views

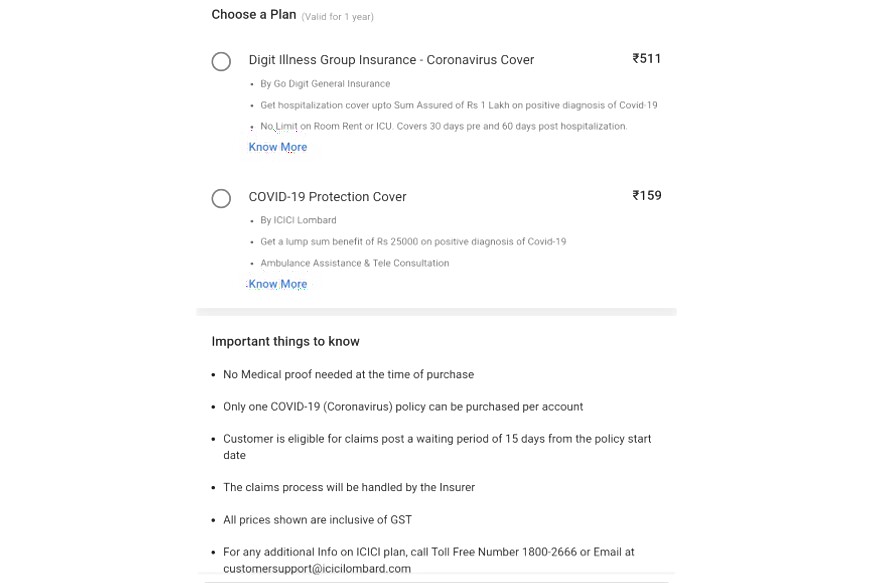

With the coronavirus pandemic still at large in India, Flipkart has introduced two medical insurance plans on its platform, by providers Digit and ICICI Lombard. Each of the two plans offer users hospitalisation cover as well as comprehensive medical cover, and both come with instant claim benefits. However, there are key differences between each of the plans, which you must be aware of, before attempting to buy a COVID-19 insurance policy.

How to avail the plans

At the time of publishing, it seems that the insurance policies are only available through the Flipkart mobile app on Android and iOS, and is not offered through the website. To access the plans through the app, tap on the hamburger button on the top left corner, and you should see an 'Insurance' tab with a 'new' badge beside it. Tapping on this opens up the overall insurance plans made available on Flipkart, and tapping on the top option takes you to the insurance policies page, which lists both the plans on offer — one each from Digit Insurance and ICICI Lombard. For both the plans, buyers will have a waiting time of 15 days before they become eligible to claim the benefits. Additionally, only one of the two plans can be bought by a user.

Digit Illness Group Insurance - Coronavirus Cover

Why you should buy: Larger sum insured, pre- and post-hospitalisation coverage, shorter cut-off for international travellers.

Why you shouldn't buy: No coverage of home based treatment, compulsory hospitalisation, only covers individuals up to 60 years of age.

The COVID-19 insurance on offer by Digit has a more comprehensive coverage, offering hospitalisation coverage of up to Rs 1 lakh. The plan is eligible for all individuals between the age of 18 and 60, and claims to offer no limit on the rental coverage amount of a room or ICU (intensive care unit) charges. To be able to claim the policy, users do not need to undertake a medical examination, but are mandated to certify that they have not travelled outside India within the past 30 days, and are not already patients of long term illness conditions linked to diabetes, heart, lungs, kidney and liver. Any form of cancer or other terminal illnesses are also to be declared before purchasing the policy.

Digit's policy also states coverage for 30 days pre-hospitalisation and 60-day post-hospitalisation procedures. For ambulance services, 1 percent of the insured sum (in this case, Rs 1,00,000) can be availed. The policy will only covered COVID-19 treatments, and individuals who have already recovered, or are under home treatment for COVID-19, will not be able to claim it. No foreign treatments will also qualify for the insurance claim. If you clear all the clauses, you can purchase the plan for Rs 511, which gives you an assured coverage of Rs 1,00,000 for one year.

ICICI Lombard COVID-19 Protection Cover

Why you should buy: Home treatment coverage of full sum insured, longer age span coverage, telephonic and video consultation with doctors.

Why you shouldn't buy: Smaller sum insured, 90+ day international travel cut-off, amount too low in case of sudden hospitalisation.

The policy from ICICI Lombard offers coverage worth Rs 25,000 upon positive diagnosis of COVID-19. This plan is applicable for an age bracket of 18 to 75, therefore covering a wider range of potential patients (with the elderly particularly at risk). It also offers four telephonic consultations with doctors, free of charge, and extends "ambulance assistance" in case of emergencies. Like Digit's plan, ICICI Lombard also has a 15-day waiting period before the claim period begins, and also has a 15-day cancellation period, within which the insurer will refund the full amount to the user.

In terms of eligibility, ICICI Lombard requires users to certify that they have not travelled outside India after December 31, 2019, and have neither been quarantined or come in close contact with any known COVID-19 patient. However, in contrast to Digit's policy, ICICI Lombard does not require mandatory hospitalisation, and will pay the full sum insured if a customer tests positive from a government or ICMR-authorised test centre. In order to support home treatments, ICICI Lombard is also offering virtual doctor consultations for free as part of the package. This policy insures a sum of Rs 25,000, and can be bought for a yearly premium of Rs 159.

Comments

0 comment