views

Prepaying for Your Own Funeral

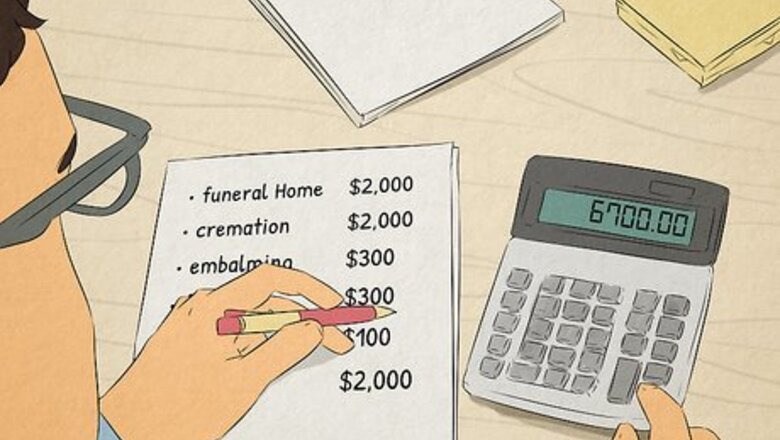

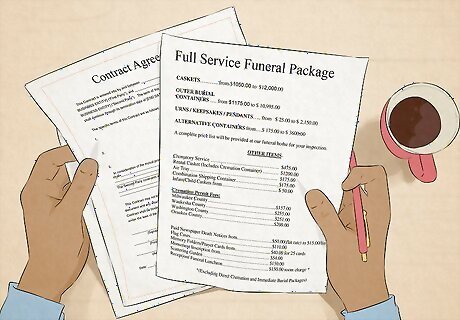

Calculate how much you'll need for your funeral. The cost of a funeral varies widely depending on the kind of services and products you want. Scout out services and get estimates for how much it will cost to get what you want. As of 2019, the average funeral and burial in the US costs around $7,000 and the average cremation costs around $5,000. Think about what's really important to you and your family. The costs can vary widely, depending on how elaborate you want to service to be. Costs will also vary among different funeral homes. However, the most important part of the cost is finding a place that you like where you feel that your friends and family will be comfortable. Assuming you don't have any chronic health issues, start your end-of-life planning in your 40s and 50s. This should give you plenty of time to organize everything you need and pay for your own funeral in advance.

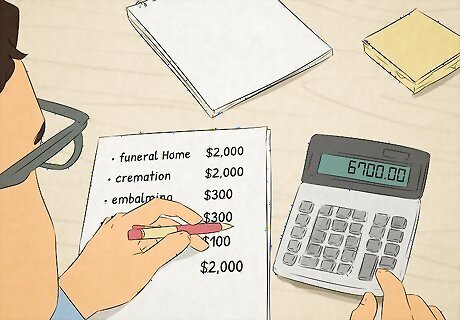

Enter a pre-need contract if you want to work with a specific funeral home. Funeral homes will plan your funeral with you down to the last detail, including the specific services and casket or vault that you want. The funeral home will keep a copy of your plans so they're ready when you need them. Read the contract carefully before you sign and make sure you understand exactly what you're paying for, how the costs are estimated, and what potential expenses are not included. For example, most pre-need contracts don't include costs for flowers.

Go with a funeral insurance policy to give your family more choice. A funeral insurance policy is similar to a life insurance policy. However, it pays out more quickly and is intended to help with funeral costs. The beneficiary usually is your next of kin or the person who would likely be responsible for organizing your funeral. With most of these policies, you can also name a particular funeral home or list other preferences related to your funeral. While you can use a regular life insurance policy for this purpose, a life insurance policy isn't intended to cover funeral expenses. Even if you make your intentions known, the beneficiary can do whatever they want with the money. Additionally, your life insurance policy typically won't pay out until several weeks after your death.

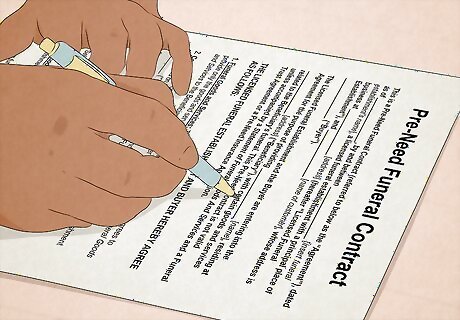

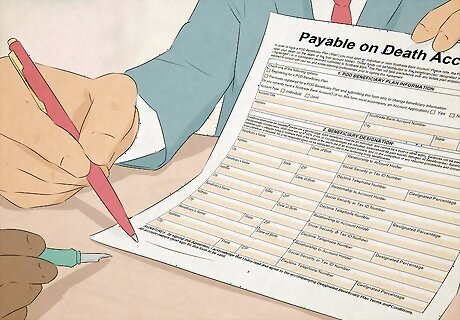

Open a payable on death (POD) account at your bank to help with funeral costs. A POD account, also known as a "Totten trust," is a type of savings account that you open with your bank. You can put as much money as you want in it. While you're alive, it functions just like a savings account. However, you have a listed beneficiary who gains access to the account after your death. With this type of account, the beneficiary typically only needs a valid ID and a copy of your death certificate to gain access to the money. This means this money is often available more quickly than insurance policies. You can't specify your preferences for your funeral with a POD account, so you would have to make those known to your loved ones in some other way. You can also use a regular savings account for this purpose. The only difference would be that a family member would need to be a joint owner of the account and would also have access to the funds in that account while you were alive.

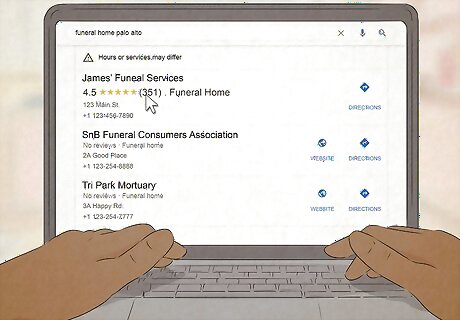

Choose a funeral home with a trustworthy reputation. If you've decided to work with a specific funeral home in advance, find one that's established and reliable. Check licenses with the health department and read reviews online. Ask friends and family members for funeral home recommendations. If there's a particular funeral home that your family always uses, you may have an easier time working with the funeral director there. Pay attention to your own comfort level while talking to funeral directors. If the place makes you feel leery or uncomfortable, walk away. Your comfort and trust are more important than anything else.

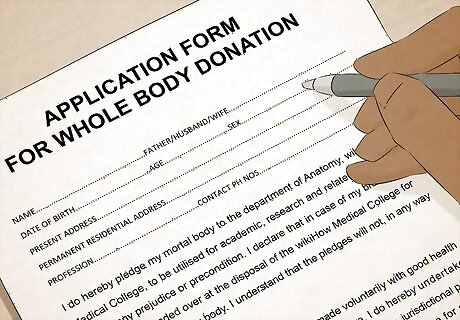

Arrange to donate your body to science to avoid costs. If you want to save everyone funeral costs, contact a local medical school and ask about their cadaver donation program. Usually, this is absolutely free. If you decide to donate your body, you'll have to complete the paperwork yourself — this isn't something your family can do after your death.

Keep records of your payments and agreement. Maintain detailed records in a safe place, including all receipts and contracts. Tell several trusted friends or family members where these records are so they can easily be located in the event of your death. If you have an attorney handling your estate planning, you can also leave this information with them. However, you also need to let close friends and family members know the name and contact information for the attorney so they can call them immediately. Make several copies of these documents and store them in different places, so you still have the records if something happens to the originals. A safe deposit box at a bank or post office is a good option.

Let close family members know about your agreement. If you've prepaid for your funeral expenses, make sure your closest family members know this so they don't unwittingly shoulder the expenses themselves. If you've contracted with a particular funeral home and you've already made specific plans for services, give them that information as well. Typically, your next-of-kin is responsible for your funeral arrangements. However, you probably want to include more than one person, especially if your next-of-kin is older than you or in poor health. If you have children, talk to them about your end-of-life plans once they're old enough to understand. Explain to them that, while you don't think you'll die anytime soon, you want to be prepared so they have less to worry about when it happens.

Choosing Affordable Funeral Options

Compare prices at different funeral homes and cemeteries. Funeral homes in different parts of town can have drastically different rates. Get a breakdown of itemized expenses from several funeral homes so you can compare and see which service is actually the best value. The price of cemetery plots varies depending on the location of the cemetery. Different plots in the same cemetery might also vary in price, with the more accessible or attractive locations being more expensive. Expect a full funeral service with a viewing, ceremony, and graveside ceremony to run from $7,000-10,000. If you have an informal service or don't have a viewing, you can usually save about $1,000.

Choose cremation to lower the overall funeral costs. Generally, cremation costs about half of what burial does. If you opt for an informal ceremony and don't keep the cremated remains in a vault or mausoleum, you can lower costs even more. If you want to have a viewing, you can rent a casket from the funeral home for the viewing and then follow the viewing with cremation. This will increase your costs, but it will still be several thousand dollars cheaper than a formal funeral and burial.

Go with direct burial to save the cost of embalming. A direct burial saves the cost of embalming by burying the body as soon as possible after death. People who choose direct burial typically opt for a simpler casket as well. With direct burial, you could save thousands of dollars in funeral expenses, even with a formal ceremony. If you're planning to do a direct burial, contact the cemetery where you want to be buried (or plan to bury your loved one) and make sure direct burial is permitted there. Some cemeteries require you to use particular liners or vaults. One type of direct burial is the "green burial," which is designed to have the least environmental impact. The body is not embalmed, and no hardwoods or metals are used in the casket. The grave is also not lined and a vault is not used.

Look into burial at home if you own your own property. Home burials are typically permitted by local governments, but may require an inspection of the site you want to use to make sure it's safe for burial and won't harm the local water supply. However, before you do this, make sure the land is a place you plan to have in your family for a long time. Graves typically can't be moved and may make the property more difficult to sell if someone decides to do that down the line.

Getting Additional Support

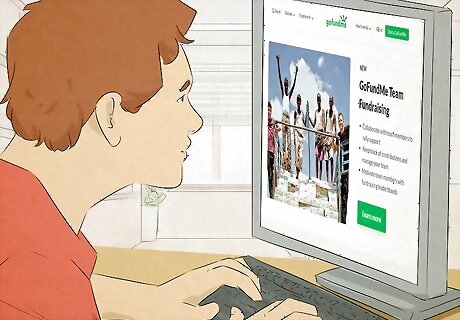

Hold a fundraiser online or in your community. Friends and family are often willing to help out, especially when someone dies suddenly or unexpectedly. Don't think that the financial burden of the funeral is yours alone. Enlist other loved ones to help you raise money. You can use crowdfunding platforms to organize your effort and help you raise money. However, check the usage terms carefully. Some platforms won't release the money unless you reach or exceed your goal. For others, you may have to wait for weeks or even months to get the money.

Apply for government benefits if you have a low income. Many governments have benefits available for low-income citizens who can't afford funeral expenses for a loved one. Typically, you have to qualify as next-of-kin to take advantage of these resources. If the deceased was on government benefits when they died, they might also qualify for funeral benefits. However, usually, you must meet eligibility requirements as well.

Talk to nonprofits and charities about help with costs. Depending on the deceased and the circumstances of their death, there might be nonprofit organizations or charities that have funds available to cover some or all of the funeral costs. For example, if the deceased died of cancer, you might talk to cancer charities to find out if they have resources available.

Ask the employer of the deceased about survivor benefits. Many employers have survivor benefit programs that can help with funeral expenses, especially if the death was work-related. Unions also often have these benefits for their members. Someone in human resources would typically have information about these programs. Be prepared to prove your relationship to the deceased so they'll release the information to you.

Check into veterans' benefits if the deceased served in the armed forces. In the US, if the deceased is a veteran, they are entitled to burial in a national cemetery at no cost. These benefits cover any expenses associated with the gravesite, headstone, vault, and interment. This leaves the family responsible only for other charges, such as flowers and fees paid to anyone delivering funeral rites. Additional money is available if the death occurred during active duty or as a result of service-related injuries. Although these benefits are specific to the US, other countries may have similar programs. Ask your country's veteran affairs department for more information.

Work with law enforcement if the deceased was a crime victim. If the deceased was a murder or wrongful death victim, you might be able to get money for funeral services from the victims' services division of local law enforcement. The officer in charge of the criminal investigation will likely have information for you on the services available. Some of these programs provide you an upfront allowance or help with arrangements, while others reimburse reasonable costs. Get in touch with the division as soon as possible following the death so you can fill out any necessary paperwork and get the process started. Otherwise, it might take weeks or even months to get the assistance you need.

Look into a funeral loan as a last resort. If you've tried everything and still don't have enough money to cover the funeral, a funeral loan might be an option — but it can be costly. With interest rates ranging from 6-35%, taking out a funeral loan is like paying for the funeral with a credit card. If you know you're going to get the funeral expenses back from the estate of the deceased, a funeral loan isn't a terrible option — assuming you know that the estate won't be tied up for years. Because funeral loans are personal loans, they are extremely difficult to get if you don't have extremely good credit (a score of 700 or above).

Comments

0 comment