views

The Reserve Bank of India (RBI) on Wednesday announced Rs 50,000 crore term liquidity for ramping up Covid-related healthcare infrastructure and services till 2022 in the backdrop of the second wave of the pandemic sweeping across India.

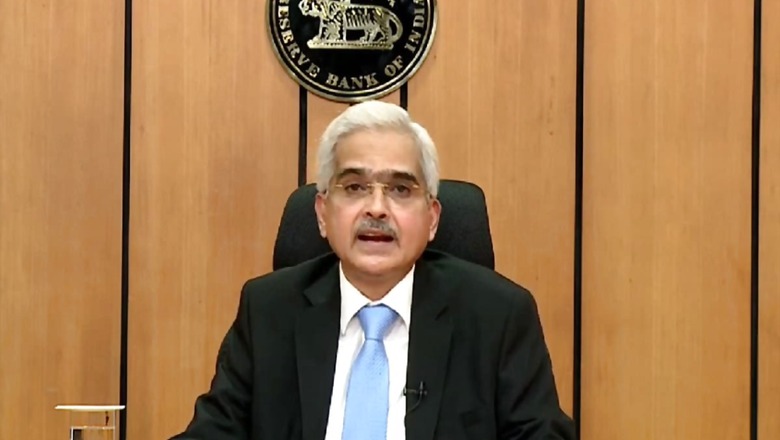

RBI Governor Shaktikanta Das said that under the scheme, banks can provide fresh lending support to entities like vaccine manufacturers, importers and suppliers of vaccines, hospitals, dispensaries, logistic firms and patients.

Making an unscheduled speech on Wednesday, RBI governor Shaktikanta Das said the Covid-19 pandemic has reversed the economic situation in India, with the country witnessing a shift from strong economic recovery to facing a fresh crisis.

Das said RBI will continue to monitor the ongoing situation and deploy all resources to fight the virus. He further added that a normal monsoon forecast should help contain food price inflation.

As part of RBI’s measures to fight the impact of second coronavirus wave, he announced that no punitive action will be taken against customers who don’t update their KYCs till 31 December, 2021. He added that localised containment measures are keeping demand buoyant as compared to last year.

Das also announced that banks will create a Covid loan book in their balance sheets where they can park money equal to loans disbursed with RBI at 40 basis points above reverse repo rate.

This comes at a time when the second wave of coronavirus continues to devastate the country.

On March 3, Das had expressed optimism about the overall COVID-19 situation following the rollout of the vaccines and complimented all the SAARC central banks for their efforts in combating the pandemic, the central bank said in a statement on Tuesday.

Das made these remarks in his opening speech at the 41st Meeting of the SAARCFINANCE Governors’ Group in virtual format. Das had chaired the meeting.

The RBI said that while the Governors agreed that the pandemic had an adverse impact on their economies, they recognized the importance of leveraging technology to spur growth.

The speech comes amid a ferocious second wave of COVID-19 cases in India. Many states have introduced lockdowns and other COVID-induced restrictions, which could hurt the economy.

Experts told CNBC-TV18 that the RBI Governor may announce relief measures like loan moratorium extension, one-time loan restructuring for small borrowers, additional liquidity relief, among others.

The RBI Governor on May 3 met the representatives of NBFC- MFIs and the two industry associations— Sa-Dhan and MFIN (microfinance institutions network), Moneycontrol had reported.

Deputy governors MK Jain and MD Patra and other top RBI officials attended the meeting.

The microfinance industry has asked for restructuring of borrower loans and liquidity assistance.

Read all the Latest News, Breaking News and Coronavirus News here. Follow us on Facebook, Twitter and Telegram.

Comments

0 comment