views

PF Withdrawal Limit For Medical Treatment: If you face a medical emergency or require urgent treatment, you can withdraw money from your Employee Provident Fund (EPF) account. The EPFO allows members to make advance withdrawals from their accounts to cover specific unforeseen financial needs, such as medical treatment, weddings, education, home loans, and house construction costs.

The Employees’ Provident Fund (EPF) is a retirement savings program for salaried employees, where a portion of their monthly income is deposited with the Employees’ Provident Fund Organization (EPFO). Employers also contribute a fixed amount to this fund. Over time, the accumulated corpus serves as a financial resource for the employee, either during their service or post-retirement.

PF Withdrawal For Medical Emergency Limit

In the case of medical emergencies or hospitalisation due to life-threatening conditions, EPFO members can withdraw up to Rs 1 lakh. Previously, these advances were only available after submitting estimates provided by the hospital.

Later it was announced that a lump sum medical advance of up to Rs 1 lakh can be granted by the authority for withdrawal without the need of an estimate from the hospital or documentation.

The money that can be withdrawn is the minimum 6 months’ basic wages and dearness allowance (DA) of the member or the member’s share of contribution with interest.

EPFO had stated that in case of life-threatening illnesses, it becomes “imperative to get the patient immediately admitted in a hospital in an emergency to save his/her life and it is not possible to get the estimate from the hospital in such serious situations.”

However, certain conditions need to be fulfilled when availing of this option.

The withdrawals can be made for patients admitted to a government or Public Sector Unit like ESIC or CGHS-empaneled hospital for treatment of the disease. In the case of a private hospital, a background check would be done by EPFO.

The case will be checked by the competent authority of EPFO to decide if the advance can be made or not.

EPF Advance Claim Process

The maximum advance amount is calculated according to the member’s basic pay, dearness allowance, personal contribution share, and interest, ensuring fair access to funds for medical needs.

Apart from medical expenses, EPF subscribers have the option to make partial withdrawals for a range of purposes including marriage, home purchase, loan repayment, or house renovation.

To withdraw money from your EPF account for medical purposes, you will need to follow these steps:

- Step 1: Go to the e-SEWA portal of the EPFO. https://unifiedportal-mem.epfindia.gov.in/memberinterface/

- Step 2: Enter your Universal Account Number (UAN), and password, and type in the captcha code to log in.

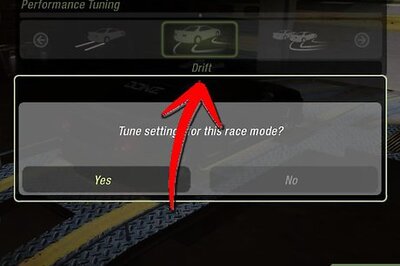

- Step 3: Enter your bank account information on the new page that opens and select “Verify” to continue. This information is linked to your PF account. Now, click on “Yes” to accept the terms and conditions.

- Step 4: Click the “Online Services” link and choose Claim Form-31 for illness

- Step 5: After this, click on ‘Proceed for Online Claim’.

If the patient is discharged from the hospital, an employee must submit the medical bills to EPFO within 45 days to avail the facility of PF withdrawal.

After processing, the claim will be sent to the employer for approval. Subscribers can monitor the status of their claim by selecting the ‘claim status’ option within the ‘online service’ section.

EPFO Doubled Partial Withdrawal Limit For Treatment

Earlier this year, EPFO raised the previous eligibility threshold for automatic claim settlements under Paragraph 68J. This adjustment aligned with EPFO’s objective of optimising auto claims processing.

Paragraph 68J enables subscribers of the Employees Provident Fund (EPF) to request advances for medical expenses for both themselves and their dependents.

The situations include prolonged hospital stays, significant surgeries, and conditions such as tuberculosis, leprosy, paralysis, cancer, mental illness, or heart ailments.

EPFO Paragraph 68J

Paragraph 68J of the EPF Scheme is all about helping you access funds for medical emergencies. It allows EPF members to withdraw an advance for their own and their dependents’ medical treatment costs.

Significantly, the revised provision removes the requirement for extra documentation like medical certificates or proforma, thus streamlining the claim process for subscribers.

Here’s what you need to know about paragraph 68J:

- Purpose: Provides financial aid during medical situations.

- Eligible Conditions: You can claim an advance for hospitalisation lasting a month or more, major surgeries, or critical illnesses like tuberculosis, leprosy, paralysis, cancer, mental illness, or heart disease.

- Recent Update (April 2024): The limit for auto-claim settlements has been increased from Rs. 50,000 to Rs. 1,00,000. This means claims that meet specific criteria will be processed automatically without needing further approval.

- Withdrawal Amount: There are two options: -Lower of 6 months’ basic wages and dearness allowance (DA) or-Employee’s contribution (including interest) – whichever is less.

Paragraph 68N

Moreover, members with physical impairments can utilise Paragraph 68N to apply for advances to acquire equipment that mitigates their condition, provided certain conditions are met.

Paragraph 68N of the EPF Scheme deals with providing financial assistance to physically challenged EPF members. It allows them to withdraw an advance payment to purchase equipment that can help minimise the difficulties arising from their disability.

Comments

0 comment