views

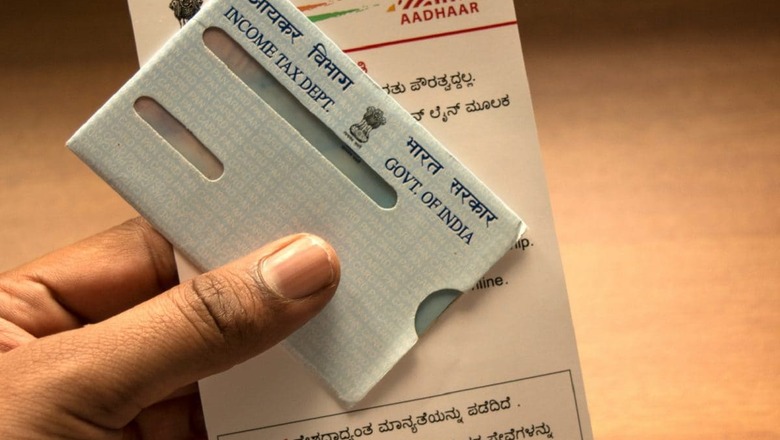

PAN-Aadhaar Linking Penalty: From July 1, Friday, which is today, the penalty for linking PAN Aadhaar has doubled. Till June 30, the PAN-Aadhaar linking fine was Rs 500, but from July 1 that same has been increased to Rs 1000, as per the instructions of the Central Board of Direct Taxes, or CBDT. The top tax board has has extended the deadline to link PAN-Aadhaar to March 31, 2023, but such people who are yet to link will have to pay the double fine of Rs 1,000 from today.

How to Pay PAN Aadhaar Linking Fee on Income Tax Portal?

If one wants to link their PAN Aadhaar now, as mentioned above, they will have to pay the penalty of Rs 1,000. This can be done on the NSDL portal by paying the amount under Challan No. ITNS 280. “The late fees can be paid under Challan No. ITNS 280 with Major head 0021 (Income Tax Other than Companies) and Minor head 500 (Other Receipts) through e-payment service available at the Tax Information Network website of the Income Tax Department,” said. Sharath Chandrasekhar, partner at DSK Legal.

Here is a Step by Step Process to Pay PAN Aadhaar Late Fees

Step 1: Visit the link https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp to go on with your Aadhaar PAN link request

Step 2: Under the options available, proceed under Challan No. ITNS 280 to submit PAN-Aadhaar link request

Step 3: Select the tax applicable from there

Step 4: The payment should be done under Major head 0021 (Income Tax Other than Companies) and Minor head 500 (Other Receipts) in a single challan

Step 5: You can either pay through net banking or credit card. Select your preferred mode and enter details

Step 6: Enter your PAN, address and assessment year

Step 7: Enter the Captcha and make payment

It must be noted in this regard that the payments made at the NSDL portal requires some time to display at the income tax e-filing portal. Therefore, people who want to link PAN-Aadhar should attempt raising their requests a few days after paying the fine, as per experts.

What Happens if PAN-Aadhaar is Not Linked?

While the CBDT has extended the deadline to link PAN-Aadhaar, getting the work done is mandatory. “If an individual (who is eligible to receive the Aadhaar number) fails to link his/her Aadhaar to PAN by March 31, 2023, the PAN of such individuals may become inoperative and all the consequences under the Income Tax Act, 1961 for not furnishing, intimating or quoting the PAN shall apply to such individuals. Accordingly, such individuals, after March 31, 2023, will inter alia not be able to conduct financial transactions which require disclosure of PAN, file income tax return, open a bank account and/or invest in mutual funds. Further, the income tax authority will not process the pending returns nor complete the proceedings in respect of defective returns filed by such individuals,” said Chandrasekhar.

Read all the Latest News , Breaking News , watch Top Videos and Live TV here.

Comments

0 comment