views

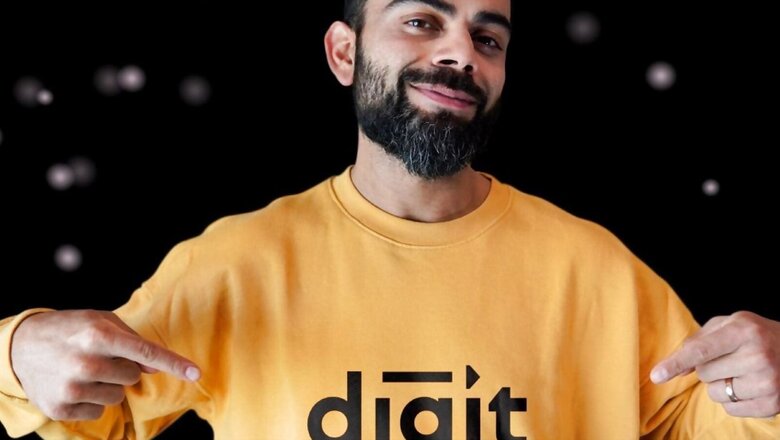

Digit Insurance IPO: Indian insurance firm Digit Insurance, which is backed by Canadian billionaire Prem Watsa’s Fairfax Group, is considering to launch its initial public offering, or IPO, soon, as per a report. According to the report, the Digit Insurance IPO will look to raise $500 million though its initial stake sale despite markets have remained choppy since the beginning of this year. Digit Insurance has Indian cricket icon Virat Kohli as its investor and brand ambassador. The company is speculated to file its IPO draft papers later this year.

Digit Insurance IPO: All You Need to Know

While the exact dates of Digit Insurance IPO is not known, sources familiar with the development told Reuters that the company plans to file its draft documents to the markets regulator Sebi by September this year and list by January next year. The founder of Digit Insurance Limited, Kamesh Goyal is a veteran of the insurance industry. He has several feathers in his crowns as he has worked with Germany’s Allianz and headed its Indian joint venture.

As per the Reuters report quoting anonymous sources, Digit has appointed Morgan Stanley and Indian investment bank ICICI Securities as bookrunners for the deal. However, none of the companies’ representatives have agreed to comment anything on the development. “Digit plans to raise money by offering new shares along with Fairfax, its largest shareholder with about 30%, trimming its stake,” the sources told Reuters.

Digit will complete its five years as a company before it goes public, as per Sebi’s regulations. The Digit IPO is likely to be listed in January. The company’s revenue increased 62 per cent to about $675 million in the last fiscal year, outpacing the industry’s 11 per cent increase. Digit Insurance recorded a net loss of $7.8 million on revenue of $309 million in 2020/21, but its latest profit or losses could not immediately be ascertained, Reuters reported on the day.

Digit looks to do business in the under-penetrated general insurance market in India, “market along with users’ need for a better customer experience like easier claim settlements”. The company was valued at close to $4 billion, as of last month, when it completed a tranche of funding. ” It has so far raised more than $400 million from Sequoia Capital, A91 Partners and Faering Capital, besides Fairfax,” as per the report.

However, the Digit Insurance IPO plans comes at a time when Indian stock markets have remained volatile for months now. Earlier this month, India’s largest insurance company LIC got listed at bourses at a discount, with an inability to up its game further. The LIC IPO did not fetch the target valuations. On the other hand, IPOs of startups in India have also not been faring well at the markets due to negative investor sentiments. The Digit IPO performance will depend on how much the company prices its shares, as per experts.

Read all the Latest Business News here

Comments

0 comment