views

The inflation genie is not back in the bottle yet, with sub-optimal Kharif sowing in pulses and oilseeds expected to lead to an increase in dal and cooking oil prices going forward. There are other domestic inflation concerns too besides continued global uncertainties such as volatile crude prices adding to the problem. Such weighty inflation considerations could have pushed the Reserve Bank of India (RBI) to raise lending rates in its bi-monthly monetary policy review, which concluded on Friday morning.

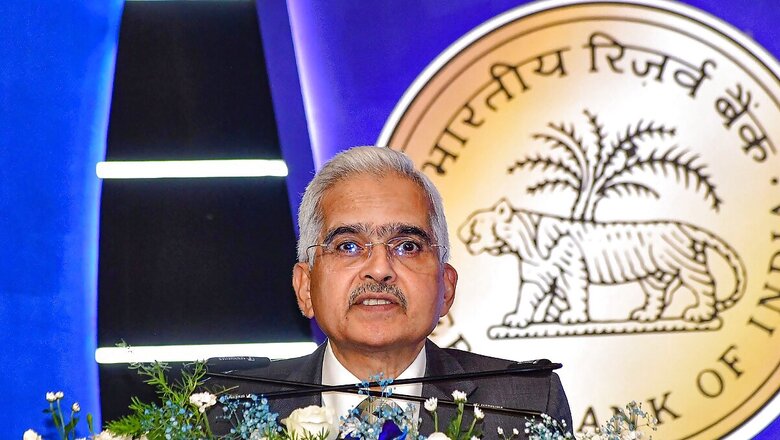

So when RBI Governor Shaktikanta Das invoked Kautilya’s Arthashastra to emphasise the importance of stability in policy, there were many sighs of relief. Das said the monetary policy committee has decided to keep the repo rate unchanged at 6.5%. Repo rate is the rate at which RBI lends to banks and which determines the rate at which banks lend to consumers.

The status quo in the rate means interest rates for retail as well as corporate borrowers will remain stable. So the equated monthly instalments for your vehicle and housing loan will not rise. RBI had begun increasing repo rates from May 2022 and reached the 6.5% level in February this year. Since then, rates have remained unchanged with wide expectations of any cuts now coming only in the new calendar year.

Anuj Puri, Chairman of ANAROCK Group, called this status quo in lending rates by RBI a “festive bonanza” for homebuyers since it allows them further opportunity to make cost-optimised home purchases. In this festive quarter, there is already a strong momentum in housing sales and unchanged interest rates will act as a major catalyst for growth in the residential market. The same principle applies to other popular loan categories, like car and two-wheeler loans. Steady rates would likely boost festive purchases.

As for tackling inflation, the Governor said that near-term inflation is expected to soften since prices of tomatoes and cooking gas have softened. But the future path of inflation remains uncertain due to lower sowing of pulses during Kharif season due to patchy monsoon and concerns over onion prices. Also, the prices of key spices are up due to a demand-supply mismatch. Global crude prices are turning volatile, and already IndiGo, India’s biggest airline by passengers, has imposed a distance-based fuel surcharge on tickets, making flying a little more expensive.

So in a nutshell, the decision of the monetary policy committee to hold rates despite such pressing inflation concerns can only mean that the central bank is doing its bit to spread festive cheer.

Comments

0 comment