views

Choosing a Business Name

Determine if you want a business name. You can do business using your legal name. For example, a hairdresser can hold herself out as “Monica Smith, hairdresser.” However, you might want a business name, also called a trade name. A trade name is helpful if you advertise or if someone in your field has a similar name.

Pick a memorable trade name. Choose a name that people will remember. Ideally, it should also suggest attractive qualities about your business. For example, “Smith Family Carwash” is forgettable. However, “Speed and Shine Carwash” tells consumers that they can get fast, quality service.

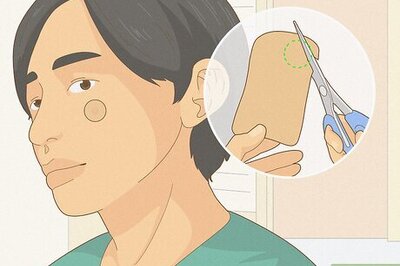

Check whether your name is available. You can’t use a trade name if another business is already using it or a similar name. Check the Arizona Secretary of State’s website. You should also check with the county recorder’s office where your principal office will be located. You also can’t use a trade name if it has been trademarked. Search the federal trademark database at https://www.uspto.gov/trademarks-application-process/search-trademark-database. You might want a website, so check whether the URL is available. Most businesses have their names as part of their URL.

Register your trade name, if you want. Arizona doesn’t require that you register your trade name. However, you can if you want to. You should register online at https://apps.azsos.gov/apps/tntp/index.html. It costs $10 to register. Your trade name is good for five years, after which you must renew it. If you want, you can also trademark your business name. Federal registration is not required, but it carries many advantages. For example, you can sue in federal court if someone uses your trademark without permission.

Completing Legal Requirements

Obtain necessary licenses or permits. Depending on your occupation or where you operate, you might need licenses or permits. You can find out what you need at the Arizona Commerce Authority website. Visit http://www.azcommerce.com/small-business/small-business-checklist and click on either “I am ready to start my business in Arizona” or “I am expanding or relocating my business to Arizona” link. The website will generate a checklist telling you what you need. You can also contact your nearest Small Business Development Center, which you can find at http://www.azsbdc.net/. A counselor there can help you identify the licenses and permits you will need.

Register to pay state taxes. You must collect and remit sales or use taxes if you sell services or goods to the public. You’ll need a state transaction privilege tax (TPT) license from the Arizona Department of Revenue. If you have employees, you’ll also need to register to pay withholding tax and unemployment insurance. You should file a Joint Tax Application. You can either apply online or use a paper application.

Get your Employer Identification Number (EIN). An EIN is your business tax ID. As a sole proprietor, you can use your Social Security Number. However, if you want to hire employees or open a business bank account, you should get an EIN. You can obtain it at https://www.irs.gov/businesses/small-businesses-self-employed/apply-for-an-employer-identification-number-ein-online.

Hire employees legally. You must report all new hires to the Arizona New Hire Reporting Center within 20 days of hiring them. Register for an account at the Reporting Center. If you have questions, call 888-282-2064 Monday through Friday, 8:00 am to 5:00 pm. Generally, sole proprietors who have employees must carry workers’ compensation insurance. You can find a list of insurers licensed to offer workers’ compensation insurance by calling 800-325-2548.

Preparing to Open Your Business

Obtain sufficient insurance. As the owner of a sole proprietorship, you’ll be personally responsible for your business debts, as well as any injuries your business causes. For example, someone might sue your business because you injured them. If the customer wins, they can go after your personal assets, such as your home, because there is no legal distinction between you and your business. To protect yourself, you should get general business liability insurance. Contact an insurance broker and discuss how much liability insurance you will need.

Open a business bank account. Keep your personal and business banking separate. This way, you can easily track your business expenses. Take your EIN and your business name certificate to a bank. Ask to open an account. Some banks offer incentives to draw in business owners. Shop around. You might qualify for reduced fees or a business credit card.

Write a business plan. A business plan explains where you want your business to be in the next few years and how you plan to get there. You’ll need a business plan if you want financing, but it’s a great exercise even if you don’t. Include the following in your plan: Business description. Identify the problem your business has been formed to address. For example, you might provide low-cost cosmetology services in northwest Arizona, which is an underserved market. Market analysis. Describe key trends and themes in your industry. Also describe your target consumer, based on location, age, gender, income, education, etc. Competitive assessment. Identify your key competitors and explain their strengths and weaknesses. Describe how you will set yourself apart. Products or services. Go into detail about what you will be selling. If you’re filing for a trademark or patent, explain that in this section. Marketing plan. Explain how you will reach your target consumer using social media, paid advertising, direct mail, etc. Funding request. Identify how much money you need and what you will spend the money on. Financial projections. Project your finances for the next five years. You should create forecasted balance sheets, income statements, and cash flow statements.

Find business space. You might want to operate your business from home. If so, check with the zoning office to see if your neighborhood has been zoned for your business. If you want to rent commercial space, then look in your local newspaper, which should list available real estate. You can also check on websites such as Loopnet.com. Commercial rents are usually calculated by the square footage.

Consider hiring professional help. When just starting out, you might want to do everything yourself. However, as you grow, you might need to hire professional help. Consider hiring the following people: Business lawyer. A business lawyer can represent you in court, but they can do so much more. For example, they can negotiate favorable contracts for you or advise you on how to discipline or fire an employee. Obtain a referral from the Arizona Bar Association. Bookkeeper. Your bookkeeper enters your daily business transactions. You might want to start by using software, such as QuickBooks. However, as your business grows, you might want to pay someone to act as your bookkeeper. Accountant. Your accountant can file your taxes, but a good accountant is also a good business advisor. They can provide strategic advice when you seek funding, and they can also analyze your strategic plan.

Comments

0 comment