views

Mumbai: The NCLT Wednesday issued notices to promoters of Hotel Leelaventure and its lender JM Financial ARC to reply to an ITC petition seeking a waiver of 10 percent minimum shareholding for minority shareholders to be counted in management matters and adjounred the matter to June 18.

Though the National Company Law Tribunal (NCLT) was keen to admit the petition of the tobaccos-to-hotels group ITC, which owns 7.92 percent in Leela, it did not do so citing procedural issues and decided to put the plea off to June 18.

It can be noted that the 10 percent minimum shareholding is defined under Section 241 of the Companies Act, 2013. There was a similar petition by Cyrus Mistry also against the Tatas after he was sacked as the group chairman in 2016, but the plea was dismissed by the Mumbai tribunal.

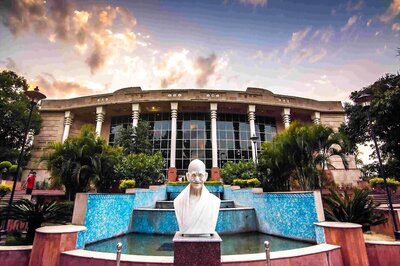

ITC is seeking a waiver of the 10 percent minimum shareholding requirement to file a petition alleging oppression and mismanagement against the hotel management and its lender JM Financial ARC and also to prevent the premium hotel chain from going ahead with the ongoing sale to Canadian fund house Brookfield for Rs 3,950 crore announced in March.

"We were suppressed of our rights as a shareholder. The postal ballot notice has not addressed many issues. It is a classic case of majority acting against minority shareholders using oppressive means, as they own 73 percent.

"We want protection for our shareholding so that the promoters cannot get away with a fraudulent deal," the ITC counsel Darius J Khambatta told the tribunal.

He noted that in 2017, JM Financial ARC bought the debt of Hotel Leela from banks and got 26 percent shareholding after converting the debt into equity. This led to the dilution of ITC's shareholding to below 10 percent, J Khambatta argued.

As per the information available with the bourses, ITC holds 7.92 percent stake in Hotel Leelaventure as of the December 2018 quarter.

Under Section 241 of the Companies Act, 2013 a minimum shareholding of 10 percent is required to file such cases. The Mumbai bench of the NCLT comprising VP Singh and Ravikumar Duraisamy issued notices JM Financial and Hotel Leelaventure to reply within three weeks and file rejoinders in two weeks thereafter.

ITC said all major hotels of Hotel Leelaventure are being sold off excluding the flagship Mumbai property, which is facing a legal battle with the Airports Authority over land lease, and also a land parcel in Hyderabad which the hotel group is developing with Prestige Developers.

Under the deal with Brookfield, the Leela promoters will get over Rs 300 crore from the buyer under royalty and management consultancy agreements for the next five years.

"We are seeking deal details or the valuation report but the company is not co-operating," Khambatta added.

Meanwhile, Brookfield Asset Management Company also filed an application to be made a party to the dispute. Its counsel said, they will file an intervention application if they are not made a party to current petition.

In another development, Leelaventure in a BSE filing Wednesday said markets regulator Sebi has asked it to hold the sale of its four hotels and other assets to Brookfield. The Securities and Exchange Board in a letter to Hotel Leelaventure said it has received representations from ITC apart from Life Insurance Corporation.

Earlier on March 18, Brookfield had agreed to acquire four hotels in New Delhi, Chennai, Bengaluru and Udaipur, and a land parcel in Agra from Hotel Leelaventure for Rs 3,950 crore. The deal is yet to go through. The flagship Mumbai property is not part of the deal and together these five hotels have over 1,400 rooms.

JM Financial ARC had filed insolvency application against the Mumbai-based hotel chain in January, which owes around Rs 5,900 crore to lenders. The Brookfield-Leela deal will also entail buying the Leela brand, existing and all its upcoming management contracts apart from absorbing the employees of these four hotels being taken over by the Canadian fund.

Comments

0 comment