views

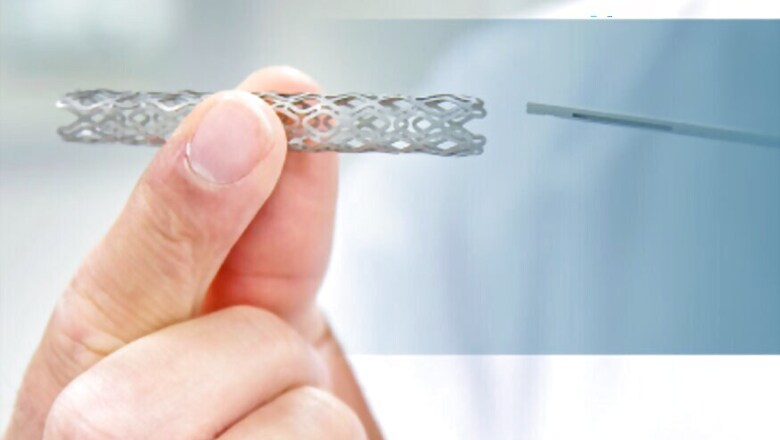

New Delhi: US-based manufacturers of coronary stents tried to create an artificial scarcity in India last year after the government reduced their prices by up to 85 per cent by introducing price caps, data with the National Pharmaceutical Pricing Authority (NPPA) indicates.

According to the figures submitted by different manufacturers to the NPPA, the opening stock of stents these companies held in January 2018 was 96 per cent more than January 2017. But the number of stents imported by manufacturers like Abbott Healthcare, Medtronic, Boston Scientific and Umbra Medical Products didn’t change much.

The number of stents imported were 3,56,753 in 2016 and 3,59,516 in 2017. However, the amount of stents distributed reduced from 3,48,594 in 2016 to 2,99,531 in 2017.

This drop was despite the demand for stents in India, a country with rising number of people with cardiovascular disease, only going up. Malini Aisola of the All India Drug Action Network (AIDAN) said the drop of 49,063 stents can only be explained by companies withholding the stock.

If the opening stock of stents has increased so dramatically - from 62,733 units in 2017 to 1,22,718 units in 2018 – it means that companies are importing at the same rate as before but not letting the product enter the market.

These multinationals dominate 60 percent of the Indian market, which makes them largely responsible for making sure people have access to the much-needed medical devices.

The NPPA had in February 2017 fixing a price cap of Rs 30,180 for drug eluting stents, down from anywhere between Rs 1.5 lakh and Rs 2 lakh that was charged earlier. This created a furore in the pharmaceutical industry, with industry bodies making gloomy predictions of loss of profit and innovation, and some MNCs leaving the Indian market.

Dismissing this industry backlash, the NPPA further reduced the prices of drug eluting stents to Rs 27,890 on Monday, exactly a year after fixing the first price cap. Drug eluting stents, which not only physically prop open blocked arteries, but also contain medicines, are used in about 95 percent of stenting procedures. The price of bare metal stents, however, saw a slight increase from Rs 7,260 to Rs 7,660.

The NPPA announcement came after a series of meetings with stakeholders, including “eminent Intervention Cardiologists”, and industry representatives MTaI, ASSOCHAM, FICCI and CII.

Many of these bodies and international manufacturers, over the course of 2017, had tried get the NPPA to price different categories and models of stents, differently. This would have meant that each new model of a particular stent, introduced by its manufacturer, would have gone up in price.

AIDAN, in a statement to the press, said, “We are glad that the Government did not cave in to the massive pressure that was being exerted by the foreign industry lobbies, particularly from the United States, for differential pricing without any scientific basis.”

In April, 2017, Abbott had tried to withdraw one model of stents from the country and refused to introduce another model in the Indian market. Medtronic and Boston Scientific tried to follow suit, even as NPPA denied all three applications and ordered the companies to maintain a regular supply of stents.

News18 had earlier reported that, in an office memorandum dated May 2, the Authority requested people to report any shortage of stents.

In the same time period, data submitted by Indian manufacturers shows only a 17 per cent increase in opening stock. Traditionally the underdogs in the market, Indian companies increased their manufacturing from 5,39,788 stents in 2016 to 5,67,805 in 2017.

The number of stents they distributed also went up from 5,13,229 in 2106, to 5,44,583 in 2017. While these are not large jumps, they could show Indian companies trying to catch up to the MNCs. Chinese manufacturers also tried to enter the market by bringing 10,262 stents to the country and distributing 7,656.

The NPPA’s latest price cut, comes two weeks after the ceiling price of stents was mentioned as a government health initiative in the budget.

The cap itself came after the government re-categorised stents in 2016 as part of the National List of Essential Medicines - whose prices can be controlled by the Centre - after sustained court battles and advocacy by the civil health sector.

Comments

0 comment