views

X

Trustworthy Source

USA.GOV

Official website for the United States federal government

Go to source

Applying for Public Housing

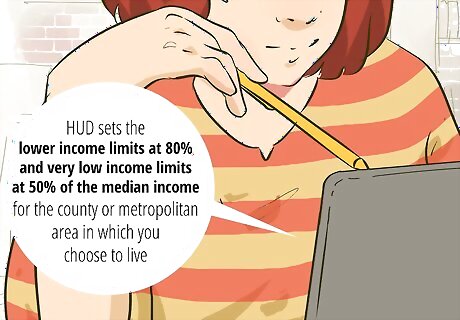

Confirm your eligibility for public housing. While some areas may have specific local requirements, the basic eligibility criteria for public housing are established by the US Department of Housing and Urban Development (HUD). Generally, at least one member of your family must have legal status, your family cannot have outstanding consumer debt obligations that are more than 60 percent of your income, and all adult family members must be able to pass a criminal background check. Because public housing is available for low-income families, income eligibility is set each year based on the median income in your area. You're considered extremely low income if you make 30 percent of the median, very low income if you make 50 percent of the median, and low income if you make 80 percent of the median. Your local housing authority can provide you with specifics for your area. Your application will be given preference if the head of your household is in college or working at least 20 hours a week at federal minimum wage. If the head of your household is disabled or over the age of 62, your application will also be given preference. Because many areas have long waiting lists for public housing, this preference is very valuable.

Contact your local housing authority (HA). Local HAs are responsible for managing and operating the public housing program in your area. Some HAs allow you to apply online, but most of them require you to make an appointment and meet with an HA representative in person. To find your local housing authority, go to https://www.hud.gov/program_offices/public_indian_housing/pha/contacts and click on your state on the map. Call ahead and ask what you need to do to apply for public housing. The representative you speak to will let you know the exact process in your area.

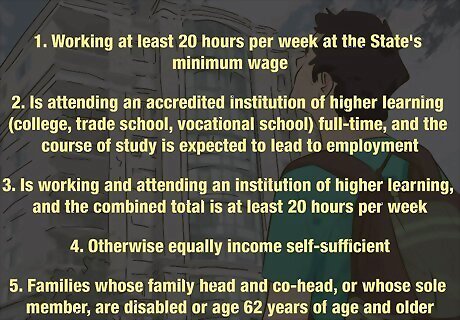

Complete your written application. On your application, provide information about everyone in your household, including yourself. The application may also ask for an estimate of your household income from all sources. You may need to provide employment information as well. In most areas, you have the option of either turning in your application to your local HA in person or mailing it in. Your application will likely be processed more quickly if you take it into the HA in person. Call ahead and find out if you need to make an appointment.

Gather documents to support your application. Once you've filed your initial application, an HA representative will contact you and let you know what documents are needed. You will likely need to make an appointment to bring these documents into the HA office. The specific documents you need will vary depending on your circumstances. However, you can expect to need documents such as: Birth certificates; Tax returns; Marriage certificates or divorce decrees; Verification from your employer; Proof of citizenship or legal residency; Bank statements; and Pay stubs.

Wait for written notification of the housing authority's decision. The HA representative reviews your application and supporting documents to decide if you are eligible for public housing. HUD requires your local HA to send you written notice of the decision. If the HA determines that you are ineligible, the notification will give you the reason why. You can request an informal hearing to challenge that decision. The notification will explain how to do this. If you are deemed eligible for public housing, you will be put on a waiting list. The HA will notify you when a unit is available with the correct number of bedrooms for your household size.Tip: You may be on a waiting list for months, if not years, depending on the demand for public housing in the city or county where you live. While you are on the waiting list, you are responsible for updating the HA if any of the information you provided on your application changes.

Sign your lease and pay your security deposit if required. The HA will notify you when a unit is available. You don't have to accept a unit offered to you. However, in most areas, you cannot choose a specific community where you want to live. When a unit opens up that you want to move into, you'll sign your lease with your local HA. The amount of rent you'll pay depends on your total family income less allowed deductions for dependents. Typically, your rent will be no more than 30 percent of this amount. Your HA may have a minimum rent. If 30 percent of your income is less than that minimum rent, you would pay the minimum (typically $25 or $50). While you're in public housing, you are responsible for providing updated income information to your local HA. Generally, you can stay in public housing as long as you comply with your lease. However, if your income increases to the point that the HA determines you can afford housing on the private market, you may have to leave. In some situations, such as if you don't have much rental history, you may be required to pay a security deposit. Your HA representative will let you know if a deposit is required. When you leave public housing, your deposit will be returned to you with interest provided your unit isn't damaged.

Getting a Housing Choice Voucher

Evaluate the eligibility requirements. Your local housing authority (HA) determines your eligibility based on your gross household income (income before taxes), citizenship or immigration status, and other factors. The specific requirements for the Housing Choice Voucher Program vary depending on where you live and the demand for the program in the area. Generally, you cannot have income more than 50 percent of the median income for the county or metropolitan area where you live. Median income amounts are adjusted every year. The HUD office nearest you can also help you understand eligibility requirements in your city or county. Visit https://www.hud.gov/program_offices/field_policy_mgt/localoffices to locate the office nearest you.

Contact your local HA to apply for a voucher. Visit https://www.hud.gov/program_offices/public_indian_housing/pha/contacts and click on your state to get contact information for your local HA. An HA representative will let you know what you need to do to apply for a Housing Choice voucher. In some metropolitan areas, HAs may not be accepting applications for Housing Choice vouchers if the waiting lists are too extensive. If applications are closed, the HA representative can help connect you to other resources for help with affordable housing.

Wait for notification from the HA. When your application comes up, the HA will contact you to provide information about the voucher payment you'll receive to help with your rent. Because demand far outstrips HA resources, particularly in urban areas, you may have to wait months, if not years, to get a voucher. While you're waiting, keep the HA updated if any of the information you provided on your original application changes.

Find a housing unit that meets the criteria of the voucher program. Landlords who accept vouchers must offer units that meet HUD health and safety standards. The landlord is also required to provide various services, which will be explained up front. In most areas, you can search on any rental website for properties that accept vouchers. Your HA may also have information about approved landlords who have units available. Unlike public housing, you will not be assigned a unit – it's up to you to find appropriate housing.Tip: Once you have a voucher, you can move to a property anywhere in the country that accepts vouchers. However, you must live in a unit in the city or county where you initially applied for a voucher for at least 12 months before you can move.

Take your lease to the HA for approval. To use your voucher to pay for all or part of your rent, the rent itself must be reasonable. You are eligible for a unit with a maximum number of bedrooms, determined by your household size. For example, if you have a household of 2, you may only be eligible for a single-bedroom apartment. If you wanted to rent a 2-bedroom apartment, you wouldn't be able to use your voucher to help pay for it. Your local HA will also inspect the specific unit you're going to rent before it approves your lease. Your landlord may have to make repairs or upgrades before you can move in.

Finding Privately-Owned Subsidized Housing

Search for low-income housing in your area. You can use apartment listing sites online to search for privately-owned low-income housing. Most listing sites allow you to filter your search results to return only low-income properties. Some properties that accept Housing Choice vouchers may also offer assistance for low-income families who do not have vouchers. Your local public housing authority may also have information or listings of privately-owned subsidized housing available in your area.Tip: Privately-owned subsidized housing is much more prevalent in later urban areas than in rural areas. Some cities offer tax breaks for landlords who specify a minimum percentage of their units as low-income units.

Evaluate the eligibility criteria. Privately-owned subsidized housing typically has less strict standards than public programs, so you may qualify for privately-owned subsidized housing even if you don't qualify for public housing. However, privately-owned subsidized housing may have restrictions that public housing does not. For example, privately-owned subsidized housing may only be available if you are working full time, not if you are working part-time or going to school. Because eligibility criteria are set by the owners of the property, they may vary from property to property. For example, you may qualify to rent in one complex, but not qualify in the complex across the street.

Fill out a rental application at the complex of your choosing. The application process for privately-owned subsidized housing is similar to renting any apartment from a private landlord. However, you may have to provide additional documents to prove your income and employment. The application process depends on the particular landlord. You may be subject to a credit check or criminal background check. Privately-owned subsidized housing is not subject to any government inspections or quality controls. Ask to see the specific unit you'll be moving into, rather than just a model. If there are any problems with the unit, insist that the landlord fixes them before you move in.

Sign a lease with your landlord for an available unit. One benefit of applying for privately-owned subsidized housing over public housing is that landlords typically only take applications if they have an open unit ready for you to move into. So assuming your application is accepted, you can typically sign your lease and move into your unit right away. Privately-owned subsidized housing leases are not subject to government approval. Read through your lease carefully and make sure you understand all of the provisions. If you don't understand something, ask the landlord to explain it to you. If you have any doubts or misgivings about the lease, take the time to have a lawyer look over it. Volunteer lawyers at nonprofit tenant associations can look over your lease for you before you sign it.

Comments

0 comment