views

In a recent move, the Reserve Bank of India (RBI) ordered Paytm Payments Bank Ltd. (PPBL) to cease taking deposits or top-ups in any client accounts — including wallets and FASTags — after February 29, 2024. As PPBL did not follow the guidelines in the service-level agreement, the Indian Highways Management Company (IHMCL), a division of the National Highway Authority of India (NHAI), prohibited PPBL from issuing new FASTags.

NHAI suggests users acquire FASTags from the 32 banks that are now on the authorised list for FASTag issuing. The final deadline has been moved up to March 15; after that, Paytm FASTags cannot be used. However, consumers will have the option to close their previous FASTag and get a refund in accordance with the frequently asked inquiries (FAQs) that the RBI has put forth.

If this concerns you, you may be looking for instructions on how to switch banks or deactivate your FASTag. Here is a step-by-step method for porting or deactivating FASTag.

Steps For Deactivation:

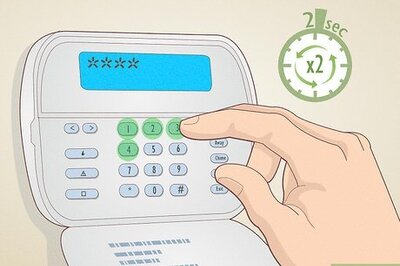

- Enter your user ID or wallet ID along with your password to access the FASTag Paytm interface.

- For verification, provide the required information, including your registered phone number and FASTag number.

- Go to the portal’s Service Request area or utilise the Paytm app’s 24/7 assistance section and choose the ‘The FASTag’ category.

- Indicate clearly that you wish to deactivate your FASTag and adhere to the guidelines given. It’s possible that more data will be needed for processing.

- Start the process of creating a service request and, for future reference, maintain a note of the complaint or reference number provided. If you don’t receive the deactivation confirmation from Paytm within the allotted time, follow up with them.

- Select ‘Closure Request’ as the request type to close either the RFID tag or the wallet linked to your account. Once deactivated, the same FASTag cannot be reactivated.

Steps For Porting:

Make contact with the new bank’s customer service department and follow their directions. This might entail completing an application, sending the required paperwork, and submitting a porting fee. Your new bank will send you a confirmation message when your porting request is approved. You can start using your FASTag with the new bank account.

Before making any decisions, it’s important to note that Paytm’s parent company, One97 Communications (OCL), has assured its customers that RBI restrictions do not impact user deposits in their savings accounts, wallets, FASTags, and NCMC accounts. These balances can still be used. The company is working closely with regulators to comply with directives and address concerns promptly.

OCL and PPSL would transfer the nodal to different banks during this time, according to Paytm. In order to provide its clients with a variety of payment options, OCL plans to establish alliances with other banks.

Make sure you know how much money is in your Paytm FASTag wallet before selecting whether to transfer or deactivate your FASTag.

You can follow these steps to buy a new FASTag online:

- Download the ‘My FASTag’ app.

- Click on ‘Buy FASTag’ to be directed to an e-commerce link.

- Purchase the FASTag, and it will be delivered to you.

Or you can follow these steps:

- Open the ‘My FASTag’ app.

- Click on ‘Activate FASTag.’

- Choose either Amazon or Flipkart.

- Enter your FASTag ID and vehicle details.

- Your FASTag will be activated.

- You can also purchase FASTags from member banks such as State Bank of India, ICICI Bank, Punjab National Bank, Airtel Payments Bank, Bank of Baroda, Allahabad Bank, HDFC Bank, IDBI Bank, and Yes Bank.

Comments

0 comment