views

Individual demat account holders and mutual fund investors must nominate a beneficiary or choose to opt out by submitting a declaration form before September 30th. Failure to do so will result in the freezing of their demat accounts and folios, rendering them unable to redeem their investments.

According to the Securities and Exchange Board of India (Sebi), this mandate applies to both new as well as existing investors.

Also Read: Investing SOS: Missed Mutual Fund SIP? Must Read What Happens After That

Under Sebi’s rule, new investors must either nominate their securities or formally opt out of nomination through a declaration form when opening trading and demat accounts.

The move is aimed at helping investors to secure their assets and pass them on to their legal heirs.

“This will ensure smooth and hassle-free transfer of securities to the legal heirs of the investors in case of any unfortunate event,” news agency PTI quoted Tejas Khoday, co-founder and CEO at FYERS, as saying.

For existing investors, including jointly-held mutual fund folios, failing to meet this deadline will result in the freezing of folios for debits. Further, investors’ demat accounts or mutual funds folios will be frozen and inaccessible until they nominate or declare opt-out.

Feroze Azeez, deputy CEO at Anand Rathi Wealth, said, Sebi’s recent move to set a deadline of September 30, 2023, for all individual demat account holders and mutual fund investors to nominate their securities is a significant and commendable step.

In July 2021, Sebi had asked all existing eligible trading and demat account holders to provide choice of nomination on or before March 31, 2022, failing which the trading and demat accounts would have been frozen for debits.

Later, this was extended by one more year till March 31, 2023.

With regards to mutual fund unitholders, the regulator in its circular on June 15, 2022, made it mandatory for mutual fund subscribers to submit the nomination details or declaration to opt out of the nomination on or after August 1, 2022. Later, the deadline was extended to October 1, 2022, and again till March 2023.

Based on representations received from the market participants, it was decided that the provision of freezing of folios and demat accounts, will come to force with effect from September 30, 2023, instead of March 31, 2023.

Market experts are of the view that many investment accounts in the past have been opened without nominating anyone to whom the assets should be transmitted in case something happens to the account holders.

This means that the rightful heirs had difficulty in getting the assets transmitted to them due to the hassles of different kinds of documentation requirements.

Explaining Sebi’s rationale, Azeez told PTI that the initiative is crucial because it emphasises the importance of proper financial planning and safeguarding investments in the event of an investor’s untimely demise. to their folios, investors are ensuring that their investments will smoothly pass on to their chosen beneficiaries.

“The deadline serves as a proactive measure to protect investors’ interests and provide them with the peace of mind that their investments will benefit their loved ones as intended. Overall, this move by Sebi promotes responsible financial management and secures the future of investors and their families, making it a significant and commendable regulatory action,” he added.

FYERS’ Khoday said that investors can nominate up to three beneficiaries for their demat account, either online or offline. They can also change or cancel their nomination at any time.

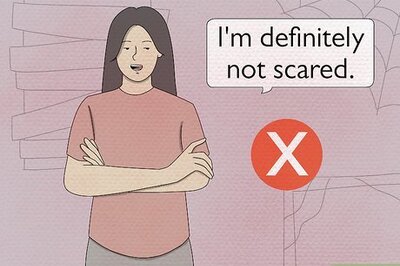

However, they can also opt out of nomination by submitting a declaration form, but this is not recommended.

(With agency inputs)

Comments

0 comment