views

Shopping Smart

Repair or refresh what you have instead of buying new stuff. Almost anything can be repaired -- cobblers, hardware stores, and electronics repair shops are all available for hire. For instance, instead of investing in a whole new couch, have it reupholstered. Instead of buying a new TV, take it to the repair shop to extend its life or replace broken parts. If a new household purchase is unavoidable, save money slowly over time in order to purchase the item you need. Avoid rent-to-own options. Rent-to-own furniture or electronic equipment is a tempting offer because you can pay in small installments over a long period. But in the long run, it will cost you more than if you had just paid the whole amount all at once. Instead of getting rid of your out-of-style garments, try mixing and matching them with your other clothes.

Hunt for bargains. Check supermarket flyers, factory outlets, and thrift stores to help you save. Try to find stores that offer price-matching sales so that you can save time by bringing in competitors’ ads instead of hoofing it all over to the stores which offer the best deals. Compare prices carefully. Many stores provide direct price comparisons if you look closely on shelf tags in the grocery store. For instance, price-per-unit shelf tags might indicate that one brand of juice might cost $1 per liter, while another might cost $1.20 per liter. Whenever possible, opt for the less expensive choice.

Buy foods in bulk. Buying in bulk means you pay by the pound for one large bag of something rather than buying several smaller pre-measured packages of the same foodstuff. Doing this will lower your grocery costs. Since grocers can move more product this way, you’ll get a lower rate per pound. For instance, instead of buying three two-pound bags of rice for $2 each, you might buy a seven pound bag for $5, and end up with more food for less money. Ethnic grocers are good places to stock up on staples like rice, beans, and vegetables in bulk.

Buy economy size when you can. Economy size indicates a product you’ll pay less per unit of measure for when buying more of it. For example, many grocery stores offer a one pound box of cereal for $3 per pound, or a somewhat larger two pound box of the same cereal for only $2.50 per pound. This nominal difference will save you more in the long run. Even though the total cost of the somewhat larger box is more expensive ($5 as compared to $3 for the smaller box), you’re getting more cereal for your money.

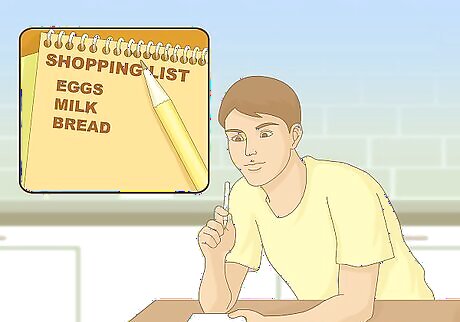

Make a shopping list before going shopping. Shop consciously when you go to the grocery store (or any store, really). This way, you’ll have a kind of roadmap when you’re visiting the grocery store, and won’t just wander all over the store looking at (and possibly buying) things you don’t really need. Obtain the items on your shopping list, head to checkout, and leave. Look for more spartan shops. Part of what you pay for when you visit a grocery store is the experience. An upscale place like Whole Foods is not the best place to shop if you’re trying to survive being poor.

Getting Help

Take advantage of local food banks. A food bank is an organization run by a church, homeless shelter, or community aid organization which offers food to those in need. Community dinners are often offered at local churches and community aid organizations for free or at extremely low cost. Call local churches to find out if they have weekly spaghetti dinners, soup kitchens, or other events where meals are provided to the general public.

Apply for the Supplemental Nutrition Assistance Program (SNAP). SNAP provides nutrition assistance to low-income individuals and families. The program is provided by the US Department of Agriculture’s Food and Nutrition Service, and funded publicly. To qualify for SNAP, you can have up to $2,250 in total household bank accounts, or $3,250 if you’re 60 or older. Supplemental Security Income, Temporary Assistance for Needy Families, and most retirement plans do not count against the total financial resources used to determine whether you qualify. The amount of income you earn also determines eligibility. To apply, find your state’s public assistance office. A full list of such offices and the online SNAP applications of states which offer them are available at https://www.fns.usda.gov/snap/apply-to-accept. Fill in the required paperwork and mail, digitally submit, or print your application. Response times vary by state. You might also try identifying and calling your local SNAP hotline with this list: http://www.fns.usda.gov/snap/state-informationhotline-numbers. SNAP benefits can be used for food purchases only. Pet foods, soaps, household supplies, vitamins and medicines, alcohol, and hot foods (take-out or deli pizzas, for example) cannot be purchased with SNAP benefits.

Sign up for the Commodity Supplemental Food Program (CSFP). CSFP is a nutritional assistance program designed to improve healthy eating in low-income elderly people by providing them with healthy foods. The program is administered by the US Department of Agriculture’s Food and Nutrition Service and is similar to other nutritional assistance programs like WIC and SNAP. To sign up for CSFP, contact your local human resources office. Search the USDA’s database for a CSFP provider at http://www.fns.usda.gov/fdd/food-distribution-contacts.

Apply for Women, Infants, and Children (WIC) benefits. If you are a low-income mother, you may be eligible for WIC benefits. The program is publicly funded and administered through the US Department of Agriculture to provide food for poor mothers and their children. Foods given to qualifying individuals as part of WIC packages include juice, milk, breakfast cereal, cheese, eggs, fruits and vegetables, whole wheat bread, canned fish, peanut butter, and legumes. To apply for WIC, contact your local state or county public assistance office.

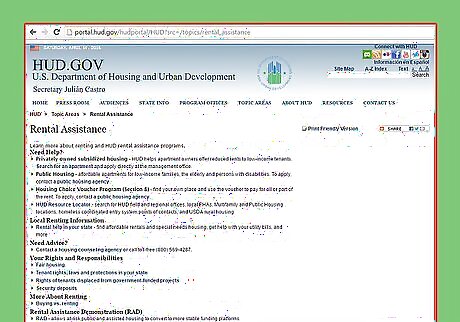

Apply for public housing. Public housing is a comprehensive suite of three rental assistance programs, plus Section 8 vouchers, designed to give low-income individuals more affordable housing options. The programs are run by local agencies but overseen by the Department of Housing and Urban Development (HUD). Most tenants in public housing pay around just 30% of their income to subsidize their rent. Limiting your housing costs in this way is an important step toward surviving poverty. To qualify for public housing, you must earn 80% or less of the average local income. Contact your local HUD office or search for publicly subsidized housing on HUD’s site at http://portal.hud.gov/hudportal/HUD?src=/topics/rental_assistance to learn how you can apply for public housing in your state or municipality. You may be put on a waiting list when you apply for affordable housing.

Managing Financial Decisions

Open a credit union account. Do not invest your money in banks. Credit unions tend to have lower fees, higher savings rates, and lower loan rates than banks, which cater more toward businesses. Credit unions are also more likely to have lower minimum account balance requirements than banks.

Do not cash your checks at check cashing services. These places offer you your cash instantly, but take a percentage out of your total check. This will leave you with significantly less income over time. For instance, assume you cash a $100 check each week, and the check cashing service takes 5% of the check. It doesn’t seem like much, but it adds up quickly. At that rate, it translates to five dollars each week; by year’s end, that’s $260.

Do not utilize automatic debit services from your bank. Overdrawn accounts are more likely to happen when you are financially on the edge. This leads to late fees and charges. Ending automatic debit for utilities, rent, and other regular costs might take more time out of your schedule each month, but you will have financial control returned to you.

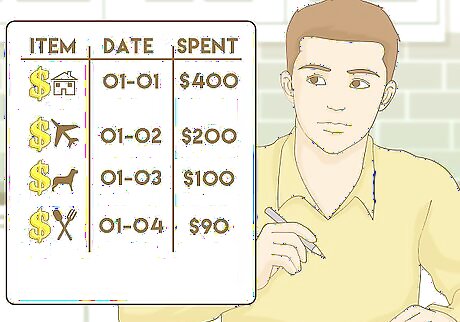

Live within your means. This can be a challenge when you’re living on a fixed or limited income, but there are positive steps you can take to reduce your financial risks. Don’t take out new credit cards; work instead on paying off the balance on your current credit cards and loans. Draw up a household budget. In one column, calculate your household’s total income. This includes revenue coming in not only from you, but from everyone in your house. Then calculate your household’s total expenses. Think about the costs accumulated by children and pets as well as by you and any other adults in the house. Subtract the expenses from the income total. If the expenses exceed the income, try to find where you can cut some expenses, or figure a way to increase your income streams. Before buying anything, always ask yourself this question: "Is this really necessary?" If not, put it back on the shelf for another day when you are not so poor.

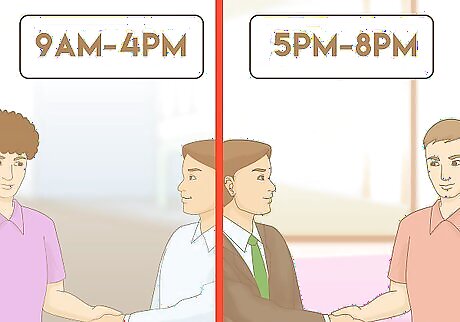

Don’t rely on a single income stream, if possible. Full-time jobs are exceedingly rare. You’ll likely have to cobble together a work schedule consisting of multiple part-time jobs to make ends meet. While it can be inconvenient to juggle two or even three work schedules, such an arrangement will ensure you always have some source of income. If one job fails to provide an adequate amount of hours in a given week or month, you’ll already have your other job(s) to fall back on. Don’t be afraid to request working more hours if you think you can take them on. Employers like seeing helpful employees who are eager to work. If you have trouble finding additional time in your schedule to work due to the presence of small children, ask a trusted relative or neighbor to tend to them while you go to work. If you have a hard time locating transportation to get to or from a place of work, ask coworkers, friends, or family to give you a ride. Check local public transit options as well. If it is impossible to take on extra work, ask for a raise at your current place of employment. You are more likely to get a raise if you’ve been on the job for at least a year.

Keep an eye out for better work opportunities. If the restaurant you work at pays 10 bucks an hour and the restaurant up the street pays 11 bucks an hour, you should think about jumping ship. Don’t feel bad about leaving a job. It’s nothing personal, you’re just looking out for your own economic interests.

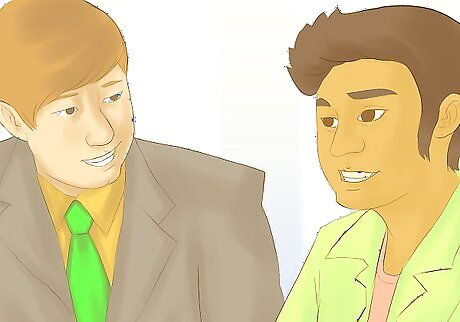

Solicit financial advice from a consultant. If you are in debt, you might consider speaking with a debt counselor. Debt counselors can help you consolidate your debt or construct a repayment plan to get your debt under control. You could also seek assistance from a financial advisor, a specially trained economic expert who helps individuals utilize and save their money in the most efficient way possible. Financial advisors can educate and train you on how to budget your money. They are often available over the phone or online, as well as in person. Be on the lookout for credit counseling scams. Some organizations purport to be debt counseling agencies but are in fact in the business of preying on economically vulnerable individuals, and charge lots of fees Do not allow any agency to add you as an authorized user on another bank account, or obtain an Employer Identification Number for you.

Taking Care of Yourself

Stay healthy. You’ll not survive becoming poor if you take sick. Not only will you be sick, but you may have to take work off, further compounding your strained financial situation. Stave off illness and maintain a strong immune system by eating nutritious, balanced meals each day. A good diet consists mostly of grains, fruits, and vegetables. A modest amount of protein should also be included, though it’s not necessary to do so at every meal. There are plenty of healthy meal options you can try on a budget. Check out the US Department of Agriculture’s menus and cookbooks online.

Spend time with friends and family. Being with people who care for you will help you realize that even though you’re poor, you’re still a wonderful, rational person whose life has value. Make time for family and friends who affirm that you are important and make you feel good. Strong social support systems will build psychic resilience. In the face of adversity, including poverty, you will be less likely to feel anxious, worried, or depressed when you know you have friends and family you can rely on.

Plan for the future. When you’re poor, it can be hard to see anything outside your immediate circumstances. You’re focused on paying the rent, the electric bill, the car insurance, and so on. The constant threat that one of these costs will push you further into financial ruin can distract you from planning for tomorrow. No matter how bad things seem, there’s always a new day tomorrow. Focusing on and planning for better days ahead can relieve stress and distract you from whatever problems you’re facing today. Don’t worry about what-ifs. Focusing on things you did wrong or dwelling on the past will not help you change your current predicament. Envision yourself in 5, 10, and 15 years. Where do you imagine you’ll be living? What kind of work will you do? Share your thoughts with a friend and invite them to do the same. Try to find something positive in each week or day that you can look forward to. Try to make it something different each day (don’t just think about how desperately you want to get out of work every day). Things like meeting a friend for a bike ride, or taking your child to the playground might be some of the things you look forward to after each day.

Recognize your own abilities. People living in poverty often rate themselves low on scales of self-efficacy, their own beliefs about what they can and cannot do. Accept the things that you cannot change. You’ve become poor, but hey, it’s not the end of the world! Recognize that your situation is temporary and you’ll come out of it better and stronger. Challenge negative thoughts. When you feel a thought such as “I’m no good” or “I’ll always be poor,” do not dwell on it. Introduce a contrary thought such as “I am a good person and many people like being around me” or “Someday I will be financially independent.” Forgive yourself. You’re a fallible person, just like everyone else. Your mistakes do not define you, they are only bumps in your personal life path. Use positive self-talk to forgive yourself. Say to yourself “I made a mistake but I am still a good person.”

Exercise self-control. In poverty, people find it more difficult to exercise self-control. You’re often in situations where you need help -- financial and material -- immediately. Think about occasions where you did not exercise proper self-control. You might have felt tempted to engage in habits like drinking or binge-eating which release endorphins and make you feel good. You might have lost your temper more than you did before you were struggling with poverty. Whatever the case, try to become conscious of occasions where you lose control and take positive steps to reign yourself in. Try to find positive outlets for your energy. When you feel that you might blow up on someone or want to have a drink, go for a run or bike ride instead. Try painting a picture or playing a musical instrument. Get enough rest. A full night’s sleep -- 6 to 8 hours -- is important for thinking clearly and deliberately. You’ll be more able to exercise self-control when you are well-rested. Set a regular bed time and stick to it each night.

Comments

0 comment