views

If you have filed your income tax return (ITR) for AY 2023-24 and are waiting for your tax return, there is a new functionality launched on the income tax portal through which you can directly check the tax refund status.

Earlier, taxpayers needed to check the refund status on the TIN-NSDL website. You can still check it from the TIN-NSDL website as well. However, now, a new functionality has been launched on the income tax portal (I-T portal) itself, which allows users to check their refund status directly from the portal itself.

If you have paid more tax than your actual tax liability, you can claim a tax refund from the Income Tax Department.

A Step-By-Step Guide To Check Income Tax Refund Status:

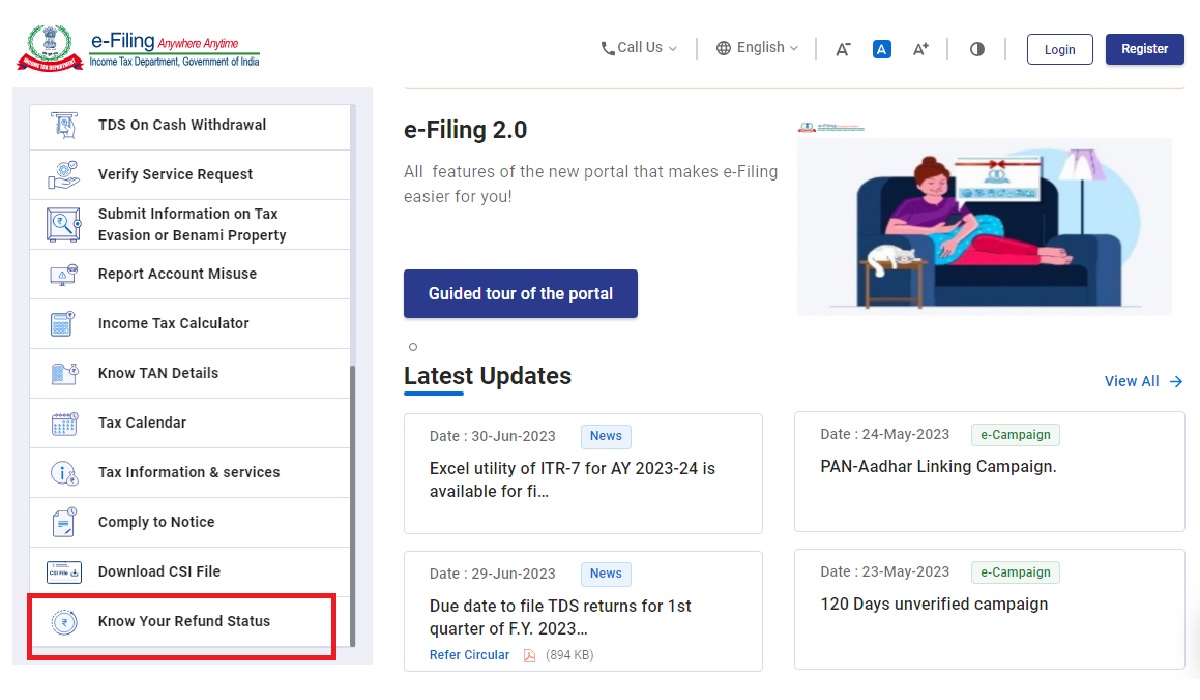

Step 1: Visit the E-filing portal.

Step 2: Scroll down the ‘Quick Links’ section till you see ‘Know Your Refund Status’. Click on it.

Step 3: Fill in your PAN number, assessment year (2023-24 for the current year), and mobile number.

Step 4: You will get an OTP. Fill in the OTP in the given place.

Now, it will show the income tax refund status. If there is some issue in your ITR bank details, it will show: ‘No Records Found, please check your E-filing processing status by navigating through e-File -> Income Tax Returns -> View Filed Returns‘.

As of July 2, 2023, about 1.32 crore ITRs have been filing for the assessment year 2023-24. Of these, around 1.25 crore income tax returns have been verified so far, according to the income tax portal. So far, only 3,973 verified ITRs have been processed for the assessment year 2023-24.

There are around 11.22 crore individual registered users.

The last date to file your ITR AY 2023-24 is July 31. People are advised to file ITR now to avoid the last-minute rush. There are around seven types of income tax forms. Each form is different and is for a particular type of tax filer. You must know which form is appropriate for you, so that any income tax notice can be avoided in future. For those having only salary income, they can file it using ITR-1, while those having other sources of income need to use other forms to file ITR.

PAN card, Aadhaar card, Form 16, Form 16A, 16B, 16C, bank statement, Form 26AS, investment proofs, rent agreement, sale deed, and dividend warrants may be required to file the income tax return.

Form 26AS can be downloaded from the income tax portal. It is an annual tax statement like a tax passbook that has details of the taxes deposited and deducted with the government against your PAN.

Comments

0 comment