views

New Delhi: Dharmendra Pradhan has backed the inclusion of petroleum products under GST, saying this is the only way to rationalise prices.

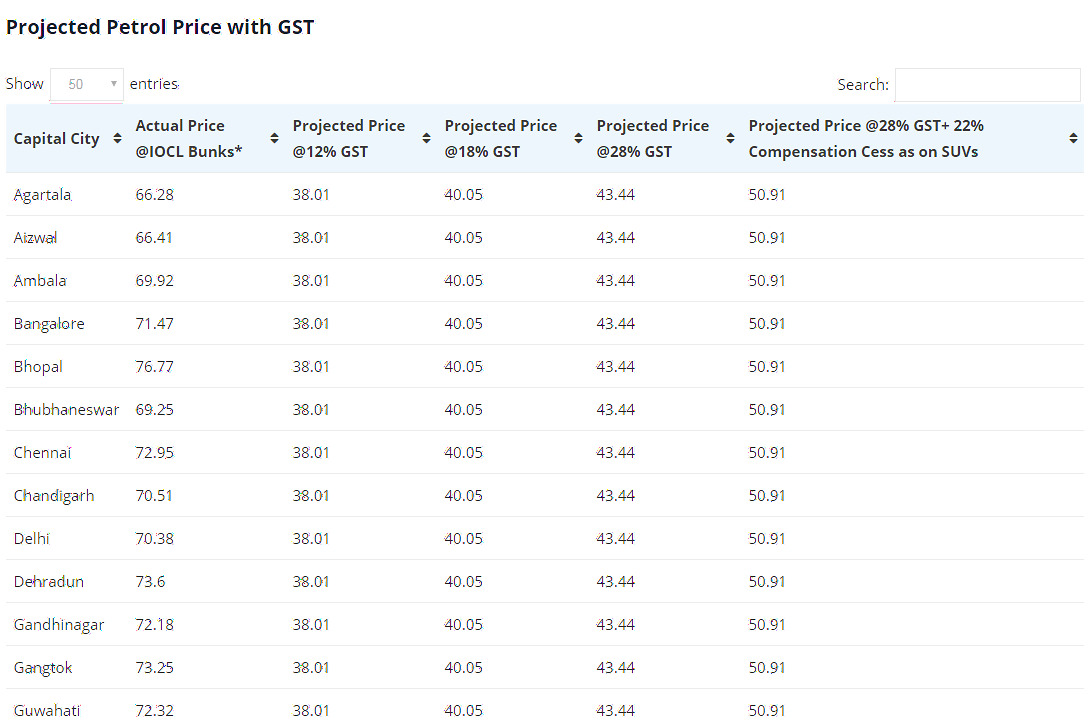

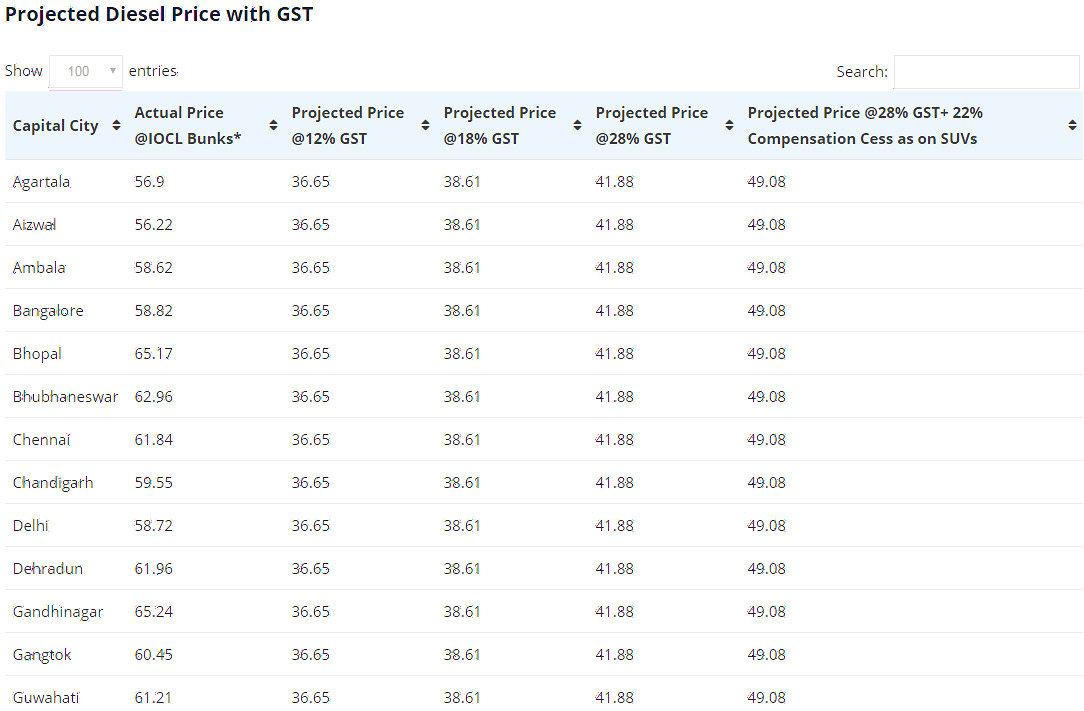

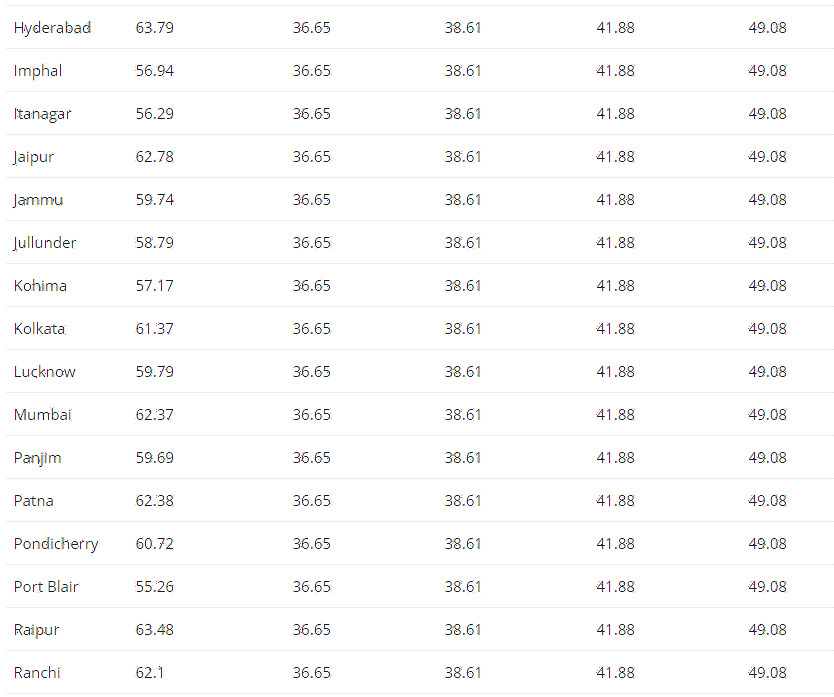

But, what would the level of fuel prices be under the Goods and Services Tax? An analysis by Factly.in, a website that makes public data meaningful, indicates that prices of petrol and diesel would be lower than what they are currently, even if they were taxed at the highest slab of 28%.

Petroleum products are currently not under GST and each state has its own tax structure, because of which the prices of petrol and diesel vary state wise. Domestic fuel prices have touched a three year high, even though international crude oil prices have been trending downward since June 2014. In July 2014 the Indian crude basket was $109.05 per barrel, which declined to $53.63 p/b in September 2017.

However, domestic fuel prices have been moving in the opposite direction, leading to a public outcry.

Petroleum products inclusion in GST only way for rational fuel prices #ETEnergyworld https://t.co/Vrhi0lAojk— Dharmendra Pradhan (@dpradhanbjp) September 14, 2017

Comments

0 comment