views

X

Research source

Knowing how to detect and report suspected mortgage fraud helps keep mortgages available and affordable or all.

Planning a Report of Mortgage Fraud

Determine the type of mortgage fraud. There are two categories of mortgage fraud. The first is committed by the applicant and the second by the lender. Each type of fraud can harm the real estate and banking markets. Borrowers can commit "fraud for property." This type of dishonesty includes lying about income and assets to get a loan. A common example of this is producing falsified tax returns or pay stubs in an attempt to show sufficient income to qualify for the loan. Borrowers rarely commit fraud with the intent to default or profit. Fraud for property is usually more wishful thinking, but still causes harm because of the higher chance for default. Lenders can commit "fraud for profit." This type of crime is dangerous and costly. It can destabilize the housing market. A common type of fraud for profit is to fake higher appraisals to artificially inflate housing prices. The result is pushing bigger loans on unsuspecting consumers.

Gather information on the mortgage fraud. If you believe you or someone close to you has been the victim of fraud for profit, you need to pull together all the documentation surrounding the loan. Conversely, if you have reason to believe that someone committed fraud for property, it is important to find out if they are paying their mortgage. If the party is not in default, the lender may or may not be interested in prosecuting the case.

Determine how you will report the fraud. Generally, mortgage fraud, especially involving lenders involved in fraud for profit, is reported to the Federal Bureau of Investigation and Federal Trade Commission (FTC). The FBI has an online report form at https://tips.fbi.gov/ Contact the FTC website If the loan was through the Housing and Urban Development Department (HUD), report it at stopfraud. If a neighborhood lender is involved, such as a community bank, you should also report your suspicions to local law enforcement, usually the city police.

Reporting Fraud for Profit

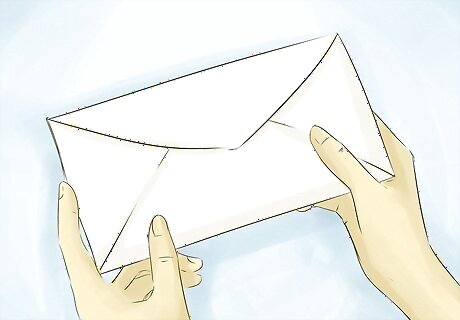

Identify if you've received a scam mortgage relief offer. If you are behind on your mortgage and facing foreclosure, you may receive a mail or phone solicitation promising to reduce your monthly payments. If a company demands a fee upfront for an "audit" of your mortgage, this is a sign of a scam. The law protects you from upfront fees. Legitimate companies will not charge you anything until you have a signed loan modification. Do not ever surrender the title to your home in exchange for a promise that the company will prevent foreclosure by using their credit to leverage better loan terms. Gather information, including flyers, brochures, and any letters you've received and report the scam to the Federal Trade Commission and your state's Attorney General. Many states have an online complaint form. Otherwise, the report procedure will either be on the state website or you can call for instructions.

Report a fraudulent appraisal. In theory, everyone wants a house to have a high appraisal value. However, in appraisal fraud, a lender cares less about the security of the loan, than how much the loan is worth in the secondary market. If you have been the victim of appraisal fraud, you may have overpaid for your house, have a higher loan than the value of the house will support, and have difficulty refinancing or selling your property. Banks used to hold mortgages for the term, collecting the interest. In today's market, mortgages are "bundled" and sold to investors. Unscrupulous lenders have an interest in inflating appraisals to maximize the loan and make the most profit when the mortgage is sold. If you believe your appraisal was fraudulently inflated, it can be difficult to prove. The first step would be to ask a real estate agent or lawyer to run a report of comparable sales in the area. There will likely be a fee for this. This is a measured moment in time of how your house compares to others. If the value of your house is out of balance with others, then the appraisal could be suspect. Pay for an independent appraisal. If you can, choose an appraiser from another area that does not have a relationship with your lender. If the appraisal varies from the one supporting your loan, this may support your claim of appraisal fraud. Expect to pay around $300 for the appraisal. Document your suspicions and contact the FBI. You can use the online complaint form, your local field office, or the direct toll-free hotline at 1-800-CALLFBI.

Uncover an "air loan" or "strawman" mortgage fraud. In this scam, mortgage brokers create fake buyers to make loans on non-existent properties with the intent to bundle them to another lender before the fraud is uncovered. If you are approached to participate in an air loan scam or become aware of one, document as much as you can and contact the FBI at your local field office or 1-800-CALLFBI.

Reporting Fraud for Property

Identify a suspected fraudulent mortgage. If you suspect someone has lied to get their mortgage, ask yourself a few questions. Is someone bragging that he put one over on the bank? Did someone get a mortgage that is way out of line with what you know about his income. Is he employed at all? Do you believe that your identify and employment or bank information was stolen and used as the foundation of someone else's mortgage? Are there unidentified mortgage broker or bank credit inquiries on your credit report?

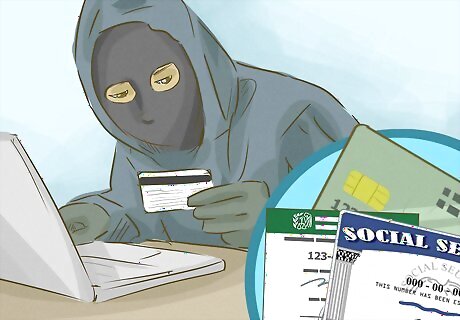

Report suspected identity theft. The most serious type of identity theft is when someone uses your information to literally steal the equity in your home by getting a fraudulent second mortgage or home equity loan. Less devastating, but just as serious, is using your financial history to get a mortgage on a house. Gather all the documentation you can and immediately call local law enforcement and the local field office of the FBI.

Consider reporting a fraud for property to the lender. If you believe someone lied on his mortgage application by giving false employment information or bogus tax returns, you can report it to the lender. If he is living in the house and paying the mortgage, while technically a crime, the damage may be minimal, and the lender may take no action. Regardless, you will not be able to get any updates or follow-up information. It will be a confidential matter between the lender and the mortgage holder. The one exception would be if you believe someone committed identity theft and used your employment and credit information to secure the mortgage. Even if it is someone you know or a family member, this is a serious crime. If he defaults, your credit could be damaged unless you report the fraudulent use of your identity to the lender.

Write a letter to the lender. If you think someone lied on his mortgage application, for example, used pay stubs from a former job he or altered the books for a home business, document your suspicions in a letter to the lender.

Report your suspicions to law enforcement. If you believe the fraud of property is a serious misrepresentation or identity theft is involved, make a detailed written report to law enforcement. You can go to the police station and use a pre-prepared form or you can detail it out in a letter. You should include the name of the person who committed the fraud, the address of the property, the name of the lender, dates, and as many details as you are confident about reporting. For example, "On [date], [name] applied for a mortgage with [lender.] [Name] is my [relationship, neighbor, co-worker, boss, employee, etc.] He told the lender that he was employed at [employer] making [salary.] I know for a fact that he left that job in [date.] I discovered this because [reason, such as "he listed me as a reference and the lender called to confirm employment."] [List any additional information.] You can make an anonymous report, but the prosecutor won't be able to use your statement in court without your sworn testimony and may not be able to do anything with the information. Strongly consider signing with your name and address.

Comments

0 comment