views

Telangana, home to the first Cyber Safety Bureau of India, has been one of the first states to recognise the rise of cyber crime all over the world and build infrastructure to deal with the menace.

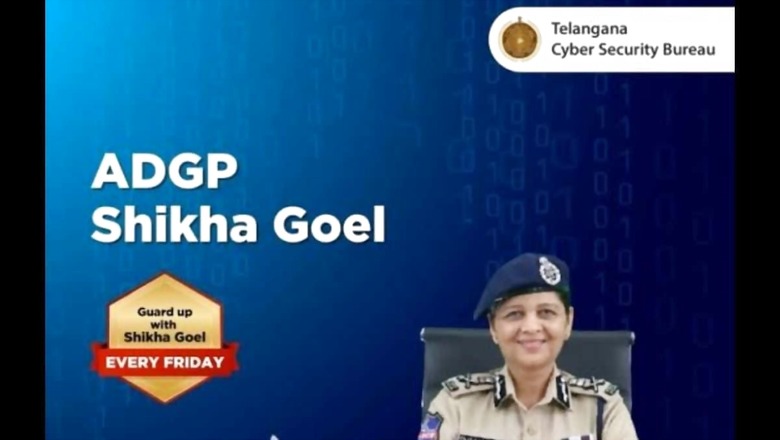

The bureau has been coming up with several initiatives to ensure cyber crimes are nipped in the bud and the latest measure involves an online initiative called ‘Guard Up’ to spread awareness about cybercrimes. The programme, hosted by the director of Telangana Cyber Safety Bureau and ADGP Shikha Goel, is shared on social media handles every Friday.

News18 caught up with Goel during the weekend and asked her about the objective of the show, the rate at which money is recovered in cases of such crime and how people can safeguard against cybercrimes.

High conversion of complaints into FIRs

“From January this year, we had approximately 57,000 complaints coming through the 1930 helpline. The number of registered cases is approximately 9,900. Telangana shows high number of cases due to our alacrity in registering them. We were the first in the country to set up a Cyber Safety Bureau. We were also the first state to have a fully functional 1930 helpline in the country. That’s why, the number of complaints coming in are more. The conversion rate from complaints to FIRs is one of the highest in the country,” Goel told News18.

Lok Adalats expediating money recovery

Goel said the principle behind setting up 1930 was to return money to the victims that was taken by scammers. “Banks and financial institutions are linked to 1930. As soon we receive a complaint of financial fraud, we alert the banks to freeze the amounts which are moving into different branches. Cyber criminals move very fast and large amounts can be transferred across banks in different locations in minutes.

“That is why, we encourage victims to lodge a complaint within an hour after the crime has taken place. It is called the Golden Hour. We have seen that if a complaint is made early, the chances of putting the money on hold are 51 per cent. However, as the time lag increases, chances of recovery go down.”

Goel said since March, the bureau has started returning money to victims. “Approximately Rs 300 crore has been put on hold in different bank branches for recovery. Till recently, the recovery process was tedious because the victims had to produce a court order to claim their own money.

However, we have now tied up with district legal services authority and, with the support of high court, we are trying the cases in Lok Adalats. This step has simplified the process to a large extent. We are most probably the only state in India where the money is being returned quickly through Lok Adalats,” she said.

Using AI for 1930 team

There is an upper limit to the number of people who can be engaged to receive complaints via the helpline, the bureau’s director said. “Right now, we have 50 people working on the lines 24×7. Instead of increasing manpower, we are focusing on increasing the efficiency of the team through Artificial Intelligence (AI). Besides 1930, there is a portal called cybercrime.gov.in which follows the same procedure of blocking money. However, people prefer calling the helpline rather than submitting the form on the website,” she said. Goel added that the helpline process takes more time as the receivers have to jot down the details. “We encourage people to submit complains via the website as it saves time.”

Most victims are tech-savvy, private employees

It is a myth that the elderly fall victim to cyber frauds more, the cop shared. “In Telangana, 56 per cent of the victims of financial fraud are private employees, who are mostly tech-savvy, and 76 per cent of the victims are men. Financial fraud is the most common cybercrime. They can manifest as fake part-time job offers, offers to invest stock, as courier frauds or as fake loan apps. A minority of the cases, which are not reported widely, are sextortion cases,” she said.

How to be immune to cybercrime

Cybercrimes take place only if one clicks an unknown link or receives calls from unknown people, Goel said. “If you exercise the basic do’s and don’ts, you will become immune to online scams. Cases of phishing or duplication of credit cards are very limited. Most of the time, the victims themselves share personal details with the scammers,” she said.

“Sharing your account number, sharing your PAN, clicking on links, downloading apps and giving them all permissions — all these are done by the victims themselves. There are other cases where senior police officials ask them to attend video calls. One must remember that no government officer in India functions that way. It’s just not possible for a senior police official to ask someone to transfer money from one account to another,” she added.

Goel said one must know that stock trading happens only on NSE or BSE through Demat accounts. “It does not happen on websites. Can any authority give you a loan even before you have asked for it? If you take these basic precautions, then you cannot be scammed irrespective of the modus operandi of the criminals. When you are outside, you do not talk to strangers. Even if you exchange a smile, you do not share your personal details. Then why are you doing that online?”

Comments

0 comment