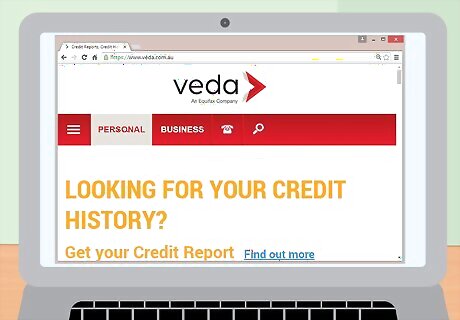

Verify your identity online. In order to proceed with the account process, you will need to allow your bank to complete a preliminary verification of your identity. If you agree, you bank will disclose your name, date of birth, and residential address to a third party (such as Veda Group Limited) who will verify your identify using commercial, commonwealth or governmental data bases.

Deposit money. Depending on which bank and which type of account you have selected, you will need to deposit a certain minimum amount of money. Your account will only be able to receive deposits until you have completed your in-person identity check with the bank. (In other words, until you arrive in Australia, you will not be able to access to money you have deposited into your account.)

Find your local branch. All of the major banks in Australia have more than one location. Find the branch that is nearest to where you will be staying, and go to pay them a visit.

Complete your ID verification in person. When you arrive in Australia, you will need to visit your bank in person and verify your identity. You will need to bring two forms of government-issued identification, such as a driver’s license, a passport, or a social security card.

Opening an Account on a Tourist Visa

Consider the benefits. If you consider yourself a perpetual traveler, chances are you have considered investing (or have already invested) in some type of offshore banking. Unfortunately, most offshore banking opportunities (such as those in Brazil) present some limitations (e.g., inabilities to use PayPal and Kickstarter, problems making purchases in some countries). Consider placing your money in an Australian bank instead. Australia allows you to open an account on a tourist visa. As a non-resident, you will still receive tax breaks. Your account will come with a Visa/Mastercard debit card that can be used internationally.

Select an “immigrant-friendly” bank. You will need to select a bank that is friendly to immigrants and non-residents. Good choices for this include Commonwealth Bank and NAB.

Apply online. Visit the website of the bank you have chosen and fill out all the necessary information. As for the address, you may use an address outside of Australia (to qualify as a non-resident). Under visa, you can select “ETA.” You will need to verify most of your information in person, and you will verify your tourist visa at this time, as well.

Book a trip to Australia. In order to activate your account, you must appear in person in Australia. So now is an excellent time to book a trip! Be sure to bring all necessary personal identification, including your passport, visa, and at least one other form of I.D.

Visit your bank and verify your account. Go to your bank in person and complete the final steps in creating your non-resident bank account. At this time, you can request your debit card and set up online banking.

Opening an Account as an Australian Citizen

Choose a bank. There are four major banks in Australia: Westpac, Commonwealth Bank, NAB, and ANZ. Select one of these banks to house your account. Consider which bank is closest to your home or work. You may also want to compare the services and fees offered by each bank.

Select an account type. Most banks will offer two basic types of accounts for Australian citizens: everyday accounts and savings accounts. Additionally, most banks will have special offers for students, with lower minimum balances and lower fees. Consider what you will need to use your account for and choose the account to suit your needs.

Gather personal information. In order to open your bank account, you are going to need some documents, such as proof of address, and two forms of government-issued (like an I.D. or passport). Additionally, if you will be applying for a student account, you will need a copy of your school I.D. and/or school schedule to verify your student-status. Gather these materials before you apply for your account.

Apply online. Visit the website of the bank you have chosen and begin the application process. You will be asked to select what type of account you would like, and to fill in some personal information. You may deposit money electronically at this time.

Visit your bank in person. After you have begun the online application process, you will need to visit your bank in person. At this time, you will present any verifying documents, deposit money into your account (if you haven’t already), and receive your debit card. Alternatively, you skip the online application and visit your bank in person to complete the process from start to finish. Depending on your bank and type of account, you may need to meet a certain minimum deposit in order to open your account.

Comments

0 comment