views

J C Sharma, MD, Sobha Developers believes that the forthcoming Budget will decide how the demand situation will pan out going forward. However, Sharma feels that the worst is behind for the real estate sector with the Reserve Bank of India giving clear indications that interest rates have reached the peak of the tightening cycle.

An optimistic Sharma said that 2012 will be a year of growth where realty companies should post better numbers. "Coming to 2012 demand scenario, we feel that we have again entered into that growth phase where with the decrease in the interest cost to the borrowers and with expectations of some positive surprises from the coming Budget, the demand can only pick up," he said.

Below is the edited transcript of his interview with CNBC-TV18's Latha Venkatesh and Ekta Batra.

Q: We understand that you already launched two projects in Chennai this quarter and are on track to launch another residential project in Bangalore - how are things actually on the demand side shaping up for you?

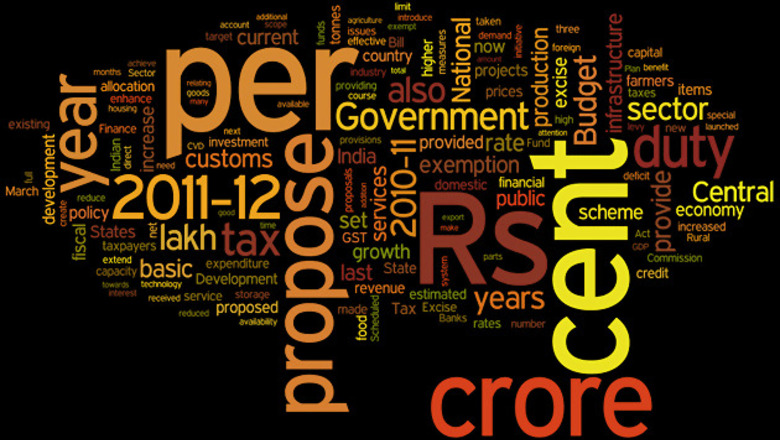

A: We have done reasonably well in 2011. We sold over 3 million sq ft. We realised more than Rs 5,000 per sq ft. In 2012, it is clear that we should do better than 2011. We feel that forthcoming Budget on March 16 will also give some kind of a direction on how much we should be doing and how the demand will pan out. With the RBI giving clear guidance that the interest rates will not peak any more and with interest rates coming down going forward and if the Budget doesn't give any new surprises, we hope that the worst for the real estate should be behind all of us. 2012 should be the year of growth where most of the real estate companies should show better numbers.

Q: Given that interest rates are likely to ease and therefore probably the fourth quarter, being stronger, does that mean your guidance for FY12 is intact?

A: We have already done Rs 1200 crore plus and we hope that we should be doing Rs 1600-Rs 1700 crore of new sales in this financial year. This will be higher than the Rs 1500 crore what we have communicated to our investors.

Q: What about realizations - the 9 month average is Rs 8100 per sq foot; will you sustain that?

A: Of course. Rather, there can be a small increase in that too. Going forward, we find that with Delhi contributing for the whole year and wherever we have the current projects, they are giving us realisations of more than Rs 5100 per sq foot on an average. So we should get better realisations going forward in the coming financial year.

Q: We also understand that the Bangalore projects have actually shown the maximum amount of strength with respect to high property absorption in 2011. What is the outlook for 2012?

A: I think Bangalore is number two after Noida but the quality of buyers in Bangalore, in our view, should be the best because there is no investor driven demand in Bangalore.

Coming to 2012 demand scenario, we feel that we have again entered into that growth phase where with the decrease in the interest cost to the borrowers and with expectations of some positive surprises from the coming Budget, the demand can only pick up. We also strongly believe that the worst is behind the real estate companies.

In this financial year, they should be able to raise money from the banking system and they may be able to raise money from the capital market also which should augur well for them to restructure their balance sheet and focus on execution and ensure that they sell more. The underlying demand in these cities remains very strong and we are looking forward for a better year in the coming financial year.

Q: A bit of a concern actually might be the debt levels of the company which continue to remain elevated at roughly around Rs 1400 crore levels. Are you comfortable or uncomfortable with those debt levels? Are there any plans to reduce it?

A: No. As far as our debts are concerned, we are fairly comfortable. We generate a positive cash flow from our operations. We have been generating it since the last three quarters and we will continue to do so in this quarter as well as in the coming quarters. Our repayment commitments are negligible in the coming financial year and we are committed to bring our debt to 0.5 which we should be bringing sooner. We hope that by the next quarter, it should be brought to 0.5 which is far more comfortable than what most of the companies are operating at today.

Comments

0 comment