views

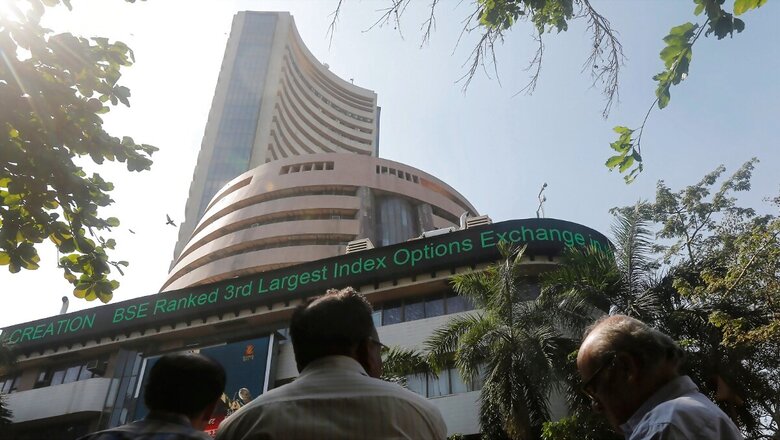

Equity benchmark indices, BSE Sensex and the NSE Nifty, fell sharply to end in red in tandem with losses among global peers. At close, the Sensex was at 78,768.42, down as much as 2,222 points or 2.74 per cent. The index plunged nearly 3 per cent to hit the day’s low of 78,588 on Monday.

Mirroring the Sensex, the Nifty50 also tumbled 662 points or 2.68 per cent to settle at 24,055. After posting a gap-down opening, the index tumbled 3.33 per cent to hit Monday’s low of 23,893.

The fear index, India VIX, ended at a record high of 20.37 points, up 42.23 per cent, indicating massive volatility in the markets.

Bears took over as 45 out of the 50 listed stocks on Nifty50 posted a negative closing, with Tata Motors, ONGC, Adani Ports, Tata Steel, and Hindalco being the top laggards, each falling over 7 per cent.

From the BSE space, 28 out of the 30 constituents of the Sensex ended lower, with Tata Motors and Adani Ports being the top laggards. Only Hindustan Unilever and Nestle India managed to end in the green.

The broader indices settled in red, with Smallcap and Midcap being the worst hit, falling over 4 per cent.

The sectoral indices also faced mayhem, ending in red with losses in Auto, Metal, IT, and Banking sectors of up to 4.85 per cent.

Global Cues

On Monday, the Korea Exchange announced that it had implemented sidecar trading curbs on the KOSPI market, suspending program trading for five minutes from 11:00 to 11:05 a.m. local time.

Japanese stocks tumbled to their weakest levels since early January on Monday, extending last week’s selloff triggered by the rout in global stock markets and worries investments funded by a cheap yen were being unwound.

The Nikkei share average is down 15% in three sessions and seemed set for its biggest three-day plunge since 2011, as banking stocks led the decline.

On Monday, share markets in Asia fell sharply while bonds saw a boost as concerns about a potential U.S. recession drove investors away from riskier assets and increased bets on a swift reduction in interest rates to support economic growth.

Continuing the trend from Friday, Nasdaq futures dropped by 2.27%, S&P 500 futures fell 1.41%, EUROSTOXX 50 futures decreased by 0.6%, and FTSE futures were down by 0.2%.

Comments

0 comment