views

The Reserve Bank of India has set the price of premature redemption of the Sovereign Gold Bond (SGB) scheme 2016-17 (Series IV) at Rs 5,077 per unit. Starting today, September 17, the second due date of premature redemption of the SGB will be due, as per an RBI press release.

The redemption price of the SGB is based on the simple average of closing gold price of 999 purity of the week (Monday-Friday) preceding the date of redemption as published by the India Bullion and Jewellers Association Ltd (IBJA), the RBI said. “Accordingly, the redemption price for premature redemption due on September 17, 2022 shall be Rs.5077/- (Rupees Five Thousand Seventy-seven only) per unit of SGB based on the simple average of closing gold price for the week September 05-09, 2022,” it further added in the press release.

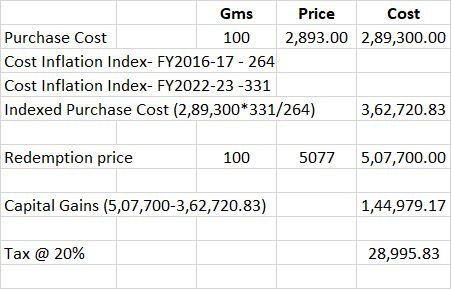

Those who have invested in the scheme are expected to get an annualised return of about 11 per cent or 75 per cent absolute return per gram of gold. At the time of the issue, the Sovereign Gold Bond Scheme 2016-17, Series IV was priced at Rs 2,893 per gram of gold, The nominal value of this SGB was Rs 2,943 per gram.

Therefore, those investors who have opted for premature withdrawals will get an absolute return of 75.49 per cent: redemption price of Rs 5,077 minus issue price of Rs 2,893, divided by 100.

However, investors must note that they have to pay taxes on their capital gains.

How are Sovereign Gold Bonds Taxed?

The interest earned on SGBs bonds is taxed as regular interest incomes as per the rates applicable to the individual’s slab rate. “If one is falling in the highest slab rate, such interest would be taxed at 30 per cent plus applicable surcharge and cess. For charitable trusts and NGOs whose income is exempt, the interest income would be exempt,” said Ankit Jain, Partner at Ved Jain & Associates.

“On redemption, the capital gains on such gold bonds enjoy a preferential treatment. For individuals, the whole of capital gains on such gold bonds is exempt. No tax is required to be paid on the gains of such gold bonds. For non-individual taxpayers, while the gains are taxable in their hand, unlike regular bonds, the gold bonds are eligible for indexation where they are held for a period of more than three years. The tax rate in such a case would be 20 per cent,” he added.

Proceeds from redemption of the bonds after the tenor of eight years are exempt from taxes, Pallav Pradyumn Narang, Partner at CNK told News18.com.

“If the bonds are redeemed after the lock-in period (five years) but before maturity (eight years) then the difference in redemption value and purchase price is taxed as long term capital gain at the rate of 20 per cent with indexation benefits,” added Pradyumn.

Should You Invest in Sovereign Gold Bonds?

Investing in SGBs provides the following three benefits, as per Nihal Bhardwaj, Associate, SKV Law Offices.

(a) During the holding period, an interest @2.50 per annum p.a. (fixed rate) on the initial investment amount is earned.

(b) There is no capital gain tax is payable on redemption of SGBs after maturity.

(c) There are no storage hassles like those of physical gold

“SGBs are a better alternative to physical gold as they eliminate the risks and costs associated with physical gold. It makes sense to allocate a small portion (10-12 per cent) of the portfolio to gold and invest in SGB,” said Bhardwaj.

“Sovereign gold bonds are a great investment opportunity providing multiple benefits especially to individuals. In a country, where gold is a necessity for all households especially at auspicious times such as marriages, investment in such gold bonds allows one to hedge against the price of gold while enjoying the interest and taxation benefits. And since these bonds can be held in demat format, one need not worry about safety and security aspects as are associated with physical gold. It is a must have investment instrument in each and every household,” added Jain.

Investing in Sovereign Gold Bonds is being encouraged lately. “The hassle in maintenance of gold is what is saved while making investments in SGBs. Further, SGBs are normally issued by the Government at a discounted price from the average market price, adding yet another benefit to the investment,” said Sameer Jain, Managing Partner at PSL Advocates & Solicitors.

Read all the Latest Business News and Breaking News here

Comments

0 comment