views

Bitcoin is to cryptocurrency what WhatsApp is to instant messaging and Xerox is to the simple activity of generating photocopy. An unmistakable identifier. When someone says they’d like to invest in bitcoins or that investing in bitcoins is fun (or whatever adjective they’d like to insert here) they may not specifically mean Bitcoins only. Chances are, they’re referring to cryptocurrency in a much larger sense, and could very well be investing in Ethereum, Litecoin, Cardano, Dogecoin and other crypto coins. Apps including CoinSwitch, WazirX and CoinDCX are gaining popularity across platforms, including Android phone and the Apple iPhone. But what most crypto investment regulars and those who are taking the leap for the first time would notice, is that UPI (unified payments interface) as a payment option for adding money to the wallets on these apps to buy crypto coins, remains largely missing or unavailable.

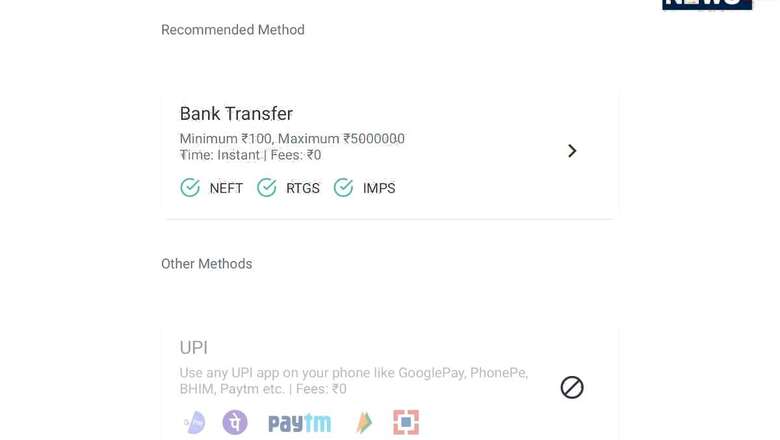

Let us quickly run you through the payment methods that apps such as Coinswitch, WazirX and CoinDCX offer. CoinSwitch by Kuber currently allows you to deposit money to the CoinSwitch Wallet using bank account transfers—that’s Immediate Payments System (IMPS), the National Electronic Fund Transfer (NEFT), Real Time Gross Settlements (RTGS) transfers by logging into your netbanking account for your savings or salary account, adding CoinSwitch as a payee and then transferring money to your wallet. CoinSwitch confirmed in response to a query by News18 that banks seem to be “hesitant to engage with crypto exchanges due to the lack of regulation in the crypto space.” The app, at this time, lists UPI payment as an option which means it is very much a part of the larger scheme of things, but the option remains disabled. The developers specifically point to ICICI Bank and say that some other banks also are distancing themselves from supporting Bitcoin and cryptocurrency trading. This is even after users are onboarded to the cryptocurrency trading apps after the complete know your customer, or KYC, formalities are done.

Different platforms, same tales of woe. “Day 928. What do we want? We want to help in nation building Flag of India. Is that wrong? Is it a crime to be involved in innovative technology in India? Why cannot banks in India follow the Supreme Court ruling? Why do they have to cause trouble to 15 million people?” writes Nischal Shetty, Founder and CEO of WazirX India, in a tweet. This comes after the developers had already informed users earlier this month that the UPI option to make payments has been disabled by their banking partner. They say that talks are on with more banking platforms to enable UPI on the app as a payment method. On its part, CoinDCX is accepting deposits via bank transfers and the MobiKwik payments app, to add money to the wallet for investing in crypto coins. Popular UPI payment apps in India are Paytm, PhonePe and Amazon Pay.

It is the past that leads us to the present. The National Payments Corporation of India, which runs the UPI real-time payments system, has refused to ban cryptocurrency transactions in India. Instead, they have asked banks to make their own guidelines with regards to transactions that involve cryptocurrencies. “The recommended approach for financial institutions would be to craft their strategic responses,” says Vishal Anand Kanvaty, Senior Vice President – Innovation & Product, NPCI. He adds, “Financial institution need to focus on collaboration with the ecosystem before they launch any of the use cases. The operational effort to get the ecosystem to accept the new system would be huge and acceptance could be difficult. Hence, financial institutions need to spend effort to convince the ecosystem for a decentralized solution.” For a user to use UPI payments, it’ll always be done from a bank account that is KYC-compliant, often using the biometrics authentication using the Aadhaar card. These are bank to bank transactions, with the entire chain being KYC compliant. It is not clear why banks are payment gateways are hesitating to allow cryptocurrency transactions at this time. Banks are yet to issue any advisories or guidelines to users, who may be interesting in investing in cryptocurrencies such as Bitcoin and Ethereum.

It was in March last year that the Supreme Court of India had said that the Reserve Bank of India (RBI) circular which sought to implement a banking ban on cryptocurrency, as unconstitutional. The circular was issued in April 2018, banning regulated financial institutions from transactions in the crypto business. Since then, the RBI hasn’t issued another circular clarifying what banks are supposed to do or not do with regards to cryptocurrency transactions and providing payment services for merchants and platforms that deal in cryptocurrency. At this time, cryptocurrency transactions in India do not have a regulatory framework to work within and neither is there a ban on crypto transactions in the country. The government of India’s cryptocurrency bill was expected to be tabled during the budget session of parliament earlier this year. The draft bill, in its latest iteration. Isn’t public at this time. In an interaction with CNBCTV18 in March, Finance Minister Nirmala Sitharaman clarified that, “There will be a very calibrated approach to be taken on crypto” and insisted that there will be a “window available for all kinds of experiments”, something that is seen as a positive for the cryptocurrency space in India. According to numbers by global crypto exchange Paxful, as of December 2020, India is the second largest Bitcoin market in Asia. And the sixth biggest market in the world, behind USA, Nigeria, China, Canada and UK.

India has received a lot of donations for the relief efforts as India struggles with the deadly COVID wave, including Ethereum’s co-founder Vitalik Buterin who has donated over $1 billion (around Rs 7,358 crores) in cryptocurrency to the India COVID Relief Fund. The fund says that they’ve collected donations worth more than $1,039,721,689.57 and is accepting donations in ETH, BTC, Doge, Tron, TRC20, Cosmos, Tezos, Solana, Litecoun, Ripple and Binance Smart Chain.

Read all the Latest News, Breaking News and Coronavirus News here. Follow us on Facebook, Twitter and Telegram.

Comments

0 comment