views

New Delhi: In the last three years, the Indian banking system has lost Rs 1.76 lakh crore on account of non-performing loans of 416 defaulters - each owing Rs 100 crore or more – being written off. On an average, the amount declared as bad loans turns out to be around Rs 424 crore per borrower.

This the first time data relating to big loans and biggest defaulters – owing at least Rs 100 crore – has come to light.

Following a directive issued by the RBI to all scheduled commercial banks to come clear on the amount to be prudentially written off and set the accounts right, the data has been exclusively accessed by the CNN-News18 by filing a series of RTI applications.

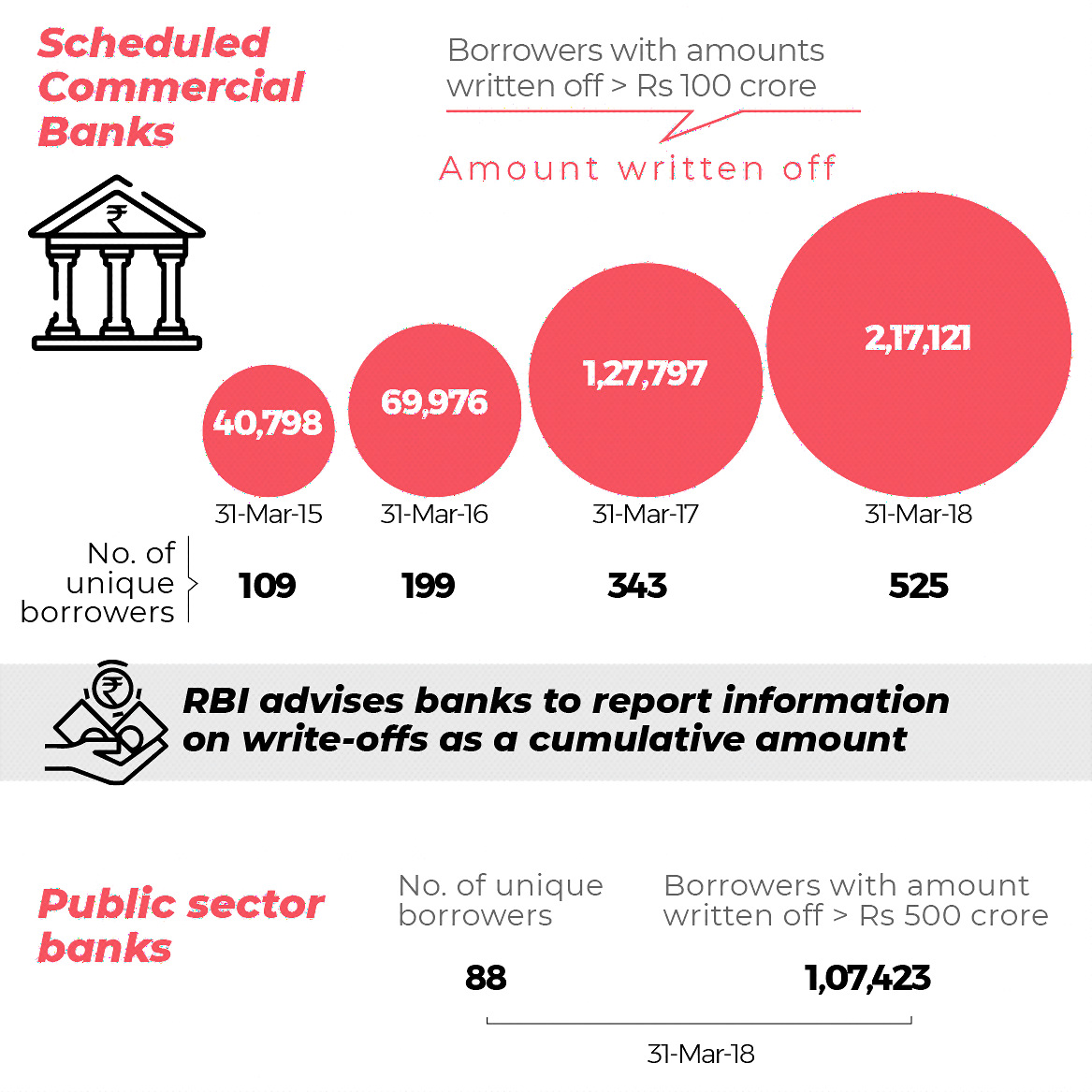

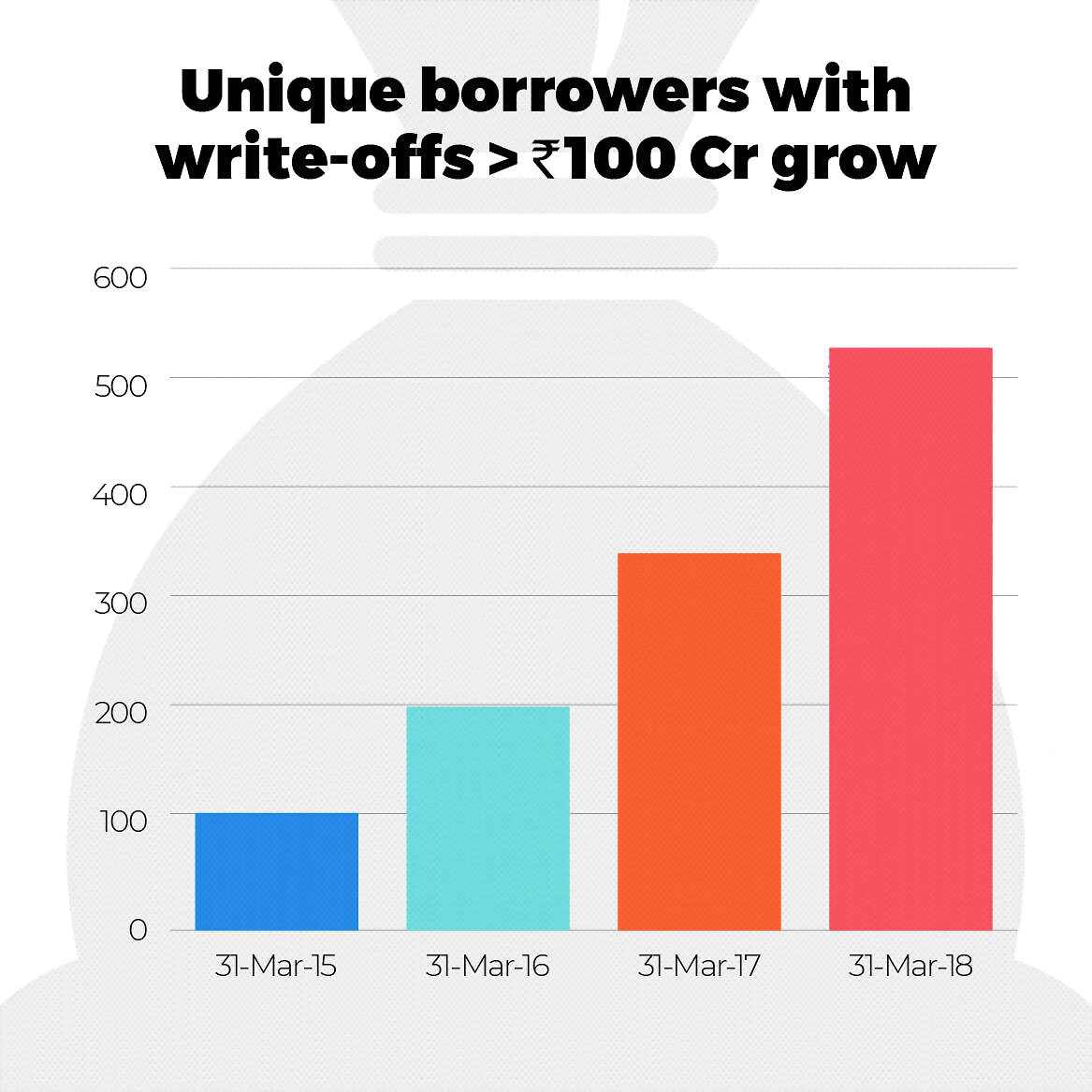

The RTI replies demonstrate a constant surge in the amount written off by public sector banks and private banks in the country since 2014-15. Between 2015 and 2018, a total of Rs 2.17 lakh crore were written off as bad debts by the scheduled commercial banks.

The statistics showed that 109 unique borrowers had their loans to the tune of Rs 40,798 crore written off. This number grew to 199 unique borrowers by March 31, 2016 with a total of Rs 69,976 crore as amount written off.

The next two years – post demonetisation, however, witnessed the sharpest increase in the amount being written off for borrowers. The number of unique borrowers grew to 343 – an addition of 144 more, i.e. a 72 per cent rise in number of such loanees.

For this period, the amount written off also jumped from Rs 69,926 to Rs 1, 27, 797 crore.

This amounted to a rise of Rs 57,821 crore as compared to Rs 29,178 of the preceding financial year. It also meant a whopping hike of almost 83 per cent in the total amount written off by the scheduled commercial banks in the year immediately following the demonetisation.

The story remained the same for the next financial year.

As on March 31, 2018, there happened to be 525 unique borrowers – this was an addition of 182 borrowers whose big loans were written off.

The total amount written off as bad debts shot up from Rs 1.27 lakh crore to Rs 2.17 lakh crore – an increase of Rs 89,324 crore – another huge jump of almost 70%.

The RTI reply pointed out that the data prior to September 2014 for number of write-offs to the tune of at least Rs 100 crore is not available.

The constant spurt in bad loans has prodded the government into stepping in time and again to bail out banks by recapitalising them. While banks claim that the recovery measures continue even after write-offs, sources say not more than 15-20 per cent is recovered.

The RBI collects credit information of large borrowers with exposure of Rs 5 crore and above, which contain data on borrowers with amount technically/prudentially written off.

The information accessed by the CNN-News18 is a first in getting the exact number of unique borrowers in respect of which an amount of Rs 100 crore and above were written off. The information also uniquely depicts the pattern between 2014 and 2018 when such numbers grew, especially post demonetisation.

Comments

0 comment