views

Understanding Current Ratio

Understand current liabilities. The term “current liabilities” is used frequently in accounting to refer to business obligations that must be paid in cash within a year or within the operating cycle of a company. These obligations will be settled either by current assets or by the creation of new current liabilities. Examples of current liabilities include short-term loans, accounts payable, debts to suppliers, and accrued liabilities.

Understand current assets. The term “current assets” refers to assets that are used to pay a company’s obligations and liabilities within a year. Current assets can also be converted into cash. Examples of current assets include accounts receivable, stock inventory, marketable securities, and other liquid assets.

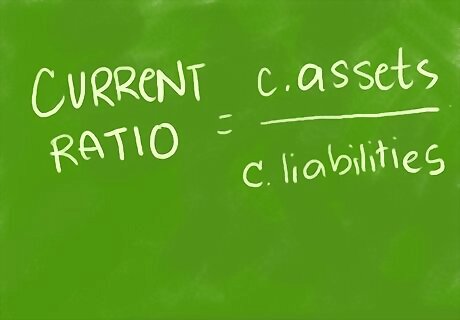

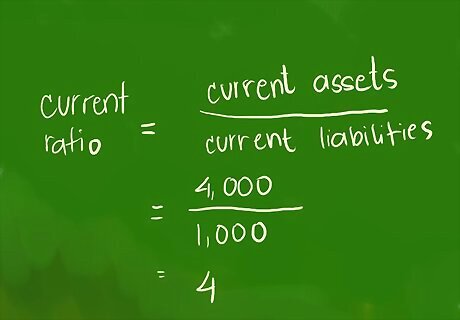

Know your basic formula. The formula for calculating current ratio is a simple one: current assets divided by current liabilities. All the numbers you’ll need should appear on a company’s balance sheet.

Calculating Current Ratio

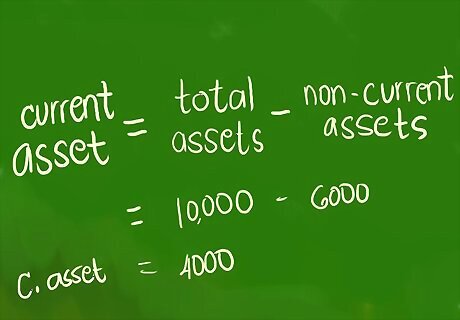

Calculate current assets. In order to calculate a current ratio, you’ll first need to find the company’s current assets. To do so, subtract non-current assets from the company’s total assets. To illustrate, let’s say you are calculating the current ratio of a company with $120,000 in total assets, $55,000 in equity, $28,000 in non-current assets, and $26,000 in non-current liabilities. To calculate current assets, subtract non-current assets from total assets: $120,000 - $28,000 = $92,000.

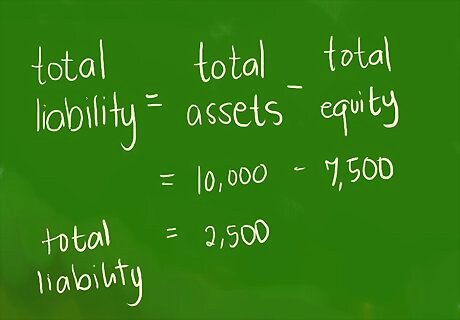

Calculate total liabilities. After calculating the company’s current assets, you’ll need to find its total liabilities. To do so, subtract total equity from the company’s total assets. In the example above, to calculate the company’s total liabilities, subtract equity from total assets: $120,000 - $55,000 = $65,000.

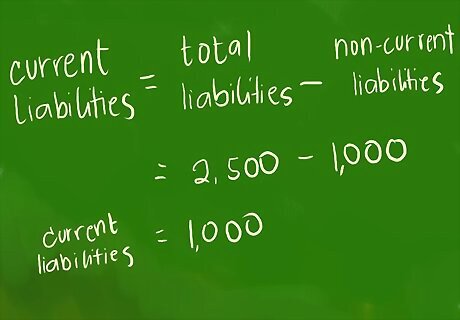

Determine current liabilities. Once you’ve found the company’s total liabilities, you are ready to calculate its current liabilities. To do so, subtract the non-current liabilities from the company’s total liabilities. In the example above, to calculate the company’s current liabilities, subtract non-current liabilities from total liabilities: $65,000 - $26,000 = $39,000.

Find the current ratio. After determining current assets and current liabilities, plug your answers into the basic current ratio formula of current assets divided by current liabilities. In the example above, divide the company’s current assets by its current liabilities: $92,000 / $39,000 = 2.358. Your company’s current ratio is 2.358, which is a satisfactory indicator of a financially healthy business.

Comments

0 comment