views

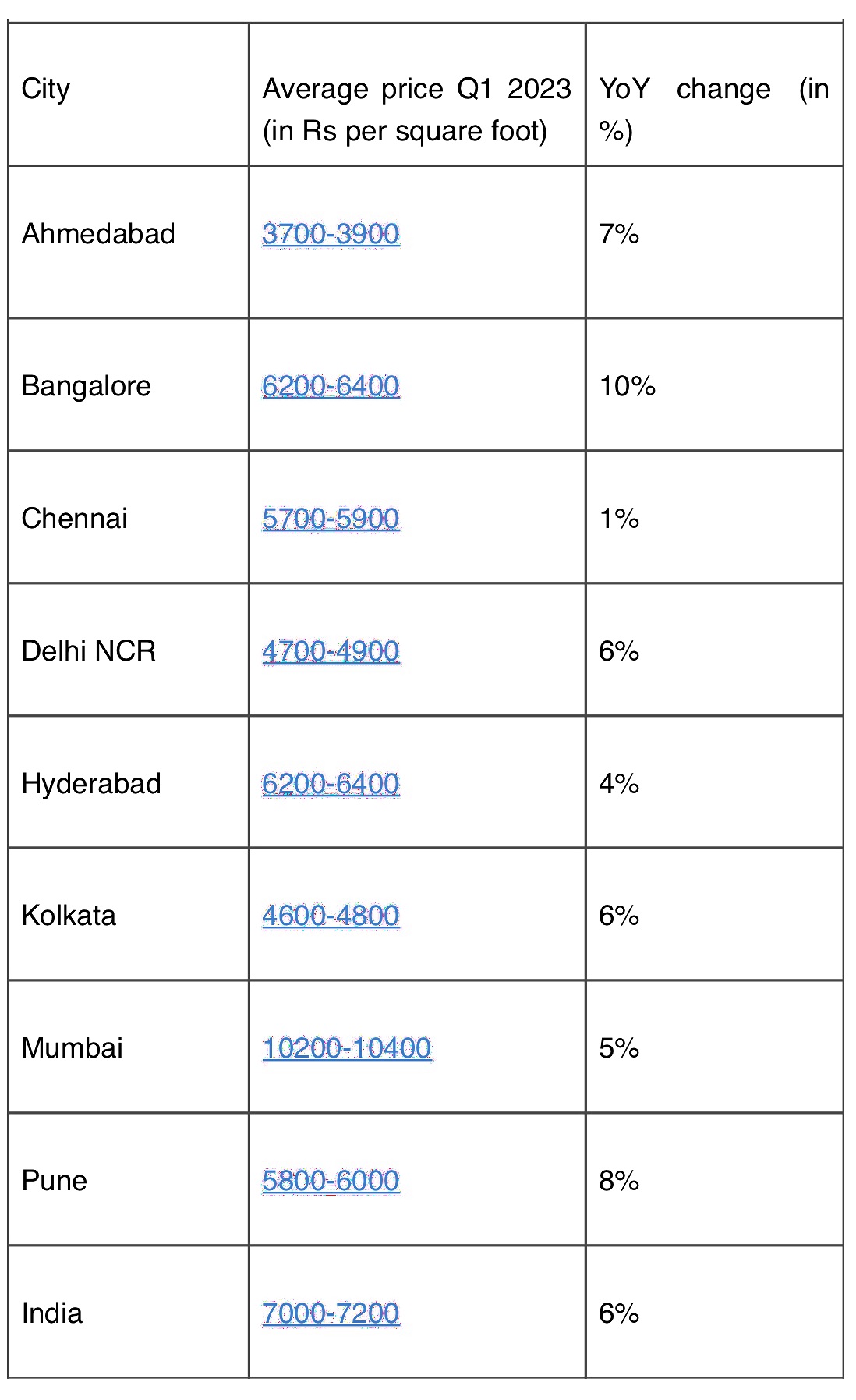

Housing prices in India surged sharply during January-March 2023, with the average price rise across all the major realty markets in the country being nearly 7 per cent as compared to last year, according to a report by PropTiger.com. The highest increase of 10 per cent in residential property prices was recorded in Bengaluru, followed by Pune, Ahmedabad and Delhi-NCR.

According to the report, all major real estate markets in India showed an upward movement in average rates of new homes. The average price per square foot in cities such as Ahmedabad, Bengaluru, Delhi-NCR, Kolkata, and Pune has witnessed a significant increase.

The average rate of properties in Bengaluru saw a 10 per cent appreciation in the past one year, making it the market with the sharpest uptrend in property prices. Pune and Ahmedabad were close behind this southern market in terms of price increase, with these markets witnessing an 8 per cent and 7 per cent rise in their average property rates, respectively.

Housing prices have increased due to several factors including the continuous rise in the cost of raw materials and labour, the growing demand for homes post-COVID, and the cessation of government-funded subsidy schemes in March this year, according to the report.

Vikas Wadhawan, group CFO of PropTiger.com, Housing.com & Makaan.com, said, “Real estate has consistently been one of the best-performing asset classes in the long term, and with prices expected to go up further, it might be a good time for fence-sitters to take the jump and buy their dream home.”

He also said one needs to keep in mind that buying a home is the most expensive purchase decision a family typically makes. So, it is important to weigh all the pros and cons carefully before making a final decision.

Ankita Sood, head (research) at PropTiger.com, Housing.com & Makaan.com, said, “Property prices in Indian cities have been growing at a fast pace of 6-7 per cent since the past year with a renewed thrust on homeownership. Apart from a rise in input costs, limited supply of the right product and ready-to-move-in projects for the end-user have led to an upward push in prices.”

Sood added that while the weighted average prices have grown by 6 per cent YoY, in the March 2023 quarter, key micro-markets in Gurugram, followed by Bengaluru, have seen YoY growth of 13 per cent and 10 per cent, respectively.

“Given the current market trends of demand-supply mismatch, we expect property prices to continue to rise albeit within a close range, where the quality ready-to-move-in segment will trade at a premium,” she said.

Read all the Latest Business News, Tax News and Stock Market Updates here

Comments

0 comment