views

Identifying Billing Errors

Look at your credit card statements regularly. Each month your credit card company will make a statement available for each account you have. Your statements may come in the mail, they might be emailed to you, or you might have to go online and download them. However they are delivered, make sure you get a copy of every one. These statements contain information about every purchase you made on your credit card, including how much was spent and where it was spent at. While credit card companies are usually pretty good about avoiding billing errors, they do happen from time to time. If one does occur, you will not catch it unless you check your statement.

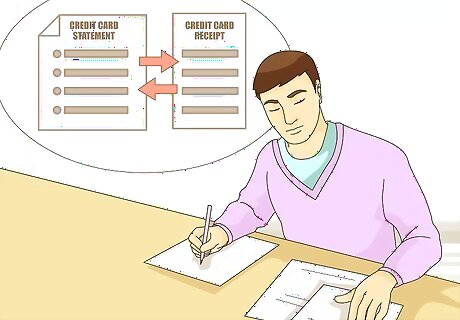

Compare your purchases to your receipts. When you look at your credit card statement, your goal is to match up every purchase, interest charge, and credit to transactions that actually took place. The best way to do this is to compare your credit card statement to your purchase receipts, interest notifications, and credit notifications. Therefore, in addition to keeping all of your past credit card statements, it is also important to keep evidence of the transactions that occur on your credit card. Start the process by looking at the first transaction on your credit card statement. Any given transaction will include the name of the entity where the purchase was made, the amount associated with the transaction, and whether it was completed or is pending. Match that transaction with your receipts or notifications. Make sure the amount on your receipt matches the amount on your statement. Follow these steps for each transaction on your statement. If everything matches, no billing error has occurred. However, if there are discrepancies, you will have to look a little bit closer to understand what happened.

Identify common billing errors. You will likely find it advantageous to understand common billing errors so you can spot them easier. Billing errors can take many forms on your statement. The most common billing errors include: Purchases found on your statement that you did not make A lack of credit that was supposed to have been put on your account Purchases found on your statement that you made but that you returned Purchases that do not identify a recipient (i.e., you cannot tell where the purchase was made) Statement accounting errors (i.e., the numbers just don't add up)

Providing Written Notice

Check your billing rights summary. Whenever you get a credit card, the company will send you a billing rights summary along with your new card. If you cannot find the billing rights summary, contact your credit card company and request another copy. The billing rights summary will tell you where you have to send your written notice as well as any other additional rules the credit card company may have. In general, the billing rights summary will simply mirror your rights under federal and state law. Credit card companies are required to send you this information in order to notify you of your rights.

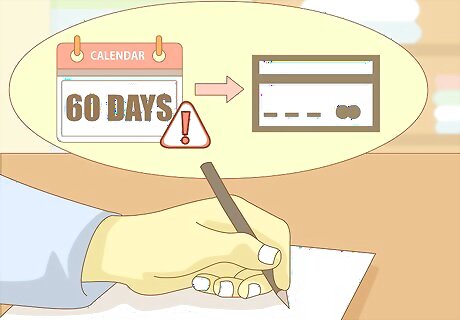

Notify the credit card issuer on time. Federal law requires that, if you think a billing error has occurred, you notify the credit card company within 60 days after you receive the statement that contains the disputed charge. Your notification must be in writing in order to be valid. If you call or contact the credit card company in some way other than writing, your credit card company may require you to send the complaint in writing within a certain period of time after the complaint was voiced (e.g., within 10 days of orally notifying the credit card company).

Draft your written notice. Within your 60 day timetable, you will need to draft a written notice that meets federal standards as well as the standards of your credit card company. Your written notice should be typed, printed, and mailed. Avoid using email or fax whenever possible. A sample notice form can be found at https://www.consumer.ftc.gov/articles/0385-sample-letter-disputing-billing-errors. In general, your written notice will need to contain the following information: Your name as it appears on your credit card. Your credit card number. The name of the seller as it appears on your statement. The date of the purchase. The amount of the transaction. A description of the billing error. For example, if you recognize a purchase you made at the grocery store but the amount on the statement is more than what your receipt shows you should have been charged, explain this. The address where you are sending the notice. The date of the notice (i.e., the date you send the letter in the mail).

Mail the notice to the correct address. When you complete your written notice, make sure you send it to the correct address. The correct address will be found in the credit card company's billing rights summary. If you do not send it to the correct address, your written notice may not be valid and your claim may be delayed. If you fail to respond correctly and on time, you may not be able to dispute the billing error at all.

Look for the credit card company's initial response. Once the credit card company receives your notice, federal law requires them to respond within a certain period of time and in a certain manner. In general, credit card companies are required to respond by taking two actions: First, within 30 days of receiving your notice, the credit card company must correct the error or give you a written acknowledgement that they have received your notice. Second, within two billing cycles, the credit card company must decide whether an error has occurred and how it will be remedied.

Await a final determination. If your credit card company believes a billing error occurred, the credit card company must correct the error, credit your account in the correct amount, and mail you a correction notice. If your credit card company conducts their investigation and determines no billing error occurred, they must mail you a determination letter explaining why they are denying the existence of an error.

Write your credit card company if you disagree with their decision. If your credit card company denies the billing error and requests payment of the disputed amount, you can write your credit card company and voice your disagreement with the decision. Within your written dispute you can request copies of any relevant documents the credit card company used to make their determination. Your letter can also state that you are refusing to pay the disputed amount. This letter must be sent within 10 days of receiving the credit card company's determination letter.

Understand the credit card company's rights. If you refuse to pay the disputed amount after the credit card company denies your billing error claim, the company can start collection proceedings and might report your account as delinquent. However, the credit card company must state that you are disputing the charge whenever it takes these actions. On the other hand, the credit card company may work with you and not start collection proceedings until your dispute has been investigated further. Your relationship with the company will dictate how this matter is handled. In a lot of situations, especially where the disputed charge is minimal, it may be best to pay the charge and dispute it with the seller or credit card company later. This will help you avoid collection proceedings and will help you maintain a quality credit score.

Withholding Payment

Attempt to resolve the dispute first. If you have accepted the item or service that has led to a possible billing error, your main tool will be the withholding of payment. For example, you might be able to withhold payment when you order a new dishwasher but it is delivered with dents and scratches. When you try to return the item the seller will not accept your return. In another example, you may be able to withhold payment if you bought something online but you do not receive it within a reasonable amount of time. When you call the company to ask for a refund, nobody answers or returns your calls. However, before you can withhold payment, you must first make a good faith effort to resolve the dispute with the seller (not the credit card company). Try calling the seller and sending a letter voicing your displeasure. If, after making these efforts, you still do not get a satisfactory resolution, you may be able to withhold payment in accordance with federal law.

Know when you can withhold payment. You can only withhold payment if you have used your credit card in a consumer transaction. Therefore, the law only applies when you buy goods or services for personal purposes. If you use the card for business purposes, you will not be able to utilize this law. Furthermore, you can only withhold payment if you truly believe you have a valid claim or defense to payment. Also, when you withhold payment, you can only withhold the amount that is in dispute. The rest of your payments must be made in full and on time. Finally, you can only withhold payments that have not already been paid. As soon as you pay the credit card bill, you will lose your right to withhold payment.

Inform the credit card company of your withholding. Write your credit card company promptly if you want to withhold payment. Inform them that you desire to withhold a particular payment in accordance with federal law. It is important to make this request in writing so you have evidence of the correspondence. In addition to sending this notice to the credit card company, you should also send a copy to the seller you are in a dispute with. Your letter should contain the following information: Your name. Your credit card number. The name of the seller. The date of your purchase. The amount that you paid. A brief explanation of why you are withholding payment. The address where you are mailing the letter. The date of the mailing.

Ensure the credit card company responds correctly. Your credit card company will respond by either withholding payment until the dispute between you and the seller is resolved, or the credit card company will tell you that you do not have the right to withhold payment. If you withhold payment properly, the credit card company cannot report payment as delinquent until the dispute is settled. If the credit card company tells you that you are not allowed to withhold payment, ask for an explanation as to why. If they can provide a quality explanation, you may have to pay the bill. However, if you believe that you are in the right, you can continue to withhold payment despite the credit card company's questions. The credit card company will start an investigation and, after the investigation, can request payment and/or start collection proceedings.

Comments

0 comment