views

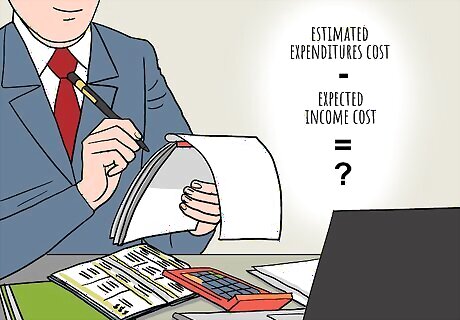

Calculating Your Finances

Add up estimates to calculate a year’s worth of expenditures. After you retire, you will still have to make payments for things like rent, insurance, transportation, food, etc. Try to add up the amount that you will spend in 1 year to realistically see if your retirement funds will cover all that you need. Track what you spend in 1 month and then multiply that number by 12 to get an estimate of your annual spending. Remember to factor in people who are dependent on your income, like children or grandchildren who you are supporting.

Calculate your expected annual income that you’ll receive after retiring. This could be from a pension, social security, or a retirement fund. Get a rough estimate of how much income you will receive annually after you retire. Try to calculate what you will receive in a month and then multiply that number by 12.

Subtract the estimated expenditures cost from the expected income cost. If you are spending more than you will be making in retirement, you may need to reconfigure your spending habits to fit your retirement plan. If you will be making enough to cover your expenses, you may be financially ready for retirement.

Factor for savings if you have them. It’s okay if you don’t have any savings, but if you do, plan on using your saved money in retirement. Based on your annual spending and earning, you should be able to get a rough figure of how much you will need to use from your savings each year. Try to factor in your age and how long you think you will need to use your savings. It’s almost impossible to guess how long you will need to use your savings. Err on the side of longevity just in case.

Consult a financial planner if you have any questions or concerns. Planning financially for retirement is a constant guessing game, and it can depend heavily on your assets and your savings. If you have a complicated situation or you aren’t sure about an important financial aspect of your retirement, hire a professional to look over your finances before you decide to retire.Tip: Look for a financial planner who has experience in retirement help, since it is a hugely complicated issue.

Considering the Benefits of Retirement

Pick up a part-time job after retirement. For some, retirement doesn’t mean just sitting at home all day. You can also use retirement to shift to part-time work in another field, or take a pay cut to do something else.Warning: If you do choose to work part-time in retirement, keep in mind that this could affect your social security and Medicare benefits. It can be nice to have a job in retirement, both as a means of income and to give you something to do.

Ask your employer if you can cut your hours to try out retirement. If you want to give retirement a trial run, talk with your employer about going down to part-time to test out how you like a lessened work-load. This conversation will go best if you’ve been working at your current job for a long time. If you really like your job, this can be a good stepping stone to retirement.

Factor in your own health and wellbeing to give yourself rest. As you age, you may find yourself slowing down. This is a totally natural part of getting older, and it may be a sign that retirement is right for you. If you find yourself becoming tired more easily, or you are unable to complete tasks at your job, you should consider retiring to keep yourself healthy. If your doctor recommends that you retire, you should definitely consider ways to stop working sooner rather than later.

Avoiding Potential Problems

Find hobbies and activities to occupy your free time. One of the downsides some people may find to retirement is too much free time. You can avoid this problem by thinking of ways you could occupy yourself if you aren’t working. This could include things like: volunteering, golfing, fishing, helping out in your community, or watching your grandchildren.

Think about ways you could get yourself out of the house. Retirement often means that you won’t be forced to leave your home every day to go to work. For some, this can lead to monotony or a feeling of loneliness. Come up with some ways that you could motivate yourself to get outside after you retire. This could be going for walks, hiking, exercising outdoors, or even gardening.

Determine if you’ll get enough human interaction after retirement. Once you aren’t in the work-force anymore, it can be tougher to socialize and interact with people. If you are worried about a lack of interaction after you retire, think about joining clubs or groups where you can talk to other people with similar interests.Tip: Check your local community center to see if they have free clubs you can join.

Comments

0 comment