views

The RBI on Wednesday retained its inflation forecast for the current financial year at 6.7 per cent. The central bank’s target for CPI-based inflation is 2-6 per cent. India’s retail inflation in October eased to a three-month low of 6.77 per cent. However, it was the 10th month in a row that the Consumer Price Index (CPI)-based inflation remained above the RBI’s upper tolerance limit of 6 per cent.

The RBI has, however, revised upwards the retail inflation forecast marginally to 6.6 per cent and 5.9 per cent for Q3FY23 and Q4FY23, respectively. The RBI expects to bring CPI inflation down to 5 per cent and 5.4 per cent in Q1FY24 and Q2FY24, respectively.

While presenting the latest bi-monthly monetary policy statement, RBI Governor Shaktikanta Das on Wednesday said, “There will be no let-up in our efforts to bring down inflation, move closer towards 4 per cent target.”

He added that core inflation remains sticky and elevated. “Biggest risks to outlook are headwinds from geopolitics, global slowdown, global monetary tightening.”

Das added that assuming an average $100 per barrel for crude oil, inflation is expected at seen at 6.7 per cent for FY23.

In September, India’s retail inflation had accelerated to a five-month high of 7.41 per cent. Before that, the retail inflation had stood at 7.04 per cent in May, 7.01 per cent in June, 6.71 per cent in July, and 7 per cent in August.

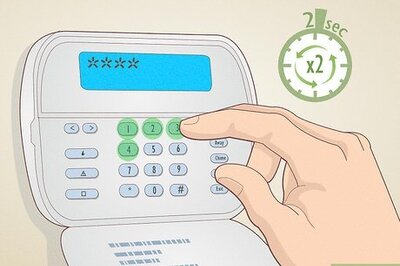

In the consecutive fifth hike this year, the RBI’s Monetary Policy Committee on Wednesday raised the repo rate by 35 basis points (bps) to 6.25 per cent with immediate effect, making loans expensive. The policy rate is now at the highest level since August 2018. The RBI has maintained policy stance at ‘withdrawal of accommodation’.

Read all the Latest Business News here

Comments

0 comment