views

Viewing Your Current 401(k)

Talk to your workplace’s HR department to get the details on your current 401(k) plan. Clarify which provider manages your 401(k) plan, and ask for the URL to the online portal — since there are many different portal options, it's a good idea to check which one you should access. While you’re at it, check with your HR rep to make sure that your on-file address is up-to-date. This way, you’ll definitely get your quarterly 401(k) statements in the mail. If your workplace doesn’t have an HR department, talk to your boss or supervisor instead.

Sign into the online portal associated with your 401(k) plan. Your provider will mail you quarterly statements regarding your 401(k) plan, but the online portal is definitely the easiest, most convenient way to stay up-to-date with your account. Depending on the provider, you might need a registration code from your workplace to get your account and login set up.

Inspect your 401(k) plan online at least annually. Your 401(k) is a long-term investment, so you want to periodically make sure that it’s doing well and growing in the direction that you want it to. Just don’t check it on a regular, weekly or monthly basis–your balance will naturally shift over time, and it can be stressful to see your balance at a lower point. If you’re having trouble finding your 401(k) balance on the provider’s site, click on the “help” page for navigational tips. If you want to check it with more frequency, once every other month is a good idea to make sure that the investments that you have selected are the ones you want and also that the money is going in correctly.

Locating Your Old 401(k)

Get in touch with the HR department of your old employers. Jot down a list of all the people or organizations that you’ve worked for in the past. Then, call up each HR rep and ask them to check their records and see if you ever participated in their 401(k) plan. In some cases, your old employer can help you get access to your old account.

Call the plan administrator’s number from an old statement. There’s a good chance that your old 401(k) provider sent you quarterly statements while you worked for your past employer(s). Sort through your old mail and see if you can find one of these documents. Your 401(k) provider’s contact information should be on that statement, which you can use to relocate your 401(k) plan. If you can’t find any old statements, call up one of your former co-workers and see if they have one on hand.

Visit FreeErisa.com if you don’t know your plan provider. According to the Employee Retirement Income Security Act (ERISA), all American employers have to report their employees’ benefit plans (including 401(k)s) via Form 5500. Thanks to this form, your old 401(k) may still have a paper trail. The “FreeERISA” search tool can help follow this paper trail for you, as long as you know the name of your original employer. You can visit the website here: https://freeerisa.benefitspro.com.

Check the National Registry with your social security number. The National Registry of Unclaimed Retirement Benefits is full of leftover 401(k) plan balances that were were reported by different employers. Enter your SSN in the database to see if there’s any money attached to your name. Check out the National Registry here: https://unclaimedretirementbenefits.com/search

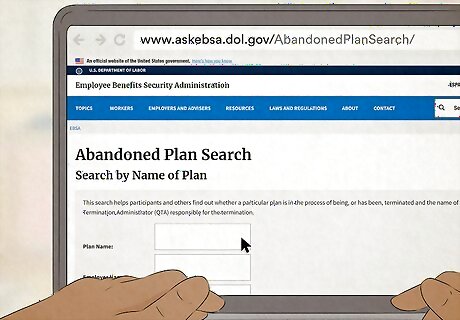

Search the Abandoned Plan database if you think your 401(k) isn’t worth much. If worth less than $5,000, employers are allowed to transfer their employees’ 401(k) accounts to an Individual Retirement Account (IRA) without talking to them first. In some cases, you might be able to find your old 401(k) plan in the Abandoned Plan database, which is managed by the U.S. Department of Labor. Check out the Abandoned Plan database here: https://www.askebsa.dol.gov/AbandonedPlanSearch. Make sure you have your plan name, employer name, city, state, and zip code on hand first. Keep in mind that if your old employer has an established 401(k) provider, they probably transferred your old 401(k)/new IRA to the same company.

Check missingmoney.com in case your old employer cashed out your 401(k). Unfortunately, your old 401(k) plan might not even exist anymore if your ex-employer got rid of their old retirement plan. Don’t worry, though–you can still reclaim the money, even if it’s deposited somewhere or converted to an IRA. This site isn’t a scam; it’s actually run by the National Association of Unclaimed Property Administrators.

Comments

0 comment