views

Understanding Your Home-Buying Costs

Shoot for a down payment of about 20%. The down payment will be the largest immediate cost of buying a home. If you can pay for at least 20% of the total cost of your home up front, you will not have to pay private mortgage insurance (PMI), which protects the lender against you defaulting on your loan. If you must buy PMI, your monthly payments may be significantly higher. You’ll also be able to get a better interest rate from mortgage companies, saving you money in the long run. You don't have to save up a 20% down payment in order to buy a house. Some loans will allow you to put 0% down, while others may require 3%, 3.5%, 5%, or 10%. Work with your lender to find the best option for you. However, paying this little will cause you to have to pay PMI. Some companies may allow you to skip PMI in return for paying a higher interest rate. This may or may not be a better option for you. Talk to a tax advisor to find out the best way to keep costs down.

Add in the closing costs and moving expenses. Closing costs include the inspection fees, property taxes, appraisal fees, escrow fees, lender insurance, recording fee, and the prepaid interest charged by your mortgage company. You may also need to pay extra fees directly to your lender, such as a charge to check your credit and a loan origination fee. All together, these will usually total between 2-5% of the total cost of the home. Moving expenses in the U.S. will generally run you between $400 and $2,000 USD. Although your inspection and appraisal fees are part of your closing costs, you will pay them when the services are rendered. In some cases, you'll need to pay for your first year of home insurance at closing, as well. Prepaid interest is the total interest that accrues between the day you close on your mortgage loan payment and your first official mortgage payment.

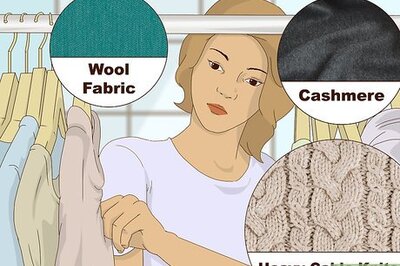

Have some cash ready for repairs and decor. Chances are that when you move in, you’ll want to make some repairs. You may also want to fill up some empty rooms with new furniture! Since you should expect to invest about 1-3% of the total cost of your home each year in maintenance, plan to spend about that much right after you buy the house as well.

Set aside enough to cover 6 months of mortgage payments. It’s never a good idea to get behind on mortgage payments, so make sure you’re starting off your relationship with your lender on the right foot. If you’ve got enough saved to make at least a half-year of payments, you’ll be prepared for any emergencies that could come up.

Do not plan to empty your savings account. Dedicate some of your savings to covering emergencies. You should always have enough money in savings to pay for 6 months of your total expenses (including food, utility bills, childcare, and everything in between). If buying a house would wipe out this emergency fund, you’re not quite ready to take the plunge yet!

Evaluating Your Income and Goals

Write down your monthly income. If your income varies from month to month, divide your total annual income by 12 to get your approximate monthly income. You’ll use this number to decide how much you can spend each month on housing expenses.

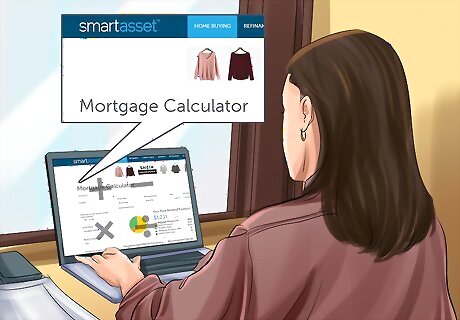

Multiply your monthly income by 0.28 to see what you can afford. Your housing expenses shouldn’t be more than 28% of your monthly income. The amount should cover your mortgage payments, taxes, repairs and maintenance, and homeowners’ insurance fees. Once you know about how much you can afford to pay per month, you’ll be able to figure out the total amount you’ll want to spend on your new house! Use online mortgage calculators like https://smartasset.com/mortgage/mortgage-calculator. These calculators will help you find out your mortgage terms, including your mortgage payment, interest rate, number of payments, frequency of payments, fees, and lender insurance, if applicable. Online calculators allow you to change these factors and see how the changes will affect your monthly expenses. Don’t forget to factor in your credit. The better your score is, the better mortgage rate you’ll receive. If your credit isn’t very good right now, talk to a financial advisor about ways to improve it before you buy your home.

Use your target home value to add up what you’ll need to pay right away. Remember, you’ll need to have cash ready for your down payment, closing costs, moving fees, repairs and new stuff, several months of mortgage payments, and emergencies. All told, this will add up to about 28% of the total cost of your home plus whatever you need for 6 months of mortgage payments and other expenses. So if your home value is $250,000 USD, make the following calculations: $250,000 x 0.20 = $50,000 USD for your down payment. $250,000 x 0.05 = $12,500 USD for your closing costs. $250,000 x 0.03 = $7,500 USD for repairs and new furniture/decor. With a mortgage payment of $800/month, 6 months’ worth would be $4,800 USD. With monthly expenses of approximately $2,000/month (not including your mortgage), 6 months’ worth would be $12,000 USD. If you add in moving fees of $1,500 USD, the grand total you’ll need to have saved when you buy is: $88,300 USD.

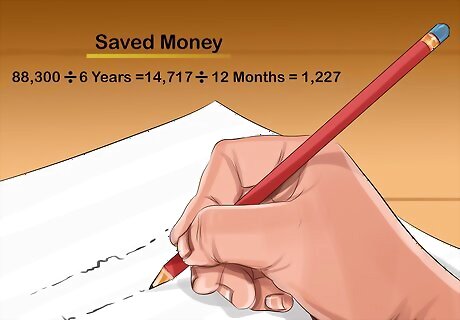

Figure out when you want to buy your home. As soon as you know exactly how much you need to have saved up to buy your house, divide that by the number of years you plan to save for. Then, divide that number by 12 to see how much you’ll need to put away each month. Say you want to save $88,300 in 6 years. Your calculations will look like this: $88,300/6 = $14,717/12 = $1,227 USD. When you make calculations, round up rather than down.

Implementing Your Savings Plan

Cut down on driving when you can. Between gas, maintenance, insurance, and any monthly payments you need to make, cars are expensive! If you’re able to carpool or take public transportation to get around, you’ll likely save thousands each year. You might even consider selling your car and learning to live without one. If you sell your car, put that money right into savings. It’ll give you a big boost and get you that much closer to your new house! If you need to drive to commute to work and get around each day, try to choose an energy-efficient car. You can also do multiple errands on each trip out of the house to limit how often you turn that key in the ignition.

Look into refinancing or consolidating your debt. If you have student loans, a home or car loan, or credit card debt, contact your creditors. See if you qualify for lower interest rates or programs that could reduce the overall amount you’ll pay in the long run. You can also make an appointment with a financial advisor to discuss your options.

Improve your energy efficiency. Replace all the old bulbs in your home with CFL or LED bulbs. You can also unplug any electrical devices as soon as you’re done using them. During summer months, aim for a temperature of 78 °F (26 °C) when you’re home, and raise the temperature about 10-15 degrees when you leave. In the winter, set your thermostat as low as is comfortable for you and your family. Lower it by 10-15 degrees when you’re away from the house. To make the house cooler in the summer, run fans in the rooms you’re hanging out in. Be sure to turn them off when you leave, though. To trap in heat, weatherproof your doors and windows.

Spend less on fun and entertainment. While going out for a drink with friends may be the perfect way to relax at the end of a long week, those bar tabs can add up. So can trips to the movies and your monthly cable bills! Treat outings as special treats and limit them to once per month. Cancel your cable and catch up on your favorite shows with Internet-streaming services, which are generally much cheaper. To systematically cut back on leisure costs, calculate how much you spend on “fun” during 1 month. In the next month, try to cut that number in half.

Plan meals to cut back on grocery trips and food costs. The more you can cook at home instead of eating out, the more you’ll save. Planning meals will not only help you have more home-cooked meals, it’ll also help you stay organized at the grocery store. This will reduce the number of trips you make and limit the random purchases you tend to make on aisle 5.

Set up an automatic transfer to your savings account. Saving money is a lot easier when it’s mindless! Contact your bank or use a mobile app to automatically transfer the exact amount you need to save for your house from checking to savings each month. When you can, you should also deposit things like bonuses, tax returns, and other cash windfalls right into your savings account.

Comments

0 comment