views

Scammers exploiting technological advances have become increasingly prevalent in India’s financial industry. Various fraudulent operations have been observed, including UPI scams, QR code frauds, part-time job deceptions, and malware-driven cybercrimes. According to the Cybercrime Reporting Portal, from January to April 2024, cybercriminals caused losses exceeding Rs 1,750 crore to Indian residents. Recently, a Gurgaon-based software engineer shared his conversation with a scammer on X (formerly Twitter).

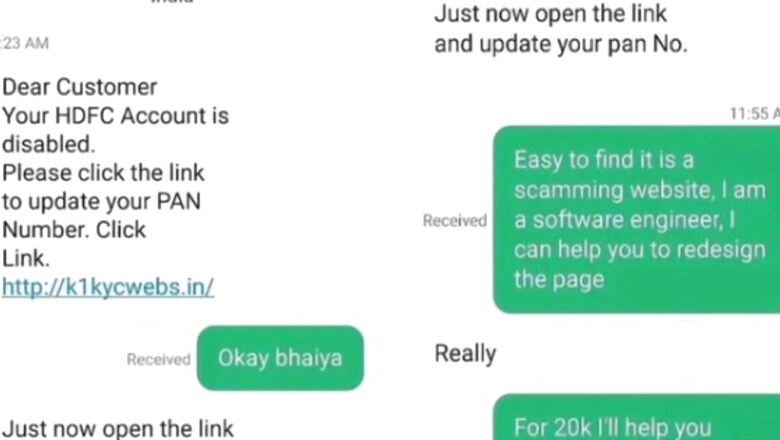

The user got a text message informing him that his HDFC Bank account was suspended and that he was required to click on a given link to change his Permanent Account Number (PAN). Being a senior analyst at a private company, he saw through the hoax right away and satirically responded to the scammer.

“Okay, Bhaiya,” he said.

The fraud said, “Just now open the link and update your pan No.”

In response, the user stated that it is simple to discover that the website is a hoax. “I am a software engineer, I can help you redesign the page.” He also stated that he could assist them in redesigning the page to resemble the HDFC net banking website for Rs 20,000.

Ironically, the scammer asked him to send some samples.

Lesson: Never mess with a developer pic.twitter.com/GSmtrdDo4A— Gaurav Sharan (@GauravSharan09) July 27, 2024

The post got more than 40,000 views.

A user humorously stated, “Aapada ko avasar me badle (Turn disaster into opportunity).”

Aapada ko avasar me badle— ashish ☘️ (@humoursapien2) July 27, 2024

“Uno reverse”, said another user.

Uno reverse ????????????— Atharva Katre (@atharvakatre18) July 28, 2024

Continuing making humorous remarks, another user said, “Playing with innocence of scammer! This is not correct.”

Playing with innocence of scammer! This is not correct— Chaitanya (@ChaituAthukuri) July 28, 2024

“Bro can never be unemployed at any point in his life,” read another comment.

Bro can never be unemployed at any point in his life.— Lalit Sharma ???????????? (@lalitdotdev) July 29, 2024

In May 2024, 7,000 cybercrime complaints were received daily on average, according to the Indian Cyber Crime Coordination Centre (I4C). As per the Economic Times, this represents a notable increase of 60.9% from 2022 to 2023 and a significant surge of 113.7% from 2021 to 2023.

Additionally, financial online fraud accounted for 85% of all complaints.

The majority of victims fell prey to OTP scams, sextortion, unlawful loan applications, gaming apps, algorithm tricks, and online investment fraud.

Comments

0 comment