views

X

Research source

These letters are needed for a number of financial transactions, for instance landlords might require a guarantor letter if they think a potential tenant doesn't have enough income to pay rent or a country may require one be included with travel visa applications to guarantee that travelers will not run out of money and become stranded in their country. Overall, it is very important for guarantors to understand all the terms they are agreeing to and to create a formal letter that solidifies these terms in writing, because submitting a guarantor letter on another's behalf amounts to making a huge financial commitment.

Reviewing the Agreement

Read all paperwork related to the agreement. Make sure you are comfortable with the transaction before you even agree to write the letter. Ask for a copy of the contract paperwork so you can assess the risks of guaranteeing the financial transaction. The responsibility of guaranteeing someone else's debt should not be taken lightly. Analyze whether or not you could actually cover the debt if the person you are guaranteeing defaulted on their payments. You may want to have a lawyer look at the contract to make sure there aren't any loopholes. If you are asked to write a guarantor letter for someone's travel visa, make sure that the person actually has the financial means to do the traveling they are planning on.

Ask to meet or speak with the institution that is requiring your guarantee of payment. This could be a rental company, bank, consulate, or other institution. This is a good time to ask any questions you may have about the terms of the contract. It is always best to make sure you are not getting into a financially risky situation on another's behalf. It is also a good idea to ask whether the institution has a a standard guarantor form that they require to be signed. This form may stand in for a guarantor letter you write yourself or, in rare cases, it may be in addition to your letter. Having a set form to fill out will simplify the process for you. Some examples of guarantor forms you may encounter are: A promissory note and A parental guarantee

Negotiate the terms of the guarantor letter. This may not be possible in every case but it is important that you feel comfortable with all of the stipulations of the agreement. In other words, if you don't want to assume financial responsibility for the contract as is, it doesn't hurt to try to change conditions you can't agree to. For instance, you may be able to only cover the debt or transaction up to a certain amount or avoid covering additional fees accrued after the initial transaction.

Formatting the Letter

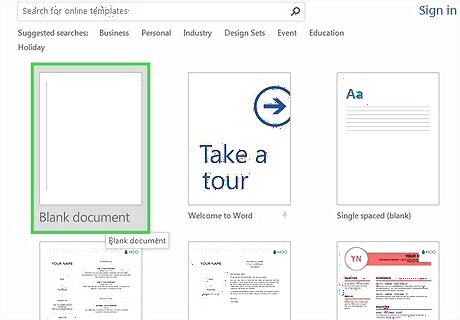

Open a document in a word processing program. You should type the letter rather than hand writing it because this is an important legal document. Many word processing programs even have templates you can use for formatting letters. This will make formatting your guarantor letter much easier, especially if you have limited experience with word processing. If a guarantor form has been supplied to you, simply fill in all the required information and return it to the institution from which it came.

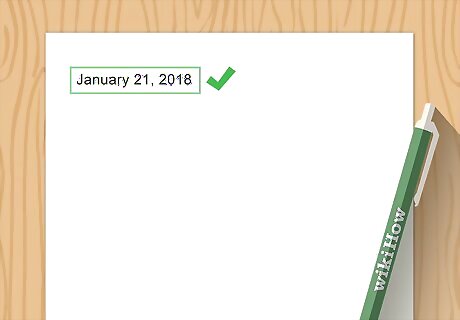

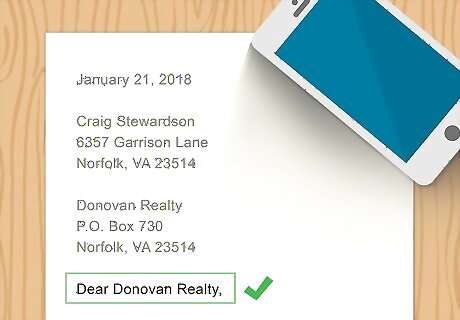

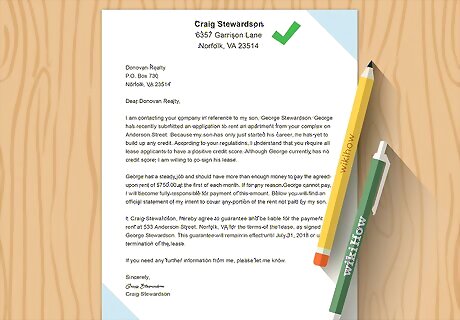

Begin by dating the letter at the top left or top right of the page. Also include your name, address, email address, and phone number at the top. Some word-processing programs include this information automatically in your letterhead, so make sure you are not repeating this information in the header and the body of the letter.

Address the letter to the company requiring the guarantee, not the specific company officials you have been dealing with. Be sure that the tone of your letter is official and straight forward. For example, "Dear Pine Street Property Management," is a simple, but appropriate, way to start your letter.

Writing Persuasive Content

Begin writing your first paragraph by identifying yourself and your relationship to the person you are guaranteeing. Ultimately, this section explains to the reader why you are willing to take on this responsibility on someone else's behalf.

State what you are guaranteeing in your own words. Whether you are guaranteeing a rental agreement, a house loan, a visa application, or a business deal, for instance, you should state plainly in your own words what you are agreeing to do. This will serve to lay out the terms you are comfortable with and will make it clear to the reader what you have generally agreed to do.

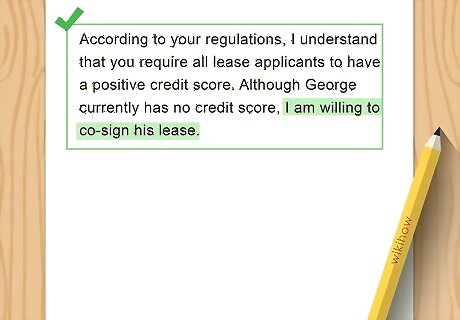

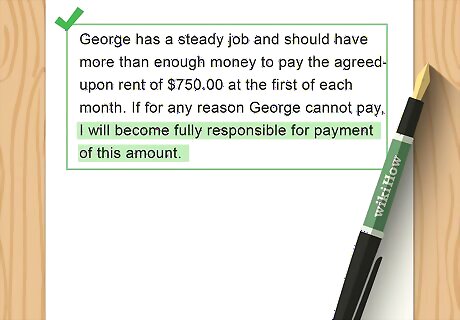

Explain why your guarantor letter is necessary in the first place, if it is at all unclear. While this is probably not necessary in all circumstances, but this is a chance to clarify for the reader any special circumstances that need to be addressed. There is no need to be vague about why you need to guarantee the transaction, as the entity you are writing to should have all pertinent financial information already. Just simply and quickly state why you are needed. If possible, immediately follow this information with why you believe the person you are signing for will make their own payments without you. In fact, to enter into this agreement tin the first place you should have a sense that this will be the case. State it to reassure your reader (and yourself). In cases where you know you are actually going to make all the payments, for instance if you are guaranteeing the lease for your child's apartment while they are attending college, just make your responsibility clear.

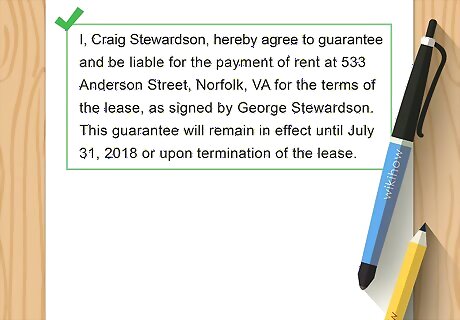

Finish your letter by making a separate clear and concise statement summarizing what your guarantor letter covers. State your name, the name of the person you are signing for, and the exact transaction that you will guarantee. This is also where you can be explicit about any financial or date limits you have placed on the transaction. Be as specific as possible. For example: "I Richard Pearson hereby agree to guarantee and be liable for the payment of rent at 745 Sperry Street, Springfield, MO for the terms of the lease, as signed by Amy Pearson. This guarantee will remain in effect until December 22, 2012 or upon termination of the lease." If you are guaranteeing someone for visa purposes, you should state the applicant's name, application number, address and possibly their date of birth. It is a good idea to check with the applicant and the issuing consulate about what is expected in the letter.

Supply any other information as requested by the company. This may include a bank account number, annual income, social security number, home address or date of birth. Be absolutely sure that this information is needed before including it in your letter. Providing this type of sensitive financial information should only be done with caution and with certainty about the security of the institution you are submitting it to.

Finishing and Submitting Your Letter

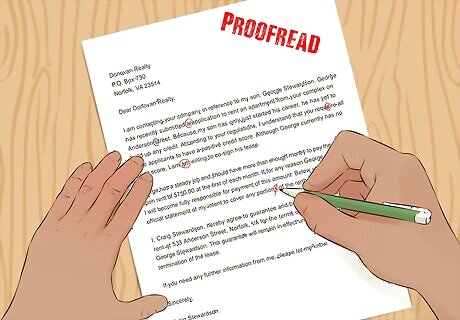

Spell check the letter. Its also a good idea to ask someone to proofread it. Two sets of eyes are always better than one.

Print the letter on personal or company letterhead. If you are writing a bank guarantee letter this is necessary, but a letterhead always looks more official for any type of transaction. You may also be asked to have your supervisor sign and date the letter, for example if your company is guaranteeing a transaction, as opposed to you personally.

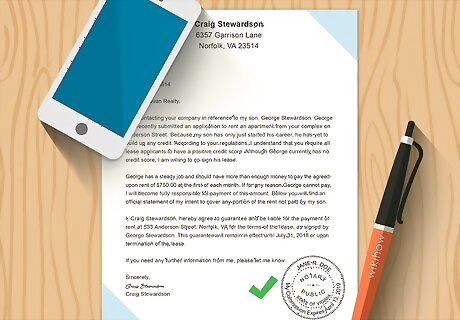

Employ a notary public to witness your signature and sign and stamp the letter. This may or may not be required by the entity asking for the guarantor letter. If it is, remember to wait to sign and date your letter by hand in front of the notary and to leave space for a notary signature and stamp in your formatting.

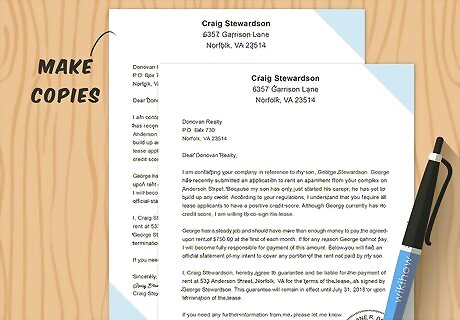

Make personal copies of the letter for yourself before turning it in. It is important that you have your own copy of what you have actually agreed to. Don't assume that the company you are submitting your letter to will provide you a copy later on.

Comments

0 comment