views

The Government of India launched the ‘Pradhan Mantri Vaya Vandana Yojana (PMVVY)’ in 2017 to provide social security during old age and to protect elderly persons aged 60 and above against a future fall in their interest income due to uncertain market conditions.

The scheme enables old age income security for senior citizens through provision of assured pension/return linked to the subscription amount based on government guarantee to Life Insurance Corporation of India (LIC).

The government notifies the time period of the availability of the scheme. Currently, the scheme is available up to March 31, 2023.

The PMVVY is being implemented through LIC. The scheme provides an assured pension based on a guaranteed rate of return, with an option to opt for pension on a monthly / quarterly / half yearly and annual basis.

The differential return, i.e. the difference between the return generated by LIC and the assured return per annum would be borne by Government of India as subsidy on an annual basis.

Also Read: Retirement Planning: 10 Tips For Gen Zs To Secure Their Future

Pension is payable at the end of each period during the policy tenure of 10 years as per the frequency of monthly/quarterly/ half-yearly/yearly as chosen by the subscriber at the time of purchase.

In 2018, the Union Cabinet chaired by Prime Minister Narendra Modi had given its approval for extending the investment limit from Rs 7.5 lakhs to Rs 15 lakhs.

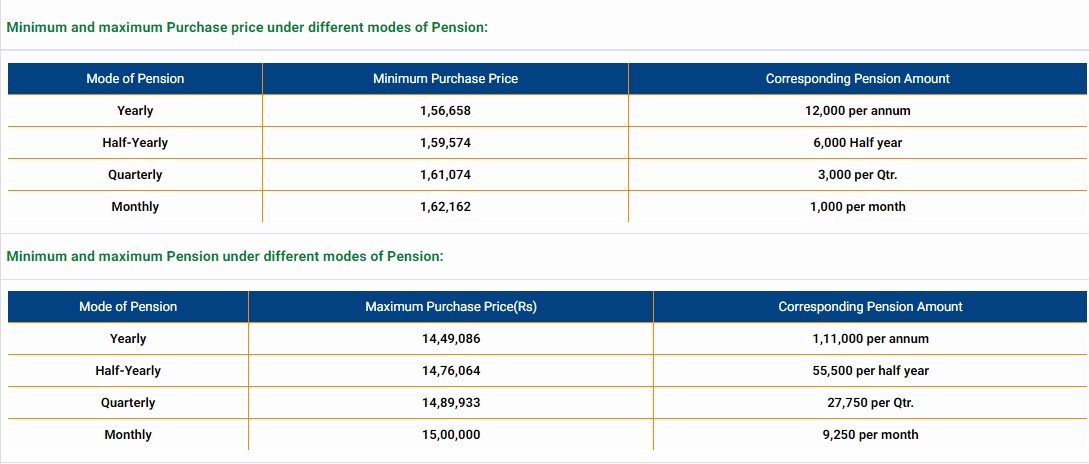

The minimum investment was also revised to Rs.1,56,658 for pension of Rs.12,000 per annum and Rs.1,62,162/- for getting a minimum pension amount of Rs.1000 per month under the scheme.

LIC’s Pradhan Mantri Vaya Vandana Yojana: Plan

- The Plan provides immediate pension for senior citizens 60 years and above. It can be purchased by paying a lump sum amount.

- The plan provides for pension payments of stated amount for the policy term of 10 years, with return of purchase price at the end of 10 years.

- Pension payment modes are available: Monthly/quarterly/half-yearly/yearly

- Pension will be paid at the end of each period as per payment mode chosen starts as early as next month if monthly mode is chosen.

- On the death of the pensioner at any time during the term of 10 years, the purchase price will be refunded to the legal heirs/nominees.

- On survival of the pensioner to the end of the policy term of 10 years, purchase price along with final pension installment shall be payable.

- Only resident Indians are eligible to purchase this plan.

LIC’s Pradhan Mantri Vaya Vandana Yojana: Features

- No medical examination is required.

- Premature exit is allowed during policy term under exceptional circumstances like Critical/Terminal illness of self or spouse. Surrender Value payable in such cases is 98% of the Purchase Price.

- Loan is available under the policy after completion of 3 policy years. Maximum loan granted will be 75% of the purchase price.

Minimum and maximum Purchase price under different modes of Pension:

Please note that once chosen, the mode option cannot be altered.

Eligibility Conditions and Other Restrictions:

a) Minimum Entry Age : 60 years (completed)

b) Maximum Entry Age : No limit

c) Policy Term : 10 years

d) Minimum Pension : `Rs 1,000 per month

Rs 3,000 per quarter

Rs 6,000 per half-year

Rs 12,000 per year

e) Maximum Pension : `Rs 9,250 per month

Rs 27,750 per quarter

Rs 55,500 per half-year

Rs 1,11,000 per year

Total amount of purchase price under all the policies under this plan allowed to a senior citizen shall not exceed Rs 15 lakhs.

For financial year 2022-23, the scheme is providing an assured pension of 7.40% per annum payable monthly.

This assured rate of pension shall be payable for the full policy term of 10 years for all the policies purchased till March 31, 2023.

The policy can be take offline or through the official website of LIC.

Read all the Latest Business News here

Comments

0 comment