views

Preparing to Complete a Deed

Examine the types of deeds available to you. A grant deed is one of the three types of deeds used most often in property transfers. Each has benefits and potential complications. Choose the one that works best for your situation. Warranty deeds guarantee that the person conveying the property, called the grantor, has a good and marketable title that is clear of liens and claims. The person receiving the property, called the grantee, is protected against third parties making claims against the property. If a claim is discovered after the property is transferred, the grantor may be legally liable for any losses suffered by the grantee. A general grant deed, sometimes called a special warranty deed, also promises that the grantor has a clean title to the property, but removes the duty to defend the title during a legal dispute. The grantor is stating that he has not sold the property to anyone else and that there are no undisclosed liens or mortgages on the property. Like warranty deeds, you can get title insurance to add a layer of protection. Quitclaim deeds transfer whatever ownership the grantor has, with no guarantees or statements that there aren't other liens, mortgages, or encumbrances against the property. A quitclaim deed is most often used in non-money transfers such as transferring property between family members, removing a spouse after a divorce equity buy-out, or adding property to a trust. This is the riskiest type of deed and not eligible for title insurance.

Verify that you can use a grant deed. Not all states recognize grant deeds. You must check with your state statute and local Deed Recorder or Register's office to ensure you can use a grant deed to transfer your property. You will want the Recorder's office which is usually located at the courthouse in the counter where the property is located. In some jurisdictions, the terms grant deed and special warranty deed are used interchangeably. Grant deeds are very common in California. If you have any doubts about the type of deed that covers your situation and is acceptable in your jurisdiction, consult with a real estate attorney.

Gather your documentation. One of the best sources of information you'll need to complete your grant deed is the most recent deed for the property. This document will have the legal description and will show exactly how your name appears on the deed. You can get this document from the Recorder's office in the county where the property is located. This is a public record, available for review.There may be a small charge for a copy of the deed.

Completing the Grant Deed

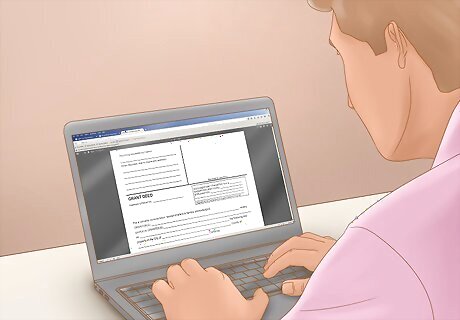

Obtain a blank grant deed form. Depending on the jurisdiction, the county government may have blank deeds either at the Recorder's office or available for download. Blank grant deed forms are also commonly available through office supply stores. The document must be clearly titled as a "GRANT DEED." That title identifies the promises, called covenants, that the grantor is giving to the grantee.

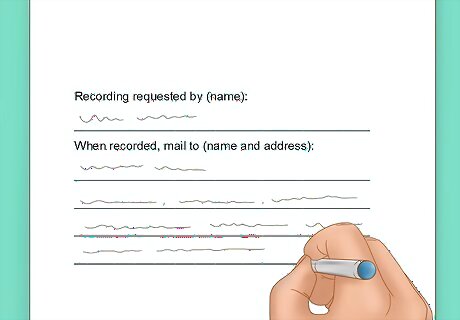

Complete the address block. Start with the name of the person who will be taking the document to the Recorder's office.

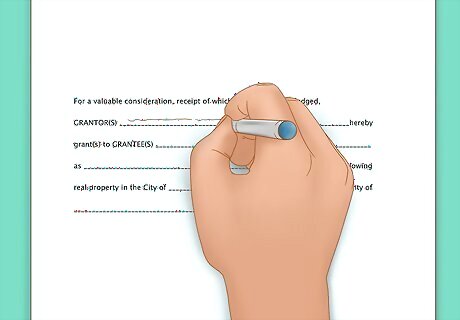

Identify the grantors. The grantors are the current owners of the property. The names should appear exactly, including titles, as they appear on the deed that granted them ownership. For example, "Joseph E. and Mary S. Jones: Husband and Wife as Joint Tenants", or "Patricia Lynn Smith: an unmarried person."

Determine the grantees status as owners. This is very important and could affect the ownership of the property if the grantees divorce or one of them dies. An unmarried person is the sole owner of the property. This person can sell the property at will and if this owner dies, the property will transfer through her will. If a married grantee wants to take sole ownership and exclude the property from the marital estate, consult with a real estate attorney for the proper language. Otherwise, the deed will be considered community property or a joint tenancy. In a joint tenancy, all grantees have an undivided interest in the property. If one of the grantees dies, his share flows to the other grantees. For example, Bill, Joe, and Mary Smith inherit their grandfather's farm as joint tenants. Under this deed, each owns an undivided one-third interest in the farm. Joe Smith dies. As the surviving joint tenants, Bill and Mary Smith each now automatically own one-half of the property. This is most common with married couples. The property can transfer to the other spouse without wills or probate. For grantees that are not married, tenancy in common is more favored by the courts. In this case, Bill, Joe, and Mary Smith would each inherit a fixed one-third share of the family farm. At Joe Smith's death, his share would pass to his heirs. Additionally, each grantee is free to sell his or her share without disturbing the rights of the other grantees. The designation of the grantees can affect the property for generations. If you have any doubt about how to identify the type of grant you are making, consult a real estate attorney.

Fill in the location and legal description of the property. The location of the property is the city, county, and state. The legal description is a combination of metes and bounds within a block, tract, or subdivision. The best source for the legal description is the most recent deed. Copy this block of text word for word. Do not miss a single comma, period, or space. A discrepancy in the legal description may result in your deed being rejected by the Recorder's office. Legal descriptions will typically read something like, "Lot 2 and the North half of Lot 4, Block 130, City of Fort Scott, Bourbon County, Kansas."

Date and sign the grant deed. All grantors must sign the deed in front of a notary. Use blue ink to denote an original document. Use the date of the signatures as the deed date. Each grantor should bring at least one form of identification. If a grantor's name has changed by virtue of marriage or divorce, bring your certificates showing both your current name and the name on the deed.

Record the deed. Typically the grantee records the deed with the county Recorder's office. The fee will typically be under $20 for a single page document. If the deed is complex and has attachments, then estimate an additional $2 to $3 per page after the first page. The deed becomes valid on recording. The county office will generally send fully executed copies to the address listed on the deed in two to four weeks. If you need it sooner, you may be able to get a certified copy earlier by paying a separate fee.

Comments

0 comment