views

- Florida, Kentucky, and South Carolina waive deductibles and have no out-of-pocket costs on windshield replacements if you have comprehensive insurance.

- Insurance providers in Arizona, Connecticut, Massachusetts, Minnesota, and New York may offer zero- or low-deductible glass coverage to replace windshields.

- Have your windshield repaired if the damage is smaller than a dollar bill and not blocking visibility. Insurance providers may waive deductibles on repairs.

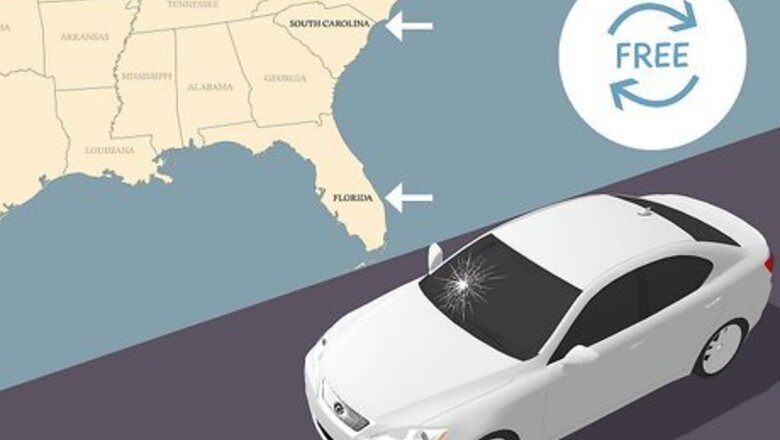

What states offer free windshield replacements?

Florida, Kentucky, and South Carolina offer free windshield replacements (with comprehensive insurance). Comprehensive insurance covers damage to your vehicle that’s not related to an accident or collision. Insurance providers in Florida, Kentucky, and South Carolina are required by law to waive any deductible payments for windshield replacements as long as you already have a comprehensive plan. If you have a crack or chip in your windshield, contact your insurance agent to see if you meet the claim requirements, and they’ll cover the cost of the repair or replacement at no extra charge. While some people call this a “free” windshield replacement, it’s more accurately called a “zero-deductible” replacement. You still need to pay for your insurance premiums, but you won’t pay any extra out-of-pocket when you have the windshield replacement completed. If you don’t have a comprehensive insurance plan, then you will have to cover the full cost of your windshield.

What states offer glass coverage?

Arizona While Arizona doesn’t offer free windshield replacements, insurance providers may offer full glass coverage to add to your insurance plan. While you’ll have to pay a slightly higher premium, you usually won’t have to pay a deductible when you take your vehicle in for repairs. Contact your insurance agent to ask if your plan includes glass coverage, and ask how much it would cost to add it to your plan.

Connecticut Insurance providers may offer higher premiums on comprehensive auto insurance plans in order to reduce the deductible you pay out-of-pocket for windshield repairs. You may also find separate glass coverage plans that have a lower deductible than your comprehensive plan. Plans and premiums vary between insurance providers, so be sure to talk to your agent to check what coverage you have.

Massachusetts While windshield damage and replacement is covered by comprehensive insurance, providers may still charge a large deductible. Instead, your provider may offer coverage specifically for glass repair that increases your premiums but reduces any charges you have to pay directly. Call your insurance provider and ask what your plan covers, and ask about getting separate glass deductibles.

Minnesota Minnesota auto insurance providers are required by law to offer the option to add comprehensive or full glass coverage for free windshield replacements, but you are not required to purchase it. Contact your insurance provider to see if you’re already paying the coverage premiums. Otherwise, ask if you can add the coverage to your existing plan.

New York Insurance providers in New York must provide the option for comprehensive or full glass coverage to their customers. Typically, these plans have a zero- or low-deductible payment for windshield replacements, so contact your agent to see if you’re already covered or if you can add a plan to your account.

Lowering Replacement Costs in Other States

Ask your insurance provider if they offer comprehensive or glass coverage. While the states listed above legally have to provide or offer glass coverage, it may still be available from insurance providers in other areas. Contact your insurance agent to ask if they can add a comprehensive or glass policy to your account. While you’ll have to pay a little more in premiums, you’ll be covered when it’s actually time to replace your windshield. You may still have to pay an out-of-pocket deductible when you have your windshield replaced, depending on your plan.

Look for auto glass companies that offer free repairs or discounts. Contact local companies that specialize in repairing auto glass and see if they have any promotions going on. They may offer coupons for free chip or crack repairs, or they may have sales that save you a considerable amount of money on full replacements.

Repairing vs. Replacing Your Windshield

Repair damage smaller than a dollar bill that’s out of the driver’s view. When you first inspect your windshield, check if the damage is smaller than 6 inches (15 cm), or about the size of a dollar bill. If the damage isn’t in front of the driver's side and not directly on the edge, you can repair your windshield without a full replacement. Many insurance companies waive the deductible on a repair, so you may not have to pay for any fixes if you submit a claim.

Replace your windshield if the damage is large or limits visibility. Sit in the driver’s seat of your vehicle and check if the damage is in your line of sight. If you have trouble seeing because the damage is in the way or too large, then it’s better to replace your windshield. Replacements are required as well if the damage is along the edge or has multiple cracks coming out from it. Even small bits of damage can refract light or expand in rough driving conditions, so it’s best to replace the windshield as soon as you can.

Comments

0 comment