views

X

Research source

Filling Out a K-1 for an Estate or Trust

Understand the purpose. If you are the fiduciary of a trust or estate, you must fill out a Schedule K-1 for each beneficiary who received a distribution from the trust or estate. The Schedule K-1 allows each beneficiary to separate the different types of income they may have received from you, allowing them to easily include the information on their tax return. You must file each K-1 with the IRS, along with your 1041, and send a copy to each of the beneficiaries.

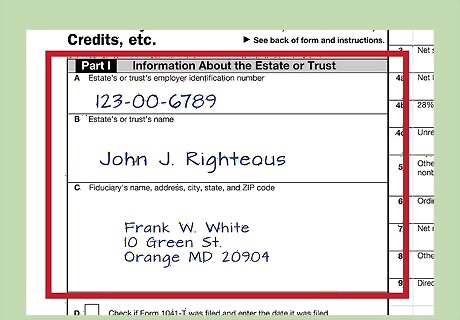

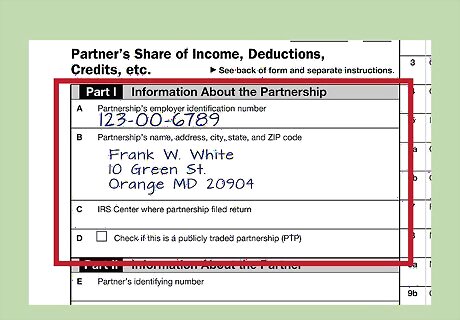

Enter information about the estate or trust. In Part I of the Schedule K-1, write in the tax identification number of the estate or trust, the name of the estate or trust, and the fiduciary's name and address.

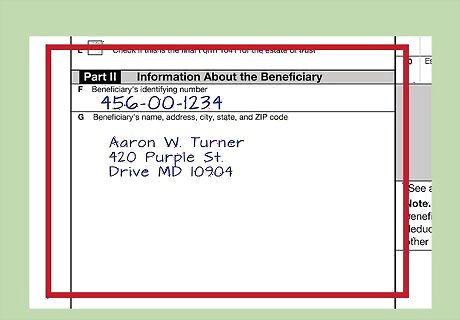

Enter information about the beneficiary. In Part II of the Schedule K-1, enter the beneficiary's name, address, and tax identification or Social Security number. If there is more than one beneficiary for the trust or estate, you must fill out a separate Schedule K-1 for each one. You may truncate the beneficiary's tax identification or Social Security number on the beneficiary's copy of Schedule K-1. You do this by replacing the first 5 digits of the number with either Xs or asterisks.

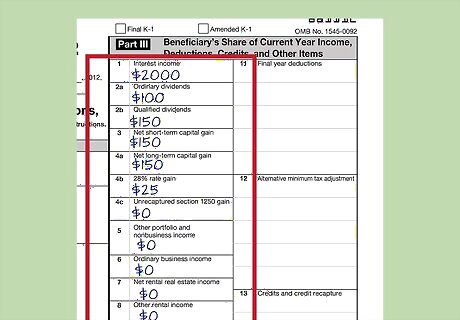

Enter the beneficiary's income from the estate or trust in Boxes 1 through 8 of Part III, as appropriate. Beneficiaries must include the amount of income distributed to them from the estate or trust in their gross income for that year. All income has the same character on the beneficiary's tax return as it does for the estate or trust. For example, if the beneficiary earned $2,000 in interest income from the trust, they would pay the same taxes on it that they paid for any other interest income. If the estate or trust has more than one beneficiary, you list each beneficiary's proportionate share of the income on their respective Schedule K-1.

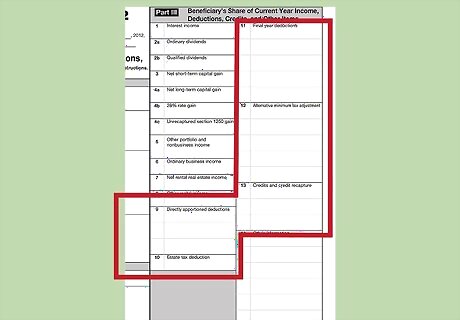

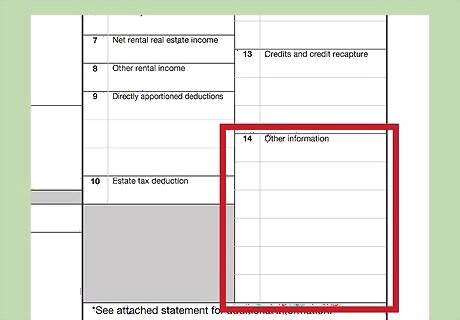

Enter deductions and credits in Boxes 9 through 13. These are the payments that reduce the taxable income of the trust or estate, and can offset some of the tax liability of the trust or estate itself. These amounts rarely can be used by beneficiaries on their tax returns, but they must be included on the Schedule K-1.

Include any other information in Box 14. If you have any other information, such as foreign taxes paid or investment income tax, that beneficiaries might need to fill out their own tax forms, enter these amounts in Box 14 along with the appropriate code.

Send out your K-1 forms to all beneficiaries. You must file all forms for trusts and estates by the 15th day of the 4th month after the trust or estate's year-end. If the trust or estate is on a calendar year-end, then the due date for the Schedule K-1 is April 15th.

File all Schedules K-1 with your Form 1041. The same due date applies for these forms as it does for sending the forms to the beneficiaries. They are due by the 15th day of the 4th month after the trust or estate's year-end. These returns can be filed electronically, or mailed to the appropriate address listed in the IRS instructions for the Form.

Filling Out a K-1 for Partners

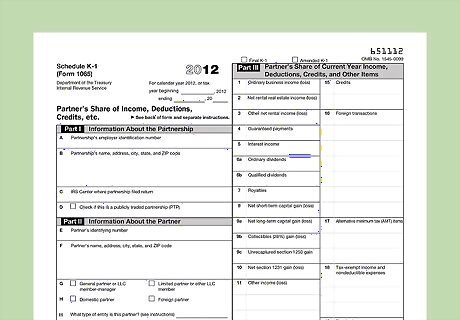

Understand the purpose of the Schedule K-1. Partnerships don't pay their own taxes; rather, they report income and certain deductions to the partners, who file them on their tax returns. The K-1 is a reporting document, like a 1099 or a W-2. Partners who receive a K-1 don't have to file it with their returns.

Enter information about the partnership. In Part I of each Schedule K-1, enter the name, address, and tax identification number of the partnership. For Item C, you must indicate whether you are filing the partnership return electronically or by mail. If you are filing by mail, you must enter the name of the IRS service center where the instructions to Form 1065 indicated you should file the return.

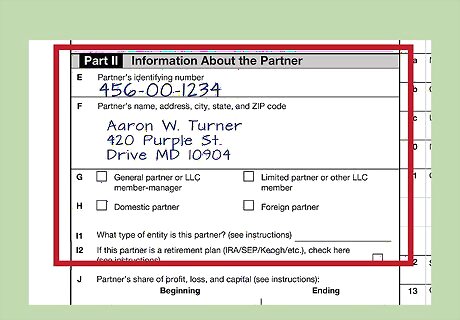

Enter information about the partner. You must fill out a separate Schedule K-1 for each partner. In Part II, you must include the name, address, and tax identification or Social Security number for that partner. Additionally, list details on the partner's share of liabilities; the partner's beginning and ending profit, loss, and capital ownership percentages; and a calculation of the partner's capital account for the year-end. The partner's tax identification or Social Security number can be truncated on the Schedule K-1 you send to the partner by replacing the first 5 digits with asterisks or Xs. However, you cannot truncate the partnership's tax identification number on any form. Check off whether the partner holds interest as a general partner or a limited partner, and identify the partner as either foreign or domestic. Then use the appropriate code to state the type of entity this partner is, such as whether the partner is an individual or a corporation.

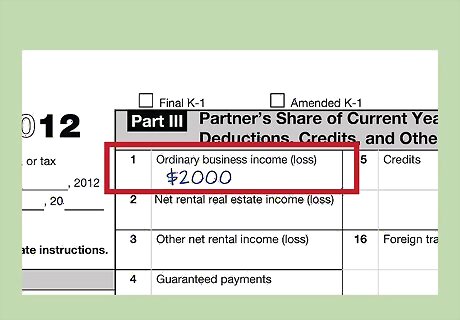

Enter the ordinary business income or loss on Line 1 of Part III. This amount is derived from the total you entered on Form 1065, calculated for each partner as a pro rata share depending on each partner's ownership percentage. Partnerships are allowed to do special allocations of income and deductions. These allocations would be noted in the partnership agreement and could mean that all income and deductions may not be allocated pro rata based on each partner's ownership.

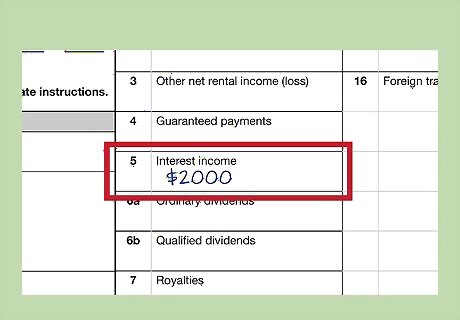

Enter other income amounts on the appropriate lines. Certain types of income must be listed separately because they retain their character and will be taxed accordingly when entered on each partner's individual tax return. For example, if the partnership has interest income, this amount would be divided by ownership shares and entered on Line 5 of each K-1. So if the partnership had $6,000 in interest income, and there are 3 partners each with equal ownership shares, you would enter $2,000 on Line 5 of each partner's K-1.

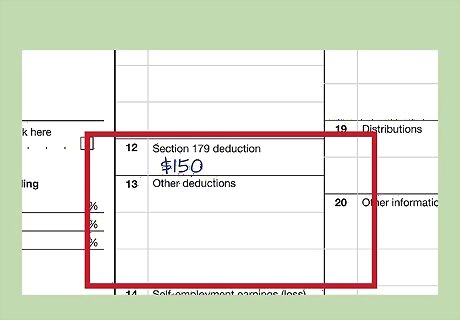

Enter deductions and credits. Starting on Line 12, you will list any deductions partners are eligible to take based on various partnership activities. For example, you may enter amounts of any charitable contributions made by the partnership on Line 13a.

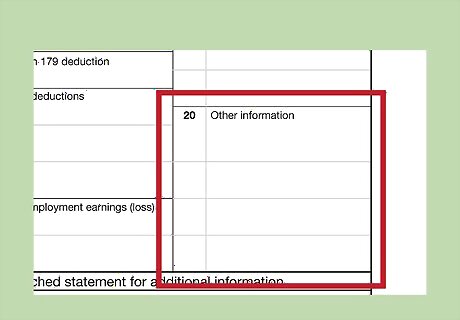

Enter any other information partners may need to complete their tax returns. If there is any other information not entered elsewhere, such as recaptures of credits, they are listed beginning on Line 20 with the appropriate code.

Send out your K-1 forms to all partners by March 15th. Because the partners will need the information on the K-1 to complete their own tax returns, they must receive it before tax day.

File all Schedules K-1 with your Form 1065. You must file the Form 1065 for your partnership by March 15th of each year. You may file your return electronically, or you may mail your paper returns to the applicable IRS address listed in the IRS instructions for filling out the Form.

Filling Out a K-1 for Shareholders

Understand the purpose of the Schedule K-1. S-corporations usually don't pay their own taxes. Rather, they pass income and deductions to the shareholders. If you are in charge of taxes for an S-corporation, you must file a Form 1120S, which includes Schedules K-1 for each shareholder. The shareholders use the information on their individual Schedules K-1 to complete their individual returns.

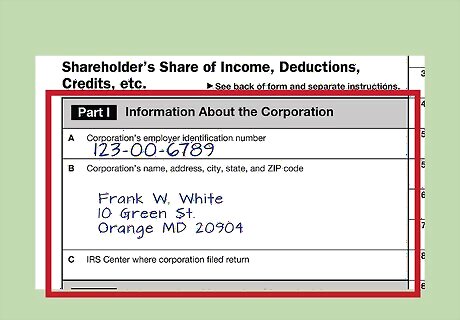

Enter information about the corporation. In Part I of each K-1, enter the name, address, and tax identification number of the corporation.

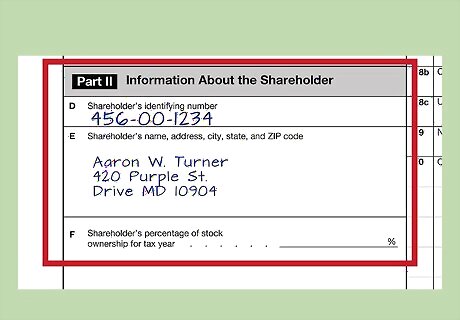

Enter information about the shareholder. You must fill out a separate K-1 for each shareholder. In Part II, enter that shareholder's name, address, and tax identification or Social Security number. You can truncate the shareholder's tax identification or Social Security number in the K-1 you send to that shareholder by using asterisks or Xs for the first 5 digits. However, you are not allowed to truncate the corporation's tax identification number on any documents.

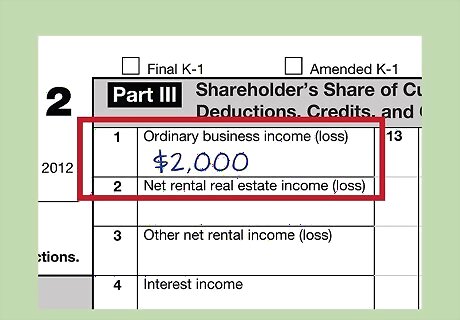

Report the net profit or loss amount of the corporation on Line 1 of Part III. This is ordinary business income (or loss), calculated as the pro rata share for each shareholder. For example, if the corporation earned $10,000 in ordinary business income, and had 5 shareholders with equal shares, you would report $2,000 in ordinary business income on Line 1 of Part III of each shareholder's K-1. Use the amount on Line 21 of your Form 1120S as your total income or loss, and calculate shares from there. It shouldn't include any rental or portfolio income or loss, as those will be entered later. The amount also should be entered without reference to a particular shareholder's basis in the stock of the corporation, or their at-risk or passive activity limitations.

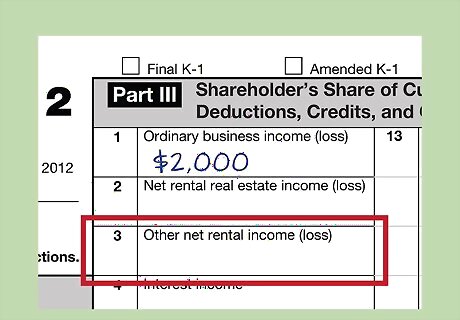

Enter other income amounts on the appropriate lines. Other income is separated out from ordinary business income because it retains its character and must be reported separately on the shareholder's return as well. For example, rental income is considered passive income except in certain situations. Passive income or loss can only be used to offset other passive income or loss, and must be reported separately.

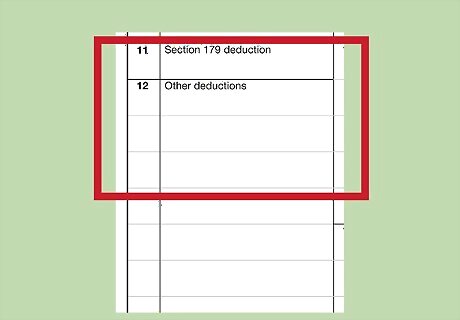

Enter deductions and credits. Beginning on Line 11, enter any deductions and credits the S-corporation made that shareholders may be eligible to use. For example, if the corporation made any charitable contributions, you can include that pro rata amount on Line 12a of each K-1.

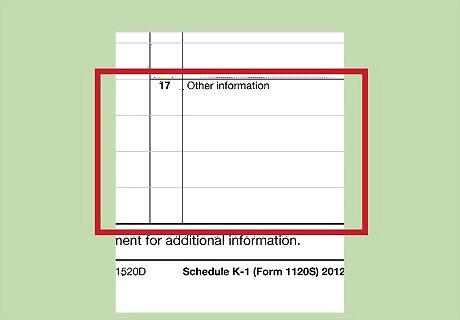

Enter any other information shareholders may need to complete their tax returns. If there is any other information not entered elsewhere, such as recaptures of credits, list them with the appropriate classification code beginning on Line 17.

Send out your K-1 forms to all shareholders by March 15th. Because the shareholders will need the information on the K-1 to complete their own tax returns, it must be sent to them before tax day.

File all Schedules K-1 with your Form 1120S. You must file the tax return for the corporation by March 15th of each year. You may file your return electronically, or look to the instructions for Form 1120S, which identify the appropriate IRS service center to file paper returns by mail.

Comments

0 comment