views

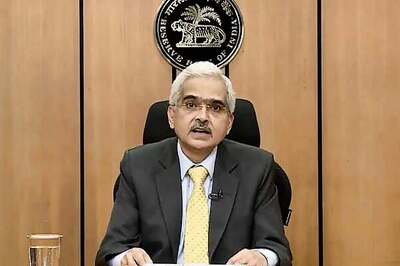

New Delhi: New Reserve Bank of India (RBI) chief Raghuram Rajan kicked-off his term with a bang, announcing a spate of measures to support the embattled rupee and unveiling a raft of steps to liberalise financial markets and the banking sector. In an unexpectedly detailed and wide-ranging briefing, Rajan outlined plans to attract more funds from overseas by subsidising hedging costs for banks and making it easier for importers and exporters to hedge currency risk.

He made clear his intention to liberalise markets, including pushing for more rupee trade settlement, introducing new financial products such as overnight interest rate swaps and removing curbs on opening new branches by Indian banks. "Some of the actions I take will not be popular," said Rajan, who famously predicted the global financial crisis and took over at the central bank in Mumbai on Wednesday after nearly a year as chief economic advisor in the finance ministry in New Delhi.

His forceful debut, which contrasted with more circumspect public comments in recent months, drew rave reviews from central-bank watchers. A Prasanna, economist at ICICI Securities Primary Dealership, said he expects bonds, the rupee and Indian stocks, especially those of banks, to react positively on Thursday.

"Overall, the way and kind of steps he has announced will instill confidence in the market, which was in short supply." A prominent former International Monetary Fund chief economist, Rajan, 50, succeeds Duvvuri Subbarao at the helm of the Reserve Bank of India. He enters office in the eye of a financial storm as the country grapples with its worst economic crisis since 1991, which has sent the rupee skidding by some 20 per cent this year.

"The governorship of the central bank is not meant to win one votes or Facebook 'likes'. But I hope to do the right thing, no matter what the criticism, even while looking to learn from the criticism," he told reporters.

Many critics and investors have complained about what they viewed as inconsistent communication and insufficient action from policymakers as economic growth has crumbled to a four-year-low of 4.4 per cent in the June quarter and as the rupee last week hit a record low. "Expectations were quite high from him and he has gone far beyond expectations on day 1," said Barclays economist Siddhartha Sanyal. "The fact that he has come with such pointed steps in mind shows that we will see more concrete steps very soon."

Earlier on Wednesday, the rupee rallied after suspected dollar sales by the central bank and after Reuters exclusively reported that the RBI was considering a plan that would help lenders raise money from expatriate Indians. Rajan, in his remarks, outlined the plan to attract more funds from non-resident Indians (NRIs) as part of a broader push to lure inflows.

The rupee recovered sharply from a day's low of 68.62 per dollar to close at 67.065. Under the plan, the central bank will offer a swap window to banks for fresh dollar deposits mobilised from non-resident Indians. India has the world's second-biggest diaspora, according to the Ministry of Overseas India Affairs, and the country has turned to overseas Indians for help in past financial crises.

The central bank will also offer forex swap into rupees at a concessional rate below market levels for banks who raise dollar funds through overseas borrowings.

Rajan's arrival has been welcomed by some traders, who hope for a fresh approach to the RBI's controversial bid to defend the rupee by tightening cash conditions and raising short-term interest rates. Those measures have pushed up borrowing costs even as economic growth sputters and have shown little success to date in braking the rupee's descent.

Among Rajan's measures, he said banks should gradually be allowed to decrease their mandatory holdings of government securities, which would free up capital for lending. He also said new bank licences should be awarded on an ongoing basis. The central bank is now in the process of awarding the first new bank licences in a decade.

Rajan also proposed the issue of inflation-indexed bonds linked to the consumer price index, an indication that the central bank may soon shift its inflation benchmark from the wholesale price index.

"He didn't take cover saying that he will first overcome the current problems and then take steps. He thinks both can be done simultaneously," Prasanna if ICICI Securities said.

Rajan also pushed back the date of the RBI's next monetary policy review by two days to September 20. That will give the central bank more time to consider the outcome of what is expected to be a pivotal two-day meeting of the U.S. Federal Reserve, ending on September 18.

The prospect that the Fed will soon unveil a plan to start winding down its monetary stimulus is weighing on emerging markets, with India faring worse than most because of a lack of confidence it can address its hefty fiscal deficit and its record current account deficit.

In a reminder of the uphill task Rajan faces, a report on Wednesday showed that activity in India's services sector shrank in August for the second straight month for its lowest reading in four years, the latest indication that growth in Asia's third-largest economy is still slowing.

"The biggest positive in this entire speech is the confidence. I think there will be decisiveness in the way things move, which will spread to the markets as well," said Ananth Narayan G, co-head of wholesale banking for South Asia at Standard Chartered Bank.

Comments

0 comment