views

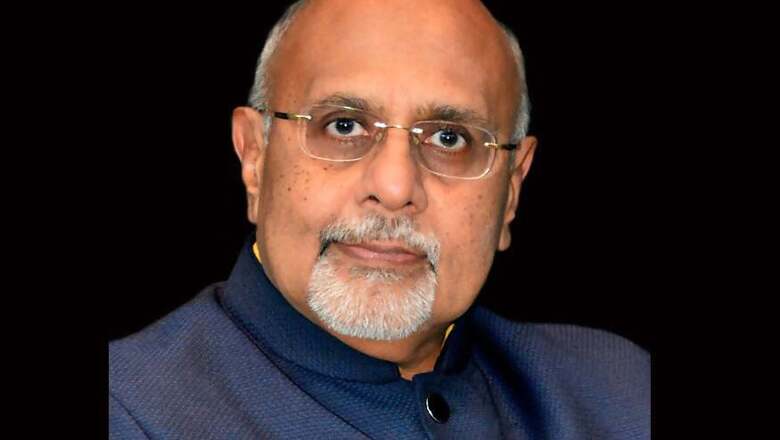

New Delhi: The new Income Tax law may do away with direct contact between taxpayers and taxmen and focus on the salaried class, Mukesh Patel, a member of the new task force set up by the Ministry of Finance has told News18.com.

Patel, an Ahmedabad-based tax advocate, was also part of an earlier expert committee to simplify income tax laws. In an exclusive interview, he has said that the new Income Tax law is the need of the hour instead of continuous patch-up work on the old 1961 legislation.

Edited excerpts:

Now that we have a uniform system for indirect taxes in the form of Goods and Services Tax (GST), are we heading for a similar system pertaining to the direct tax as well?

We have been given a mandate which clearly spells out our tasks. Now, the committee’s first task force meeting is set to take place and we have been given the freedom to work in our way but the terms of reference are clear. We have to draft an appropriate direct tax legislation keeping in view the best international practices prevalent in a lot of countries and harmonise it with the economic needs of our country. The context in which the constitution of the task force was contemplated was when the Prime Minister felt that the present law though it has been amended several times is essentially more than 50 years old. Therefore, the thought was, instead of going for continuous patchwork, why not draft a new legislation in line of them working on the new GST model.

Historically we had four direct taxes, like the income tax, wealth tax, gift tax and state duties. Three of those four legislations have evaporated over the years. Hence, as of now there is only one direct tax and that is – income tax.

What are the best international practices that might find a place in the new law?

There are a number of international practices already incorporated in the act, like transfer pricing, (general anti-avoidance rule) GAAR, among others. When we talk about best international practices, it does not only mean international tax front. We have had many things from the international tax front for many years but there is a difference. We have our own system of filing of tax returns, handling of scrutiny assessments, taking care of income tax litigation, etc. Now, when we talk about all these aspects, there is a lot that we can do with benchmarking the best international practices. In most of the advanced countries, there is a system of scrutiny where the taxpayer does not even have to see the face of taxmen, except in cases of exceptional investigations. It’s generally without any personal interference. If there are questions from the tax department, he gets a notice and he replies but no direct contact. This is a practice prevalent in many western countries like Australia, Singapore, etc. I think that is a very good practice.

Our country faces a large number of grievances in terms of high pitched assessments, or mischievous practices in terms of scrutiny assessments. Now, all this can be taken care of and much better customer satisfaction regime can be ushered in by the department. This is something which is not there in our present taxation system and we have to move in that direction.

If one talks in terms of litigation, if you consider the taxpayer base to the amount of litigation that we have (in terms of pending cases and mounting arrears) the ratio in our tax system is fairly high. The time taken to dispose litigation is because of the very nature of the things as they are. We have to still look at some of the very ideal and effective benchmarks, good practices from different parts of the world.

Similarly, if we have to think in terms of widening our tax base and balancing tax rates. This has been a perpetual and perennial tightrope walk, because, when the tax rates have gone down, the collections go up. When you have more exemptions and deductions, there is a lot of litigation due to the scope of interpretation. So, considering there is some room for consideration, we can ask why we need to upset the prevalent law and not think afresh. For example, after so many years, despite a fair amount of resistance, the Companies Act was put together and it was the philosophy that provisioning that no disputes were the same. The government, though, expects us to look at a new law which takes care of the economic needs of our country, which is of paramount importance because if there is something good in the county A, B or C, may not necessarily like it. Although, if there is something worth picking up, then we need to.

Will the new law resemble the Direct Tax Code (DTC) Bill introduced in 2010?

This is not going to be a cut-paste exercise in any manner. Although, we have, amongst our group, a common member, who was there during the drafting of the DTC 2010 Bill, we have to understand that the same government, which said that they were shelving the DTC due to a lot of debate at that point of time, felt that it was difficult to retain the direct tax code as it was proposed and hence could not meet the fate.

Now, PM Modi, having continued with our team as a convener, shows that the government does not have any bias or prejudice against a particular person, etc. If the DTC Bill had some good features and can fit within the mandate that we have been given, I see no reason why we cannot look at it. So some of the provisions of the DTC, which did not meet resistance or had approval, can be considered. We need to keep the interest of various taxpayers and stakeholders. Businesses, industry and the government itself would have its own point of view and we will be looking forward to feedback from various quarters for consideration.

What is the one element that, you think, definitely needs to be included in the new law that has had no mention in the 1961 law?

Mainly, keeping in mind the substantive provisions of the policy, we have to mind several aspects. What was good in 1961, was proper with the time and context in which it was framed. We have changed many things in the 1961 Act but we have also not touched several things. For example, the salaried taxpayer feels that he has not received sufficient attention. Perhaps because there is no lobby. Industry groups, professionals, have someone to say on their behalf, whether it’s housing, automobiles, etc. but the salaried taxpayer has no one. They feel that there are allowances, incentives that they are entitled to but their limits have not changed at all since the last couple of decades. Hence, we have to look at something which is more dynamic and keeps pace with time.

Like, I was part of the Easwar committee and one important recommendation that we made was re-visiting the capital gains indexation, as the 1981 base was fixed in 1992 when Dr Manmohan Singh presented his first budget. That time we had a gap of around of 10 to 15 years. Then in 2017, we said that we needed to move ahead by two decades and it was good that the government accepted our proposal and took the base year as 2001. This is a massive subject when we speak of Direct taxes, there are so many areas of operation, substantive, procedural and so we will have to take a close look at all them.

Finance Minister Arun Jaitley talked about reducing corporate taxes, are you also thinking along similar lines?

The group needs to meet and collectively take a call on this. The Finance Minister can speak on this about his vision, but for the group, I do not think, it would be appropriate to speak on this at this stage.

Do you think the importance of the annual budget gets undermined with economic sanctions being framed and drafted throughout the year?

Historically, whenever we had tax legislation, they have come up with taxation law amendment acts. We have never changed the Income Tax Act of 1961 but we have had several amendment acts, which were independent exercises, carrying substantial changes in the law. When we had the taxation amendment law of 1987, it brought key changes in the I-T Act of 1961. It was an amendment act and not a budgetary exercise. Financial exercise linked with the budget mostly deals with tax rates and various other provisions because we don’t have frequent amending legislation. The difference between Finance Bill and the taxation laws amendment act is that the amendment bill has to go through all the process of being presented as a bill and be debated around, hence it takes much longer.

The Finance Bill is presented during the budget, it is discussed during the budget session and is passed within no time. Hence, many important provisions are introduced through the Finance Bill as it is much quicker and faster. But I believe, that once the new law is drafted, probably this should end.

I recall the words of Nani Palkhiwala in the good old times, “If you want to keep the Income Tax Act simple, the best way is not to have frequent amendments, because if you go on amending the I-T Act, then there are problems and complexities.”

Probably, I think we are looking at an exercise that instead of doing patchwork if looked at on a holistic basis, we feel that it will do us good for a few more decades with some review over the time. The exercise will have more efficacy and stability in terms of taxpayer confidence and the department will also find it much easier to administer rather than go for frequent amendments.

Comments

0 comment