views

Creating Your Own Budgeting Spreadsheet

Use a pre-made budget worksheet for an easy option. If you’d rather not add functions to your own spreadsheets, try using one of the many pre-built budget worksheets online. Worksheets list types of fixed and variable monthly expenses, and many already contain addition and subtraction functions to calculate your budget for you. Online pre-made worksheets can also be customized for college students or self-employed professionals. You can access a number of free budgeting worksheets online here. Check out some more free examples online here.

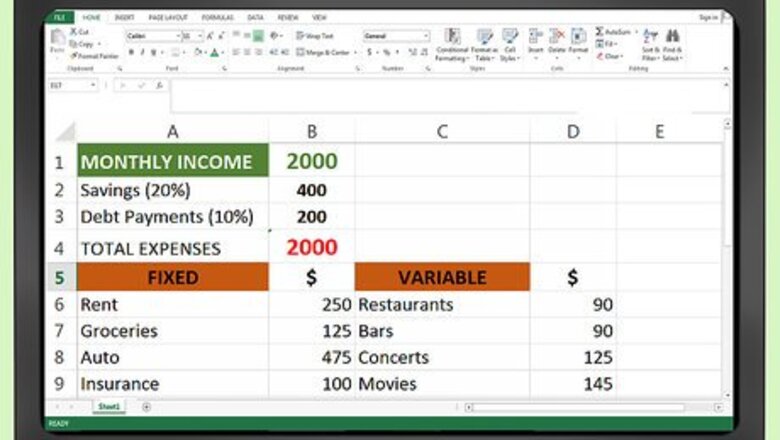

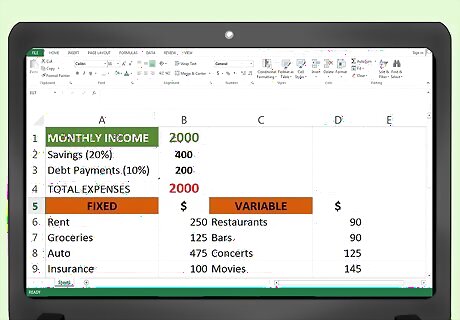

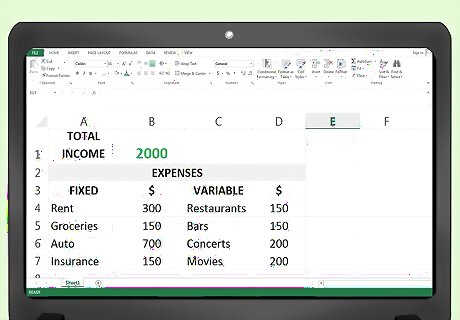

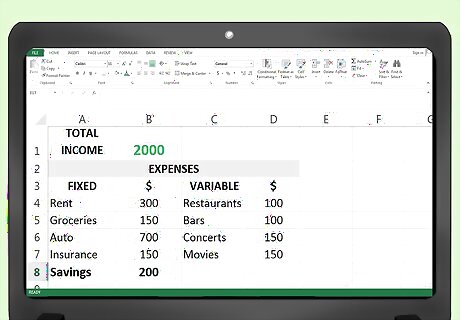

Watch your budget with a spreadsheet for a technological alternative. A spreadsheet has the additional benefit of being able to tally your monthly income and expenditures. Name rows for different types of fixed and variable expenditures. When setting up your budget spreadsheet, use the “sum” and “subtract” functions to add up your total expenditures and subtract these from your net income. If you like, break down sub-categories within expenditure areas like “food” or “entertainment.” For example, you could have “restaurants,” “bars,” “take-out” or “movies,” “concerts,” and “theater.” Or, you could use multiple spreadsheets each month. For example, 1 could be only for fixed expenses, another for variable expenses, and a third for your various sources of income.

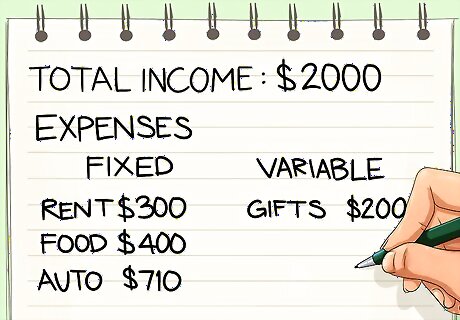

Track your budget on a sheet of paper for a simple option. Write “total net income” at the top, followed by the amount. Then, use a separate row to track your expenses. Write “fixed” and “variable” on the left side of the page, and fill in the various sub-categories: “rent,” “food,” “auto,” “entertainment,” “medical,” etc. As the month goes by, record your expenses in each category. At the end of the month, add up the expenses and confirm that they’re less than the total income.

Using a Budget App

Monitor your budget through an app if you prefer working online. If you’re on your computer or phone most of the day anyway, you may prefer to handle your budget online. Apps will allow you to input your monthly expenses and income and can calculate whether or not you’re living within your means. Useful budgeting apps available for iPhone and Android include: Quicken Pocketguard

Make monthly adjustments to keep your budget on track. In order to maintain a balanced budget, your income must be greater than or equal to your expenses. However, these amounts may fluctuate: you may get a raise at work, your monthly rent payments may increase, or you may find yourself going to the movie theater more often. Take stock of your budget monthly by calculating total expenses and income through your budgeting app. If you find that your monthly expenses have shifted and your expenses are now larger than your income, reduce your variable expenses to balance the budget. Once you start living within your means, it’s time to plan for a financial goal, like saving up for a new car. Or, you could put your money to work by investing in stocks and bonds.

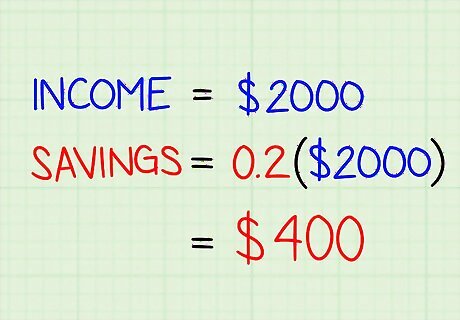

Set aside an additional 20% of your monthly income for savings. If you don’t set aside money, you’ll always be living from paycheck to paycheck. If it helps, you can think of your savings as another type of fixed expenditure. An easy way to make sure that 20% of your income is set aside for savings is to automate the transfer. Use your app to set up an automated transfer each month to a separate savings account. For example, if you have a total net income of $2,000 a month, earmark $400 for savings Your savings fund will help you be prepared for anything unexpected that might come along, like a medical bill or a parking ticket. For an easy way to help your savings grow, have a certain amount transferred into savings out of every paycheck you get. You can start really small, then increase the amount you save gradually.

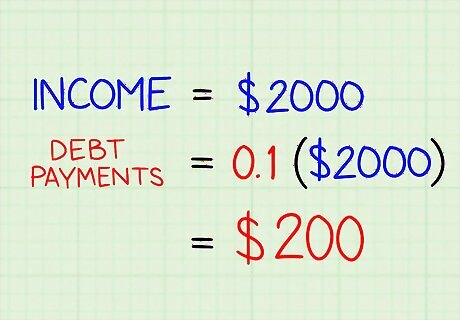

Tackle any outstanding debts by making monthly payments. This is a necessary part of your budget if you have student loans, credit card debt, or loans from buying a house or a car. Use your app to set aside a percentage of your monthly net income—say, 10%—to go towards debt repayment. Make sure that this amount is enough to decrease the principal amount of your debt, so you’re not just paying the interest. While some types of debt repayment—e.g., car loans or a mortgage—will fall under your fixed expenses, other types may not. For example, many people defer their credit card payments for months on end and rack up financial penalties. If you’re not able to set aside money for both savings and debt repayment, focus on paying off the debts. If necessary, you could use the entire monthly 20% that you would set aside for savings to pay off your debts.

Modifying Your Budget as Needed

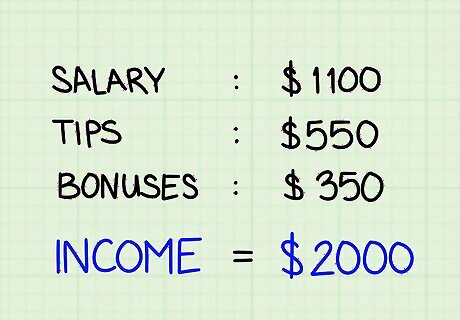

Calculate how much money you earn after taxes in a typical month. Look at your bank statements to figure out how much money you bring home each month. This amount is your net income after taxes and other deductions. The goal of your budget is to restrict your spending to less than this dollar amount. Income can include more than just your salary. Also include income from sources like tips, scholarships, legal entitlements like child support, alimony, cash gifts, government subsidies, and any other money that comes into your wallet or bank account. If you’re self-employed and file your own taxes quarterly, keep in mind that your take-home pay at the end of the month isn’t your true net income. You’ll need to calculate your average monthly income after your quarterly taxes have been subtracted.

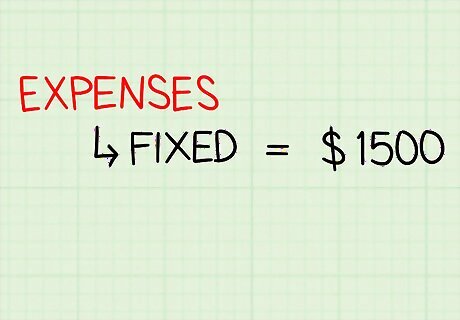

Calculate your fixed expenses to see what you have to pay each month. Fixed expenses are expenses that remain relatively stable from one month to the next. These will include items such as your rent, groceries, mortgage payment, car payment, loan payments, utilities, and insurance. To calculate expenses, save all of your receipts for a month. At the end of the month, add up all payments made on fixed, necessary items. Fixed expenses, by definition, must be met each month. In other words, the payments and amounts are non-negotiable.

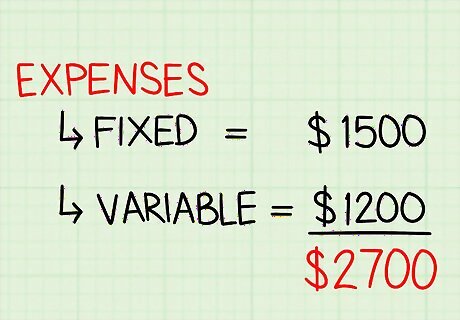

Add up your variable expenses to find what expenses can be cut. Variable expenses are items that fluctuate from one month to the next such as the costs associated with dining out, entertainment, clothing, alcohol, personal care products, and vacations. Add up variable expenses by looking at your monthly itemized credit card bill. They’ll be under categories like entertainment, clothes, or restaurants. Unlike fixed expenses, variable expenses can fluctuate from month to month and are generally non-essential. This will be the first place to make cut-backs if you are spending beyond your means. You'll be more likely to stick to a budget if you base it around what you actually spend. For instance, if you like to go out to eat a lot, but you don't include any money in your budget for dining out, you'll probably end up pulling that money from somewhere else.

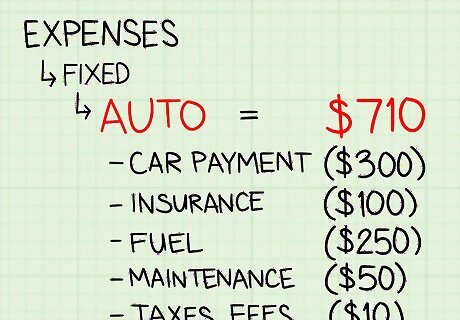

Calculate your total monthly spending within each budget sub-category. Your budget should be arranged under “fixed” and “variable” expenses, and each of these 2 main categories should contain several sub-categories. Breaking up your budget into these categories can help you figure out what you might be spending too much on from month-to-month. For example, sub-categories include rent, utilities, food, entertainment, and clothes. To figure out your total monthly spending, go through monthly bank statements or itemized credit card bills and calculate the total within each of these categories. Let’s take “auto” as an example, and say that each month you have a car payment of $300 and a $100 insurance bill. In addition, every month you spend an average of $250 on fuel, $50 on maintenance, and $10 on taxes and fees, such as registration. So, in the “auto” category, your total budget for the month would need to be at least $710 per month.

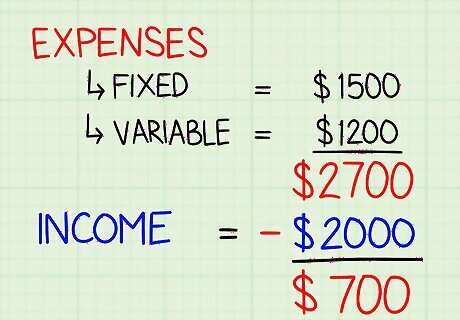

Add up all your monthly spending across all categories. This should show your total monthly spending, which is the amount of money that comes out of your bank account each month. Compare this figure to your total net income. If the total expenditures exceed the total income, you’ll need to start making cuts. For example, say you make $2,000 monthly. Say that, when you add up your total expenses (fixed and variable), they come to $2,700. This tells you that you’ll need to cut at least $700 from your monthly budget. It's really important to know what's coming in and out of your monthly expenses, so try keeping track of everything that you spend for a whole month. Then, try to determine whether the money you're spending really reflects your values.

Cut spending on your restaurant and entertainment purchases. Leisure-related expenses might help you have fun and socialize, but they can also be a big drain on your budget. Try cutting the amount you eat out in half or cutting the amount spent on alcohol in half. This way, you’ll have money left over to spend on fixed expenses, like rent and utilities. For example, say you realize that you’re spending $200 a month on eating in restaurants, and calculate that you’re $100 over budget each month. The most effective solution would be to spend $100 less on restaurants. So, you’d need to cap your total restaurant expenditures at $100 monthly. If you're having financial trouble, prioritize staying current on your bills. Try reaching out to your utility companies or other billholders to ask about any assistance that may be available.

Spend less on travel and personal care if your budget is still strained. Cutting from these categories—which includes clothing—may be difficult, depending on your lifestyle. But, you can cut little by little if that's easier. Then, use the money you save to pay off some of your fixed expenses, like rent or a home mortgage. For example, if you’re used to taking 2 family vacations each year but can’t currently pay your mortgage, cancel 1 vacation and pay your mortgage instead.

Comments

0 comment